PREAMBLE:

If you’re the type of person who buys bombed out commodity names where their current cost of capital is below their marginal cost of production hoping for a multi-bagger then the cannabis industry might be for you.

Remember, down 90% to down 60% is a 3-bagger.

It’s worth keeping in mind that unlike traditional, old economy, hard asset industries where the industry is mostly consolidated, cannabis is a nascent industry. As such, I’m focused on those who I think will be the consolidators and/or those who have thus far proven themselves to be efficient capital allocators.

The story here is simple: A company with improving internal metrics, improving margins, who’s establishing a foothold with top brands & wiser capital allocation in a growing industry which is not only trading at bottom-cycle multiples but who’s stock isn’t reflecting its growth due largely to the negative sentiment, apathy and ignorance of the opportunity. And yes, they currently have negative net income (there’s always a catch).

This is probably a more serious audience due to the recent attention that I’ve been getting on Twitter. As such, I’m going to treat you as consummate professionals. Yes, that means homework (due diligence). To help catch you up to speed on my general thoughts around the cannabis industry I’d recommend reading the following to open your eyes up to the cannabis industry in general. Some of your preconceived notions are right but I also suspect many are wrong.

Cannabis: A Contrarians choice

The Cannabis Industry & Game Theory

Pertaining to the US side (which is tangentially associated & relevant in understanding the industry as a whole) I’d recommend reading:

As a final note, if you liked what you read in those other articles, I’ve also written #MSOgang unmasked: Refugees from Delusion. It’s an ungodly 15,000 word rambling that I had pent up for half a decade that outlays much of my thinking predominantly around cannabis speculators. However, there’s also information pertaining to how I think of matters, such as:

There’s much more but that should get you largely up to speed as to what I think.

If you don’t want to read all of that then I’ll sum things up with the two images below.

We went from everybody ordering “newbuilds” and subsequently everybody's earnings hitting all-time lows…

To roughly here in the commodity cycle.

OGI

This is not exhaustive (even though you might think I’m verbose), nor should it be. I’m not here for you to consign your investing decisions to. I’m going to say things to try and pique your interest in hope that it will prompt you to dig deeper if you’re curious.

Disclaimer: At times I will be using ADJUSTED EBITDA. I’ve written my thoughts before on EBITDA & ADJUSTED EBITDA. To put it lightly, I’m not a fan.

EBITDA and the Cannabis Industry

But nonetheless, it’s the world we live in.

In the preamble I noted that Organigram was establishing a foothold with top brands. Well, here it is.

Cronos, which is not the discussion of today, can be recognized under the Spinach brand. FYI, they're cash from operations positive, are a net-net growing their topline. But I digress.

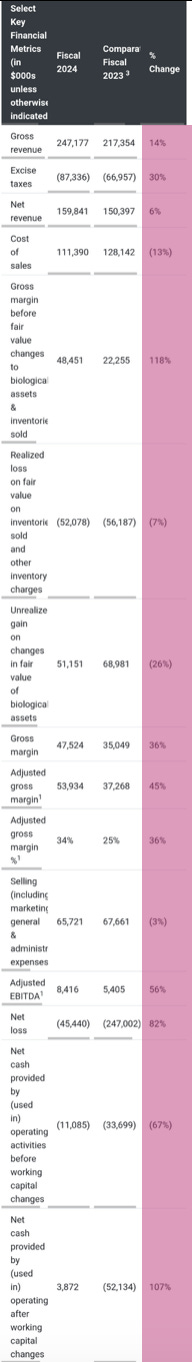

I also noted that their internal financials were inflecting positively. Well, here it is.

And here is the YoY inflection.

VALUATION

Simply put, I don’t believe that the market has fully recognized and thus has properly valued the improving fundamentals.

*Disclaimer* Don’t forget, commodity companies look expensive at the bottom of the cycle. This is no different. Yeah, yeah, they’re a CPG but I find it best to think of them in commodity terms.

*Figures were established on January 5, 2025*

For FY ‘24 Organigram is currently trading at 28.45x EV/AEBITDA and a 1.5x EV/S.

However, if we were to annualize their Q4 numbers then that means they’re trading at a FWD EV/AEBITDA of 10.2x and a FWD EV/S of 1.33x. Remember, sales in this context is net revenue (excise tax deducted from gross revenue). This tells me that they're improving at their ability to convert sales into something that resembles and comes closer to actual profit.

