Knowing of the EBITDA tetrad is a good starting point in understanding the role EBITDA has in the cannabis industry. Here are 4 ways cannabis companies play to cook their books via aggressive accounting provide operational results and future prospects in a way that’s comparable over time and across the industry.

By removing the following they’re able to get much more flattering results.

ebItda: Interest on debt and interest paid on sale leasebacks

ebiTda: Deferred tax liabilities or just normal taxes

ebitDa: All the Capex non-accretive growth with none of the recognition of cost. Keeping weed on the books that’s deteriorating in quality.

ebitdA: Sale leasebacks are amortized.

It’s ironic that people who ignored these very real costs for so long are now congratulating these companies for focusing on paying down or restructuring their debt, interest payments & pulling back on their capex spending to “right the ship”. The same analysts who played pretend by ignoring these companies' omission of ITDA are now celebrating the company's attentiveness towards ITDA.

Take sale leasebacks for example. They were done by many desperate, illiquid and cash strapped companies. Nothing like compounding problems down the road and increasing their hurdle rate. But of course, management teams spun a different narrative as to why they were doing sale leasebacks. But that’s what happens when you deal with disingenuous actors.

I’ve always thought that investors & management teams were supposed to be on the same team. Yet, more often than not, it appears to be an adversarial relationship instead of a complementary and symbiotic relationship. I’m reminded of the phrase, “treat them like mushrooms, keep them in the dark and feed them shit.”

Giving Adjusted EBITDA figures and refusing to break down costs or same store sales seems to fall in line with such a motto.

When these companies provide you an EBITDA figure, they’re asking you to willfully ignore the usury interest rates on the company's outstanding debt. You’ll ignore how they’re accruing massive tax liabilities. You’ll pay no mind to large depreciation expenses which are associated with them overpaying for assets. And you’ll be more than happy to ignore how sale leasebacks and their associated interest expenses are burning a hole in the company's financials due to amortization seemingly not mattering.

Now you’d think EBITDA was a little much. But no, why stop there? Let's throw in some Adjustments too. All their sins are forgiven in the Church of Adjusted EBITDA where the zealots know no bounds in their willingness to finagle with the truth.

EARNINGS HAVE BECOME FUNGIBLE

When indoctrinated in the church of Adjusted EBITDA there is no tolerance for depreciation in their catechisms and bylaws. It’s not a thing in their observance, faith, devotion, adherence and belief systems. These practitioners aren’t concerned with intellectual integrity resulting in a comprehensive understanding but one of a constrained narrative that’s right at the exclusion of information. The evangelists and maximalists know no bounds in their accounting.

And if that’s not crazy enough, people compare one company's EBITDA to another company's EBITDA and pretend like that isn’t a stupid thing to do.

Humans have this weird tendency to measure a proxy or derivative in replacement of measuring the actual thing. If EBITDA is allegedly a gauge for cash flow, here’s a crazy idea… just measure cash flow.

It’s also interesting to see people talk about AEBITDA and also be obsessed with 280E. The reason it’s interesting is because 280E will at best minimally influence AEBITDA. This is when you realize that cannabis investors are involved in kayfabe. They know Adjusted EBITDA is a fictional metric but they have to use it because if they had higher standards, they couldn’t justify their participation in this sector in large part to begin with. Therefore, they settle for the nonsense which is AEBITDA in order to maintain their fantasy.

The two “most important financial measures” of this sector (revenue and EBITDA) are largely unaffected by 280E.

What you come to realize is that EBITDA is a backwards rationalized metric. EBITDA is largely irrelevant at assessing the performance of a business. Where its relevance lies is in its ability to paint a pretty picture…subterfuge.

Even on an EBITDA basis these companies can appear expensive, so people layer on their hopes and dreams for the future in some perfect best-case scenario and then talk about how the companies are actually cheap relative to that.

Yes, you heard that right, the stocks are trading cheap on a hopes & dreams basis. LOL. It’s no wonder why these people have gotten wrecked in their investment’s speculation.

EARMCOGSMOPEXPITDA

What does revenue minus cogs minus opex plus interest, taxes, depreciation and amortization tell you about a company?

What does EARMCOGSMOPEXPITDA tell you? Do you see how stupid that sounds? Earnings After Revenue Minus COGS Minus OPEX Plus Interest, Taxes, Depreciation and Amortization.

But that’s essentially what EBITDA is.

The only reason EBITDA doesn’t sound stupid is because you’re complacent and habituated to it and thus desensitized. It’s still largely irrelevant mush mouth nonsense though.

