WHAT IF?

On a recent TDR podcast, The CEO of Organigram, Beena Goldenberg, said that Organigram would have 35% EBITDA margins if the excise tax was strictly 10% versus the current $1 per gram rate (effective tax rate of 35%).

So, what would that imply?

Unfortunately, we can’t take people at their word. I’ve highlighted this point before about the pathology of speech corrupting the cannabis space here & here. More specifically I’m talking about this chronic propensity to use EBITDA & ADJUSTED EBITDA as though they’re interchangeable and synonymous.

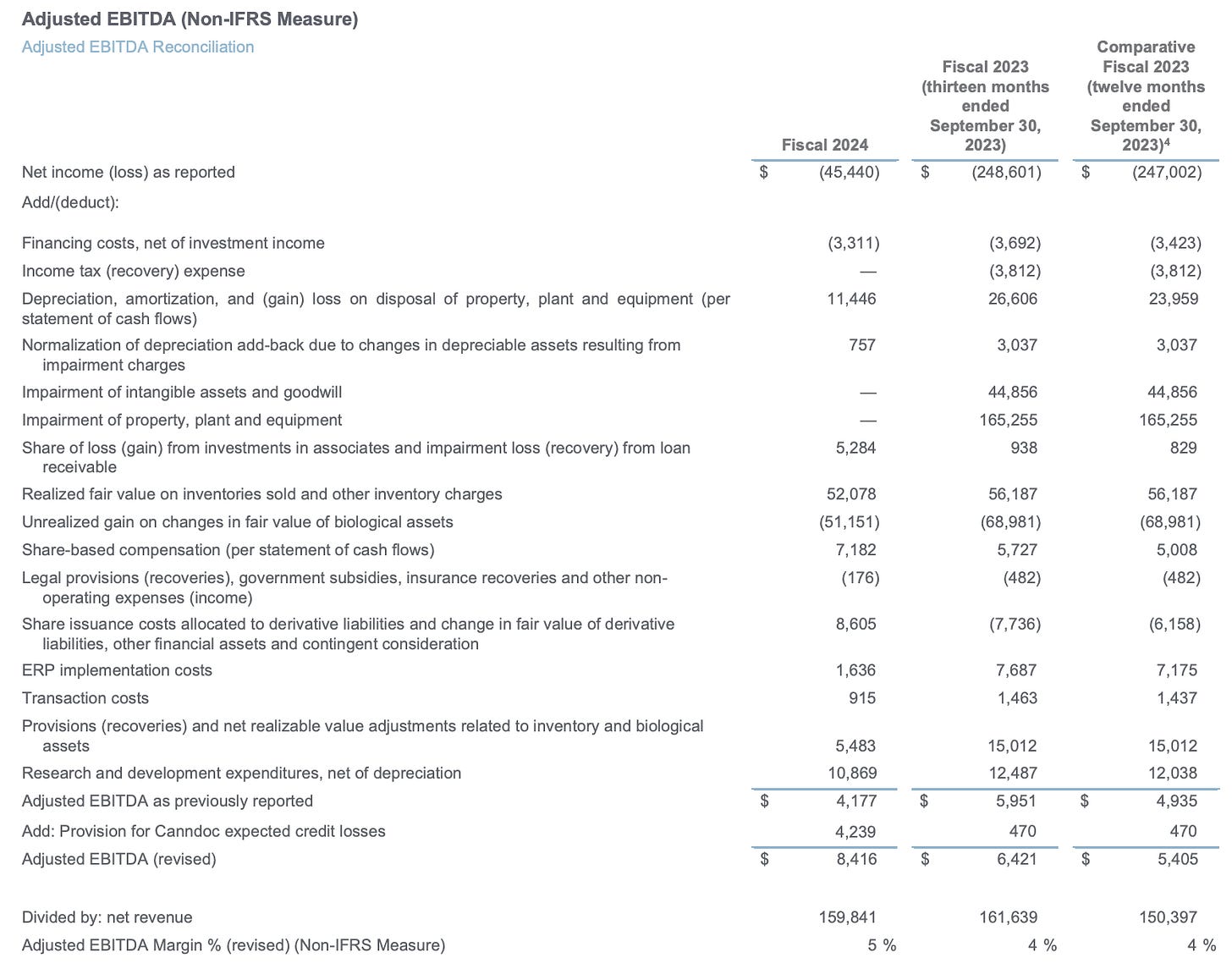

Here’s Organigram’s 191-word explanation for a two-word phrase (ADJUSTED EBITDA).