However, none of what I just said factors in the recent acquisition they made of Motif on December 6, 2024.

MOTIF

This acquisition is a big deal. It’s a 37% increase to Organigram’s EV. And a 54% boost to Organigram’s net revenue. Of course, private market vs. public market valuations is often not the same which means that it very well could contribute more than 37% to their EV. But that presupposes that the public market is paying much attention to this, which as you know, is part of my thesis as to why Organigram is a good deal.

I’d like to note a few things.

Here they are saying that net revenue for Motif was $86M.

And yet here they are saying Box Hot (Motif brand) made $158M.

Now, since we know that Organigram’s (SHRED) FY ‘24 net revenue was only $159M then we can conclude that this above image is Gross revenue and not net revenue. The difference being excise tax.

As such, we can conclude that Motif effective excise tax rate is 45.5%. In this sense, it makes Motif not an accretive acquisition due to Organigram having an effective excise tax rate of 35%. Meaning, the acquisition of Motif will compress their margins.

This would give the new and improved Organigram a blended effective excise tax rate of roughly 39%.

Using SHRED and Box Hot as proxies for their respective parent companies (Organigram & Motif), the new combined companies LTM Gross revenue would be $386M. $386M at an effective excise tax rate of 39% would lead to net revenue of $235.46M.

As opposed to if Organigram magically & organically grew to gross revenue of $386M while maintaining a 35% effective excise tax rate would equal net revenue of $250.9M.

Ok. So, we have the combined entity (tax rate of 39%) with net revenue at $235.46M and the magical Organigram (tax rate of 35%) at $250.9M.

This is a disparity of $15.4M as a consequence of merging with a company which has a higher effective excise tax rate i.e. a lower margin business, inefficiencies or scale, form factor of product mix.

However, Organigram did note this:

That’s promising, if it actually happens. Because what it means is that those synergies will narrow that $15.4M gap. Meaning that the initial loss in margins might be manageable. If so, that would entail a company whose sales are 50% larger while maintaining the same margin profile. However, we’ll need to be patient as these potential synergies are realized over a 24-month timespan.

Ultimately, only time will tell.

According to the below image (if you know the actual source of this image, please share it with me), the acquisition does make sense. As in, it was cheaper to buy Motif than their own stock. In case you’re wondering, DB is Decibel Cannabis (another Canadian cannabis company I own but am not here to discuss today).