Does EBITDA have its place? Sure. Do people use it in place of other metrics because they’re ignorant, lazy or complacent? Absolutely.

For the most part, it sounds like a bunch of gobbledygook to me and rather unhelpful. A better phrase, to quote Charlie Munger is, “bullshit earnings”.

Don’t forget, my new acronym and the currently accepted acronym are the same. One’s just top-down and the other is bottom-up.

EBITDA = Total Revenue - COGS - OPEX + Interest + Taxes + Depreciation + Amortization

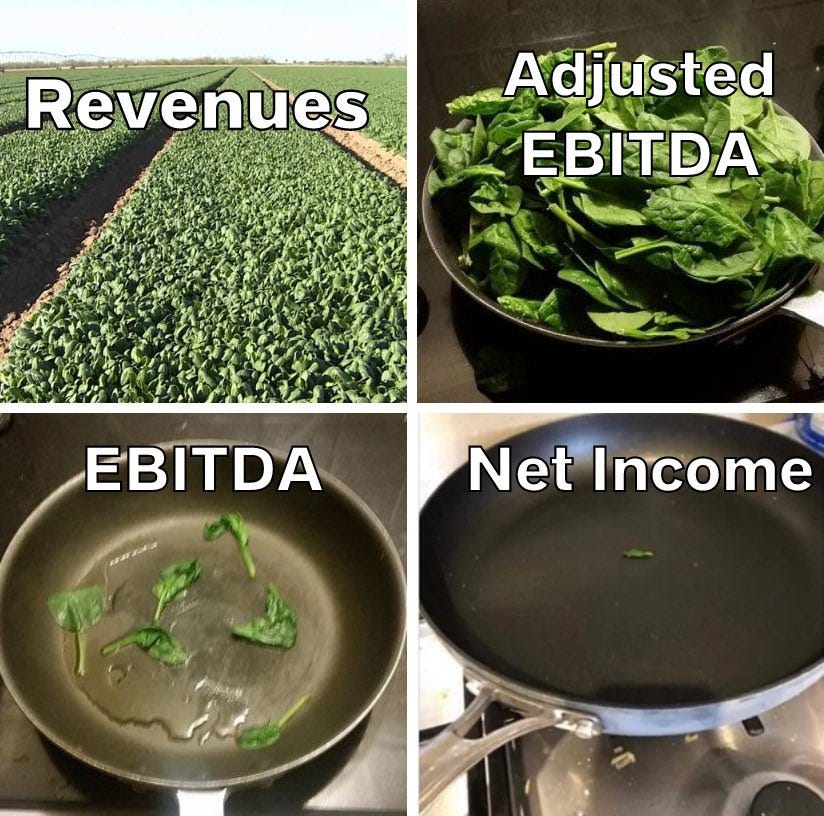

Maybe an infographic will aid you in this:

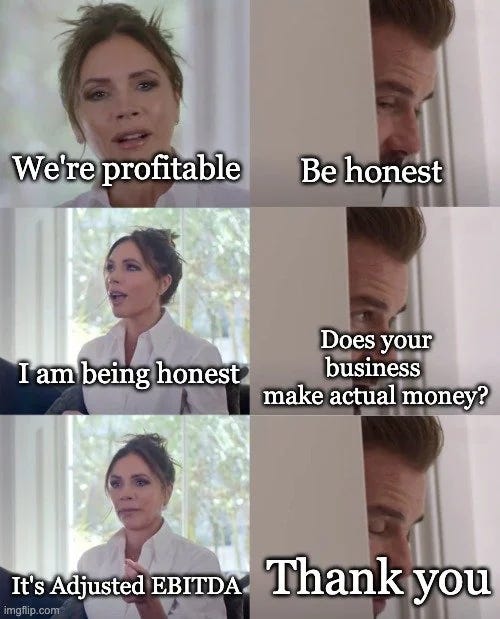

Net income profit isn’t flattering or more often the case non-existent so we move up the income statement to EBIT (operating profit). But that also isn’t good enough. So, we move up the income statement to EBITDA. But that still isn’t good enough.

So now we’re to the point of Adjusted EBITDA. Jeez, how far we’ve fallen. Or how high we’ve had to climb up the income statement to appear profitable.

Don’t forget that many of the “experts” in this field were referencing “funded capacity” once upon a time to value these companies. People will say whatever nonsense they can get away with.

Most recently certain companies are referencing their impressive FCF. But of course, they’re quieter about how that’s not factoring in the uncertain tax positions and tax liabilities they’re accruing which inflates their cash flow figures.