“Adjusted EBITDA is calculated as net income (loss) excluding: financing costs, net of investment income; income tax expense (recovery); depreciation, amortization, impairment, normalization of depreciation add-back due to changes in depreciable assets resulting from impairment charges, (gain) loss on disposal of property, plant and equipment (per the consolidated statement of cash flows); share-based compensation (per the consolidated statement of cash flows); share of loss (gain) from investments in associates including impairment loss; change in fair value of contingent consideration; change in fair value of derivative liabilities, other financial assets and preferred shares; expenditures incurred in connection with research and development activities (net of depreciation); unrealized gain on changes in fair value of biological assets; realized fair value on inventories sold and other inventory charges; provisions and net realizable value adjustments related to inventory and biological assets; government subsidies, insurance recoveries and other nonoperating expenses (income); legal provisions (recoveries); ERP implementation costs; transaction costs; share issuance costs; and provision for Canndoc (as defined herein) expected credit losses. Adjusted EBITDA is reconciled to the most directly comparable IFRS financial measure in the "Financial Results and Review of Operations" section of this MD&A.”

This is what it looks like:

My point is twofold.

ADJUSTED EBITDA is stupid.

My suspicion is that she meant 35% ADJUSTED EBITDA margin, not EBITDA margins. As such, I’ll be using the ADJUSTED EBITDA figure to do the following calculations. Because, why not, the kid/grifter in all of us likes to play kayfabe and pretendsies.

This is what Organigram has to say about ADJUSTED EBITDA.

“Adjusted EBITDA is intended to provide a proxy for the Company’s operating cash flow and derives expectations of future financial performance for the Company, and excludes adjustments that are not reflective of current operating results. The most directly comparable measure to Adjusted EBITDA calculated in accordance with IFRS is net income (loss).”

Oh, OK. Wink wink.

Let’s see how this ADJUSTED EBITDA figure acts as a proxy and compares to its closest comparable i.e. why it’s stupid?

Fiscal 2024 ADJUSTED EBITDA = $8,416

Fiscal 2024 ADJUSTED EBITDA margin = 5%

Fiscal 2024 net income (loss) = ($45,440)

Fiscal 2024 operating cash flow = $3,872

Simply put, it does a trash job at reflecting operating cash flows or net income.

PROMISE LAND

So, back to this 35% ADJUSTED EBITDA margin of net revenue she spoke of.

For Fiscal 2024, as the below image shows, they had a net income loss of -$45,440, AEBITDA of $8,416 and net revenue of $159,841. This gave them a 5% AEBITDA margin.

Now what would have happened to their net income, all else being equal, if they had an AEBITDA margin of 35% due to only having to pay an excise tax of 10%?

We now need to know their gross revenue figure.

The excise tax would be $24,717 (10% tax rate) instead of $87,336 (current effective 35% tax rate). This would bring their net revenue up to $222,459. That’s a difference of $62,619. Which means, all else being equal, they would have gone from a net income loss of $45,440 to a net income gain of $17,179.

Their AEBITDA would go from $8,416 to $71,035. $71,035 divided by the new net revenue figure of $222,459 would provide them an AEBITDA margin of 32%. So, I guess she rounded up 3 points but hey, it’s directionally accurate.

In other words, it would be a big freakin’ deal.

I’m not saying that this is likely to happen. But what I am saying is that investors paying attention to this is unlikely to happen.

I’ve lost count of the number of times I’ve heard or seen someone talking about the difference that the removal of 280E would have on a company, such as the image below.

And yet, I have never seen a single time a similar chart depicting what the impact to Canadian companies would be if the excise tax was reformed i.e. being changed to 10% rather than $1 a gram. Today’s article was an attempt at doing that. But the fact that what I just noted remains true is really worth thinking about.

I’ve been exploring this dynamic in varying ways. Here are a couple of posts I’ve made in regards to this topic.

And

Like I said, it’s really worth thinking about.