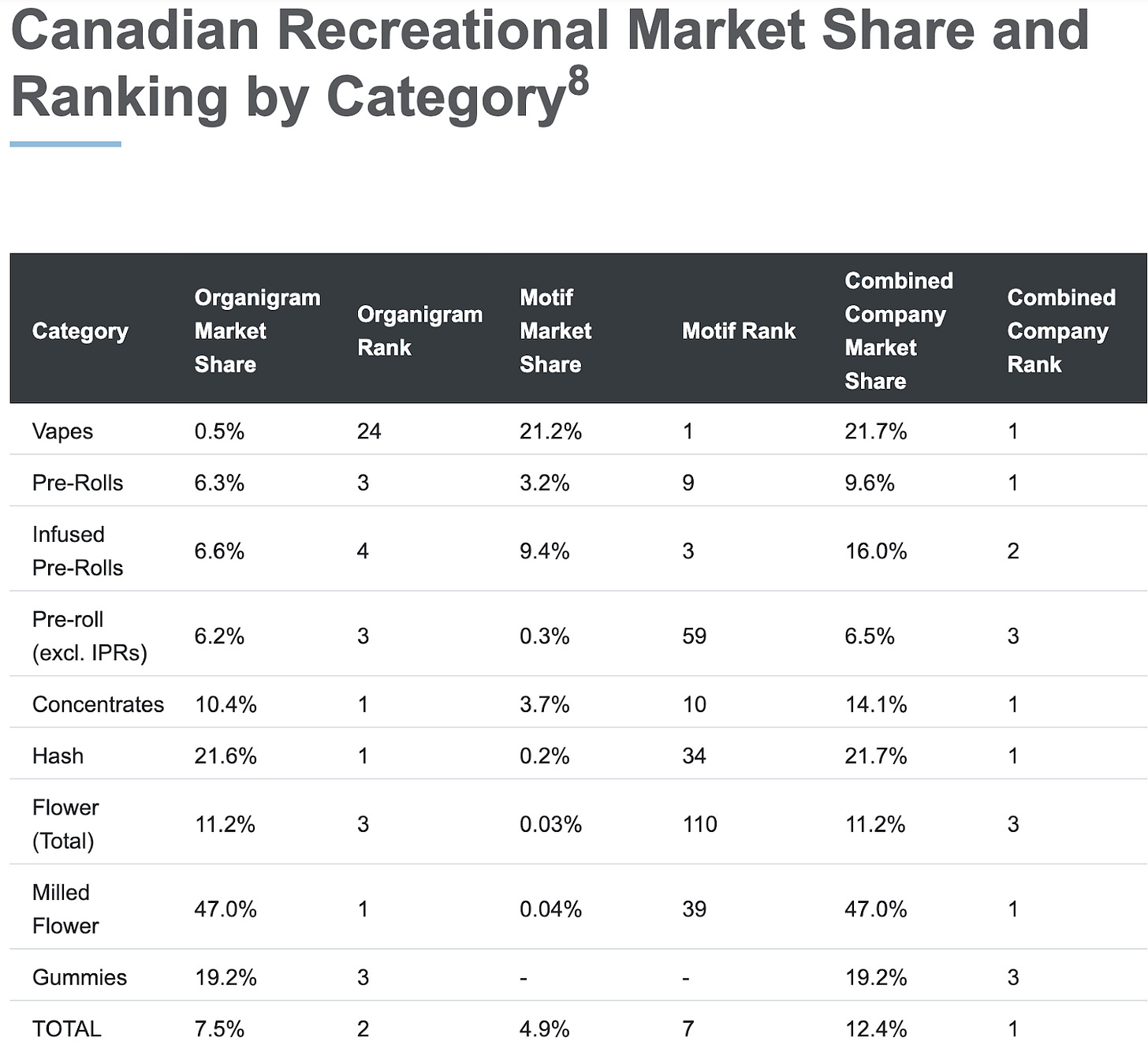

Organigram’s TTM AEBITDA margin is 5.26%. Motifs TTM AEBITDA margin is 5.46%. Organigrams TTM EV/AEBITDA is 28.45 while Motifs is 19.1x EV/AEBITDA. The acquisition of Motif allowed OGI to gain access to vapes (the 3rd largest form factor), in which OGI was seriously lagging behind.

If you can’t build it, buy it. So that’s what OGI did.

Perhaps, they bought into a dying business. Not so fast.

I don’t know the ins and outs of Motif which means they could be finagling the numbers. But if they’re not, then they appear to be doing well enough, albeit with slowing net revenue growth but growth nonetheless. The tricky thing about net revenue is it factors in the excise tax. The question then becomes is this a Motif problem or a Canadian Cannabis problem.