Pro forma FCF is not the same as FCF. Yet many pretend it is.

People are quick to co-opt their speech and bastardize language when it suits them, therefore it shouldn’t be any wonder that people leave out the adjective that’s meant to modify the noun (profit).

You know, “GROSS profit”, “OPERATING profit”, and “NET profit” when describing profit. Nope, now EBITDA is synonymous with profit. It’s sick and twisted. But that’s not all. Through this deterioration of speech, AEBITDA has become synonymous with EBITDA. LOL. And by extension AEBITDA now equals profit.

People are a glutton for punishment.

Don’t believe me? Check this (below image) out. It’s a simple tweet that shows the tier 1 MSOs EV/EBITDA multiple. Pretty simple, right? Pretty cut and dry, right? Seemingly not.

Boris Jordan (now the CEO) is seemingly incapable of understanding it. Or, if I want to assume competency on his behalf, his willingness to distort reality knows no bounds.

Below you’ll see that he’s saying that the 20.5x EV/EBITDA figure is VERY INFLATED.

He seemingly proves that the figure is “VERY INFLATED” by using Adjusted EBITDA through a slight of hand. Notice in his tweet he didn’t say that the EV/AEBITDA was 12x but that the EV/EBITDA WAS 12x. As though Adjusted and non-adjusted figures are interchangeable.

This is but one section of one thread. And to think, there are thousands of similar comments made like this.

The founder and chairman himself sees EBITDA and then immediately converts it over to AEBITDA. And he acts as though that’s even remotely ok. He acts as though using phrases and terms interchangeably is ok. It’s just an extra letter “A”, or an extra word “adjusted”. Well, in this specific example, the letter A makes a $66M difference.

Like I said, the line of what’s real and not has been so blurred, corrupted, warped and malformed that the practitioners of it have dug themselves a hole that they can’t get out of.

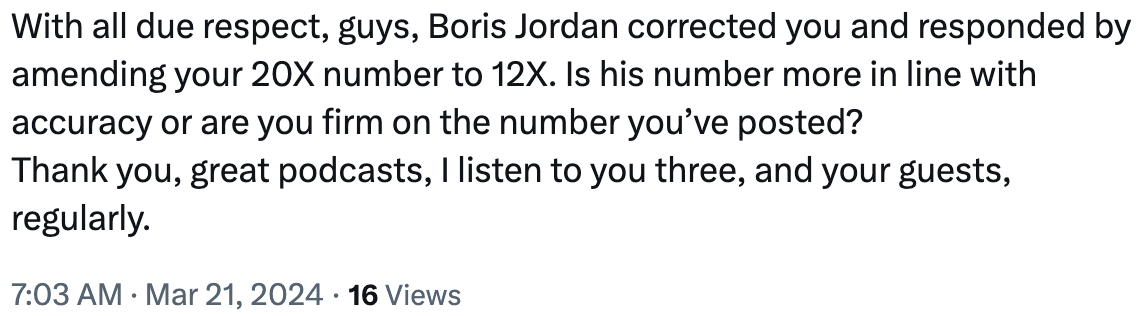

Just read the comments to see the confusion sewn. Here are a couple of examples.

To see such non-starter issues become so heavily debated and causing such confusion reminds me of this quote.

Adjusted EBITDA

Integrative cost is backed out of a lot of AEBITDA figures.

They're essentially saying, “Hey guys, we’re just going to go ahead and back out the costs associated with our primary business plan since it’s a one off.”

WTF?

Then when they shutter a store, cease operations in a state or write down an impaired asset they back those numbers out too. Why? Because it’s a one off. My God!

Talk about self-dealing.

Then you have Trulieve backing out legislative campaign contributions in their Adjusted EBITDA figure. Yet again, that’s the cost of doing business. Bribing officials paying lobbyists is part of doing business. And guess what, so are the associated legal fees of doing such things. If it wasn’t a necessary part of them doing business then I’d hope they wouldn’t be doing it in the first place. They’re a business not a charity. Oh, and by the way, cannabis businesses can’t deduct charitable contributions either.

It doesn’t matter whether bribing should have to happen or not, it is what it is. It’s part of doing business because otherwise they wouldn’t be doing it. It’s been deemed a necessary evil of the business landscape. It’s the praxeological description of the landscape of humans doing business since time immemorial.

That makes bribes a business expense and thus should be accounted for in their reported financial figures. Look people, this is elementary thinking, it’s not like I’m even reaching here to make superfluous associations.