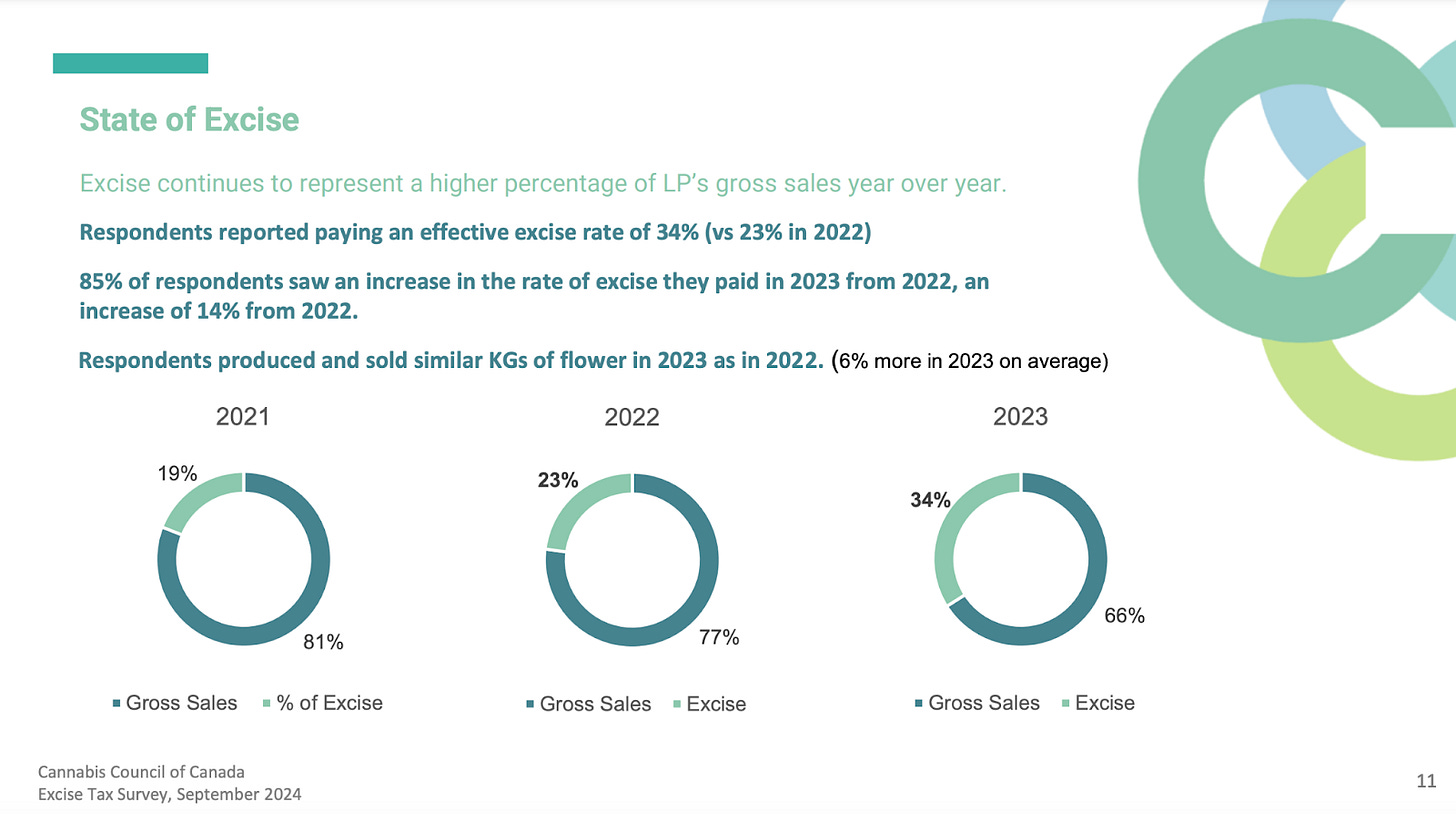

According to C3, it’s not just a Motif problem.

I don’t expect the excise tax to get much worse. The risk/reward is to the upside as far as I’m concerned (demonstrated by the “CONCENTRATION” segment next.

ORGANIGRAM VALUATION CONTINUED

We now need to tack on Motif to Organigram to see what Organigram is trading for.

On a TTM basis Organigram is now trading at a 25x EV/AEBITDA (as opposed to the earlier 28.45x).

If we annualize Organigram’s Q4 numbers, as we did earlier, plus tack on the Motif acquisition then that brings us to a forward EV/AEBITDA of 11.69x (ex-Motif was 10.2x). Which seems like an underwhelming re-rate for a company which will be growing its AEBITDA BY 20% YoY merely due to the Motif acquisition. This also presupposes that Motif doesn’t grow at all in 2025 and that none of those cost synergies manifest.

With the Motif acquisition, Organigram FWD EV/S is 0.74. And presuming that Organigram annualizes their Q4 net revenue with the Motif acquisition then they’re trading at a FWD EV/S of 1.1x.

With all of that said, the market seems to be ever so slowly recognizing the AEBITDA growth and no longer pricing it merely on sales.

Now here’s the funny thing and the confusing thing (I’m sorry). Those calculations I just ran which included Motifs AEBITDA ALSO included their EV. But guess what, OGI’s EV still hasn’t priced in Motif's full $90M EV (assuming that the market isn’t discounting the price paid due to thinking that OGI overpaid).

Back when Organigram released earnings on December 18, 2024 you could have bought OGI at roughly 5-6x EV/AEBITDA. Well, that’s not the case anymore. And remember, even with 80% of Motif’s EV now priced into the stock, none of this factor in any positive developments in 2025.

Keep in mind, even if my numbers are off, they’re directionally accurate and if anything, are understating matters.

CONCENTRATION

The below image demonstrates that Organigram went from 7.5% total market share to 12.4% market share.

The next image demonstrates that their Motif acquisition will give them #1 in market share in 6 out of 7 provinces.

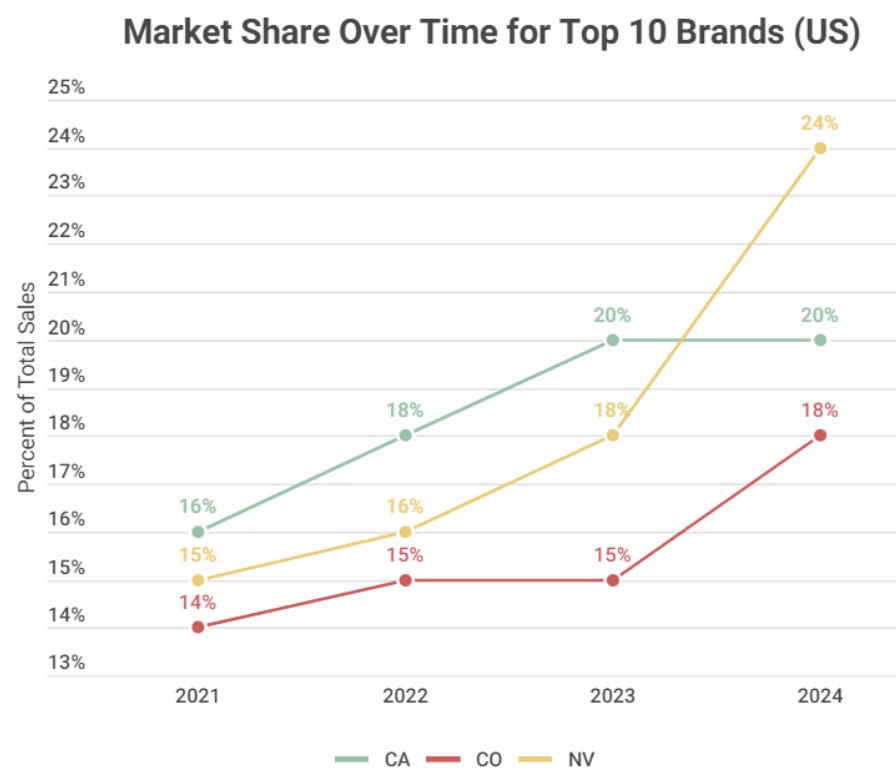

In this well-articulated headset piece and below image/quote, they’ve demonstrated and explained the dynamics at play in both the US and Canadian markets. FYI, this is the logical outcome of the Arc of Development of new industries which I outlined in the linked articles that I provided you in the preamble.

“While emerging markets see market concentration fall the first few years, mature markets show a different trend. Once the dust settles in the market, typically in the 10%-20% range for the top 10 brands, market concentration starts to creep back up albeit at a slower rate as market leaders secure their slice of the market and work to grow their base. Mature markets such as California, Colorado, and Nevada have clear market leaders while also supporting a strong cast of competing brands.”

“Canadian markets display this U-shape trend clearly and in sync due to their unified market timeline. Though the level of market concentration is noticeably higher than their southern neighbor.

When it comes to market concentration new adult use cannabis markets start out with a large amount of market share possessed by just a few brands, however, as the market develops more brands enter and carve out a space for their brand lowering the amount of total sales controlled by just a few top players. The mature market reaches a sustainable plateau which looks like 10%-20% of total sales for the top 10 brands in the US and 18%-25% for top 10 brands in Canada before increasing again at a more conservative rate reflecting the top brands efforts to grow their positions as market leaders. As always Headset has the data to help new entrants find their space in a young market while helping existing brands in mature markets find a path to sustainably growing their current footprint.”

You’ll note that in that headset article they provided this image of the US industry. Although, Organigram isn’t in the US, there's an import takeaway here.

The reason that I think that the US Top brands have captured market share at a quicker rate is due to the more burdensome 280E tax. So far, I’ve been discussing effective tax rates to the tune of 35%-45%. Well, in the US, it can very well be to the tune of 70%. Meaning, that the US is going through a relatively accelerated culling process. There's other dynamics at play, but I’ll leave it at that.