It’s a business expense. How could it be otherwise? Oh, let me guess, it’s because each campaign contribution is a one off. Well guess what? This so-called one off has now become a $50M expense. Sure, one day it might not be a necessity of doing business but it currently is and has been for some time. This is an iterative pattern of behavior. It’s become a set and series of sequential contributions that’s taken place iteratively over time.

Let me ask you this; at what point does it matter?

At this point it’s a standardized business expense. How much would they have to spend for you to want them to include it in their reporting figures? How much?! $100M? $500M? And is that per quarter, anything less they can brush under the rug known as Adjusted.

And why does it have to become a certain amount before you reconsider it being classified as a one-off? That’s not how that works. Just because you think that if it’s a negligible figure of any specific accounting period then it’s ok to call it a one-off but if it was a substantial amount then it wouldn’t be a one-off isn’t how one offs work. A one-off is measured based on its intrinsic one-off nature, not how much that one off cost?

COMPENSATION STRUCTURE

Do you remember earlier when I said that revenue and AEBITDA were the “most important financial measurements”? There was a reason for that.

The funniest thing about this is the compensation structure. These people have gaslighted the investor community so hard that they let this happen. So much for kayfabe, this is real life.

The below image is from Green Thumb.

Revenue and Adjusted EBITDA has pathologized the culture so badly that C-suites are being incentivized and compensated on it. If you don’t see how this can create a principal-agent problem due to the perverse incentives and associated moral hazards then I suspect you haven’t read to this point nor have you been paying attention over the last half decade.

In the below image you’ll note that their adjustments lead to an increase of “earnings” of nearly $93.75M. What better way to boost your EBITDA by 43% than to adjust it. As though EBITDA isn’t an adjustment in and of itself (Boris Jordan demonstrated this earlier).

You went from E to EBIT to EBITDA to Adjusted EBITDA.

Which is really to say,

“Our adjusted, adjusted, adjusted earnings are $311M.”

EBITDA doesn’t seem aggressive enough; how else could we grow our EBITDA figure in 2022 by 43%? Oh, I know, let's pretend like impairments, write-offs, SBC, acquisitions and transactions aren’t real. And then we’ll call that figure something similar to EBITDA, Oh I got it, we’ll call it Adjusted EBITDA.

IN CONCLUSION

My point here today is simple. EBITDA is a subpar and suboptimal metric. And that holds especially true in the cannabis industry where the usury interest rates and effective tax rates make it a useless metric for all intents and purposes.

The only utility it provides is for those who want to play pretend and live in fantasy land by having their beliefs and feelings validated. Or by those who want to take advantage of those who are engaged in cope & fallacy. Either way, it’s not good.

Although this article was in regards to the cannabis industry it’s also quite applicable in other markets and especially nascent markets. Take for instance online gambling.

Look at the below disingenuous slight of speech. Boris would be proud. In the below example seemingly operating cash flows and Adjusted EBITDA are one in the same. LOL. After all, one is a proxy for the other. At least that’s the oversimplified, decontextualized lie that’s been fire hosed and repeated to the point of ad nauseam.

Here’s the original.

And below is a person bringing attention to it.

Of course, Sam never replied to that question.

The sickness of mind and commitment to pathology required to conduct one's character in this fashion is something that I have practically zero interest in. Distorting reality, step by step, through creeping normalism and shifting baselines is a positive reinforcement cycle and has a gravity to it. A slippery slope, each time you do it the easier it becomes and the more complacent and compliant you become in ratcheting it up. Where you end will look nothing like where you started and it’ll be for the worse. Or the better, if you’re making a living by being a hired gunned analyst, with minimal integrity, willing to paint over reality to superimpose your own fantasy.

Your speech is the guiding and orienting mechanism that you use in the world to be able to define and identify reality in order to navigate it. As such, it’s your first and last resort in not falling into catastrophe. The problem is that the one thing which will help you avoid catastrophe (honest speech) is the one thing that many people compromise that led them to catastrophe. Meaning, that when you need it the most it won’t be there to help you. This is in part why people can’t understand why their favorite bubble stock fell 90%... they’ve compromised their speech and perception to such an extent that they literally can’t understand.

Yes, it’s not just a matter of principle or practice but of the highest existential concern to me. EBITDA is a behavioral manifestation and symptom of a deteriorating, atrophied and apathetic mind. And as I said, I want no part in that.

If you like what you read here or it made you curious, you can read Part 1 here.