Matter of fact, I have one more thing to say. Another differentiating factor is that many of the Canadian companies have or had big money backing them from alcohol and tobacco companies. As such, it has allowed Canadian companies to extend their slow collapse and buy them time to right the ship. It’s a painful slow bleed on a country wide and industry level. It is my belief that this has to some extent suppressed the prices of cannabis in Canada.

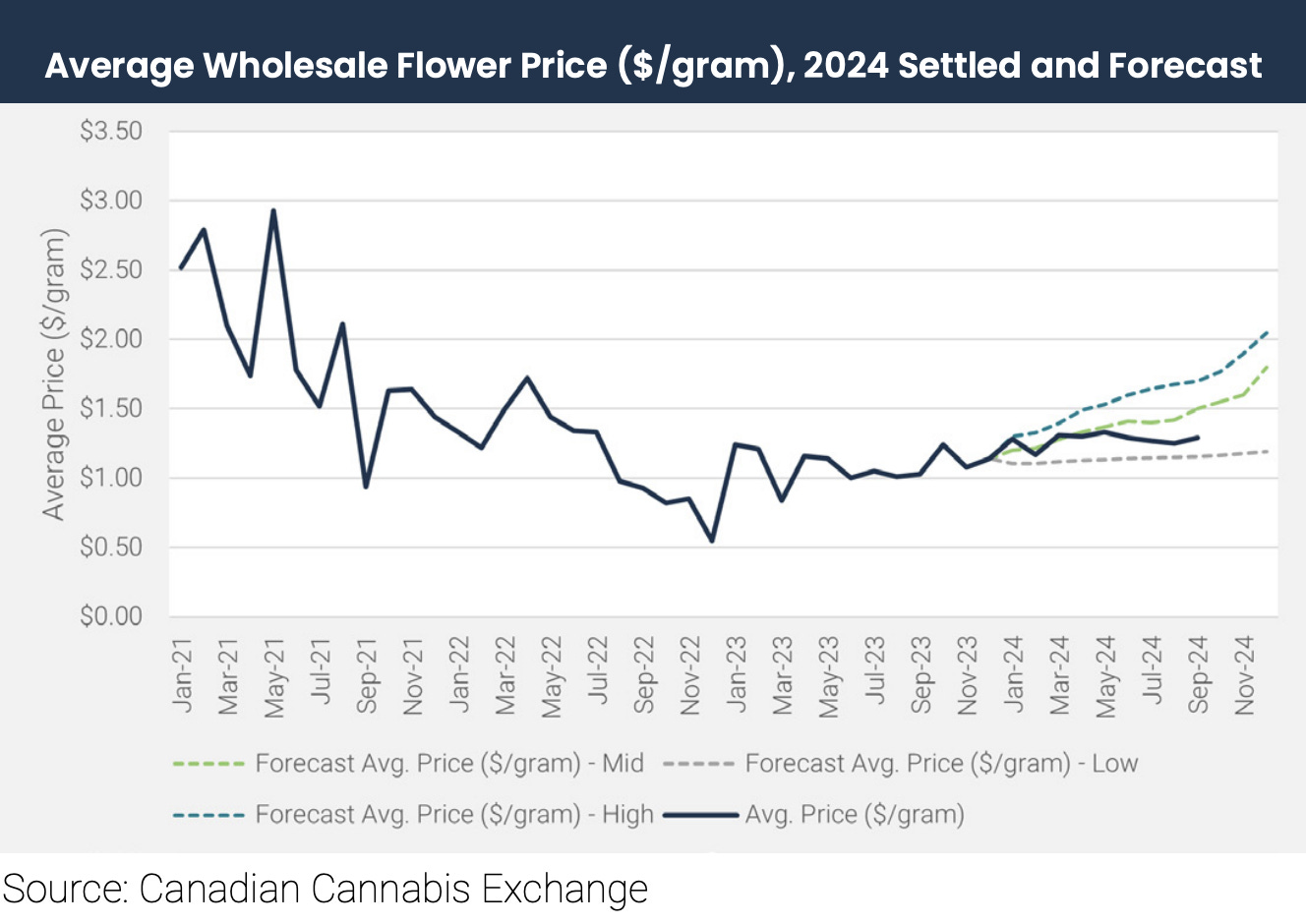

However, according to the below image, things are picking back up. As a bombed-out sector style investor, I don’t even need things to be improving per se, I just need them to stop collapsing.

It’s a slow and steady game.

This industry went full degenerate. It’s for that reason that most people aren’t thinking about thinking about the cannabis industry. As such, all that waste, overcapacity, frivolousness and uneconomic business models needs to get worked out of the system. As the below image shows, that’s what’s happening.

I’M GETTING TIRED & THIS IS GETTING LONG, SO LET’S HURRY UP

Lightning round 3,2,1…

They have negative net debt.

Although they have negative net income, they do have positive cash flows from operation (sometimes at least).

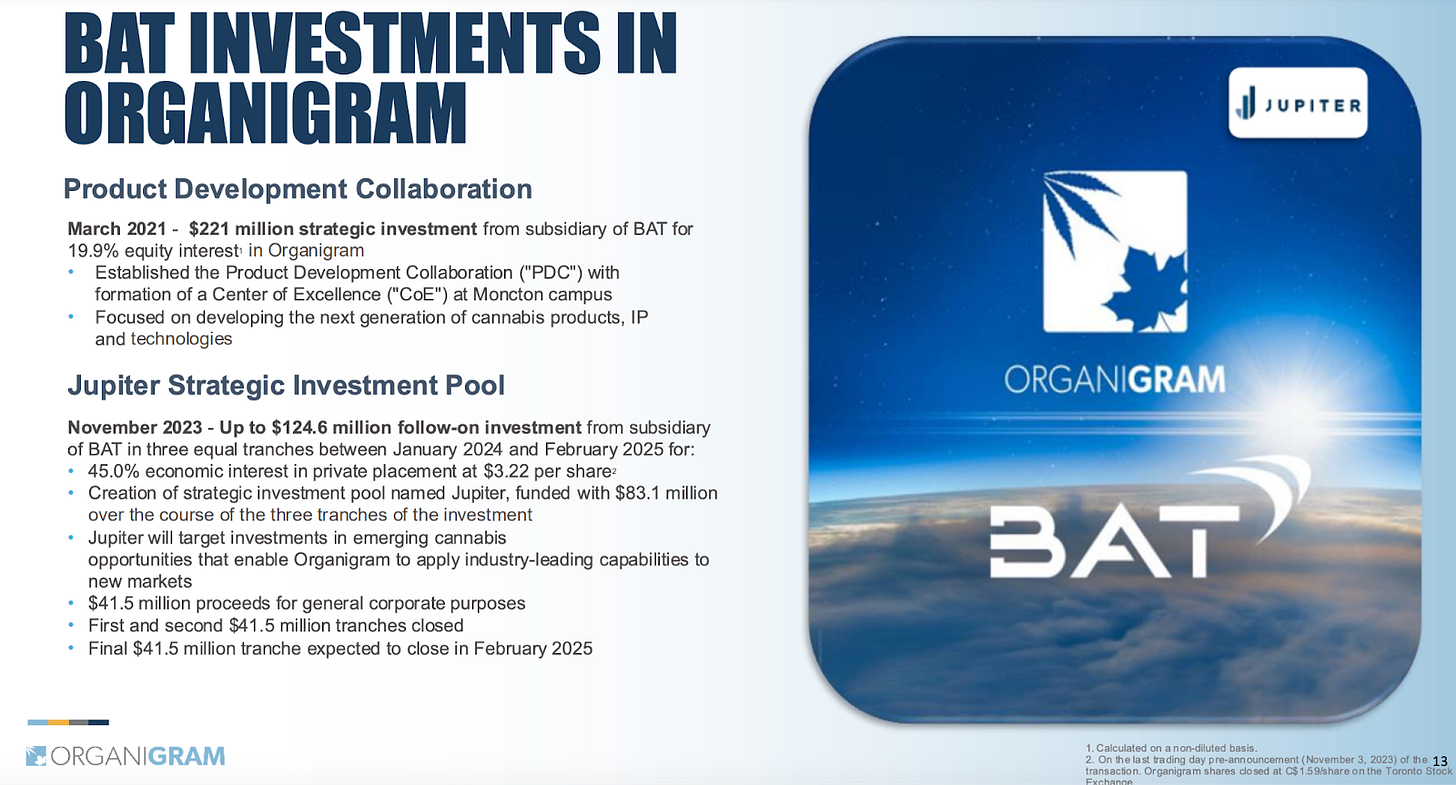

They have big tobacco financially backing them. Here’s the presentation on it.

They have their fingers in multiple entities and are targeting exports. FYI, there’s no usury excise taxes on exports.

Their US exposure isn’t so much them trying to sneak into the backdoor of the US but more to help them out in what it is they’re already doing.

Take Phylos Bioscience as an example. If you want continued efficiencies (improving margins)

Then you need to invest in companies that can help you with that.

If the excise tax reform does happen, then throw most of the numbers I’ve put in front of you out of the window because the stock would be ludicrously cheap. I wrote a piece a few days ago, touching upon that subject.

Why would the government lower the excise tax?

Political expediency

To appease the liberal crowd during the upcoming election cycle

Lobbyists (Cannabis council of Canada) become big enough

I generally disagree with the belief that if they don’t, they’ll kill the industry. My thought on that is that they’ll just create a behemoth of a cannabis company if they don’t ever change the tax structure. Maybe OGI will be that behemoth.

They’ll presumably change it when it gets bad enough, those who are well capitalized will last longer/take advantage of bankruptcies & fund growth outside Canada which doesn’t impose the excise tax.

This image from C3 2024 C3 excise survey results implicitly tells us that OGI is immediately doing better than 40% of the competition, at least on an EBITDA basis (because it’s probably ADJUSTED EBITDA).

It’s only getting worse, and has become a survival of the fittest. Yet, the catastrophe that will be needed to cause change is ratcheting up.

Or, maybe the government will float out a BS proposal that’s tangentially associated and a tease but nonetheless is helpful in some minor way.

But we shouldn’t expect much from inept, perversely incentivized individuals.

As noted, here,

“Leclerc said he tells AQIC members: “Manage your expectations because the way the excise tax share with the provinces is structured, only 25 percent stays on the federal level and 75 percent of the excise tax goes to the province. … So [the government] would have to tell the provinces, ‘Hey, you know what, there's going to be $100 million missing in your account next year because we will take off the $1 per gram excise duty. So, I'm not really sure right now with a minority government that they're going to go there. It's possible, but I really doubt it. Provinces are craving for money. The federal government has a hell of a debt for numerous reasons, so I don't really see it happening.”

Then I have trends like this in my favor.

Ultimately, I don’t care about the whole tax situation except that OGI is caught up on their taxes and that the longer this nonsense continues the better pricing they’ll get for distressed assets.

I have extensively criticized cannabis “investors” for all their fixation on regulation and 280E (the US crazy tax).

As I noted in Cannabis: The Macro, Meso & Micro:

“It is my belief that you can choose good companies that will perform relatively better to a basket of industry peers with little to no knowledge of what’s going on with the macro themes. The macro themes are an afterthought and bonus to me, not a crucial contingency of my investing thesis.”

Then on the illicit market front, some say that the illegal market is essentially stamped out.

While others seemingly disagree.

I actually like Margaret Brodie; she’s the CEO of Rubicon Organics (another Canadian cannabis company I own).

Then we have the whole drama around THC inflation. Between corrupt labs, dishonest and/or desperate owner/managers, negligent enforcement you end up with a whole bunch of people lying about how much THC they have in their product. This distorts the markets and hurts those who are doing right.

All kinds of goofy stuff can happen in what’s considered a so-called Federally legal product due to the gaslighting done around it for the last 100 years. Like this:

Yeah, you read that right, it was only roughly 18 months ago that cannabis stores didn’t have to have black out windows like they were wearing a Burka.

Or how a single package of edibles can contain a maximum of 100 mg of THC, but it must be divided into multiple servings, with each serving not exceeding 10 mg.

Or how about them being largely prohibited from advertising, like they’re a second-class industry.

My point is, it’s not all sunshine but OGI seems to be at a reasonable valuation for a company in an emerging industry.

Hopefully I’ve said enough to pique your interest, in one way or another.

The valuation image you reference was compiled by Mark E. Merritt - see here https://x.com/markemerritt/status/1865455727311253784?s=46. If he is not the author he will know the origin