Once again, I find myself in isolation. As everyone is talking about Florida, here I am, talking about Minnesota.

Let me put this in perspective for you. On a recent episode of The Cannabis Investing Podcast, the interviewee, Jesse Redmond, discussed the Florida, Pennsylvania, Ohio and Minnesota markets. Yet, as you’ll soon see, the depth of analysis differs.

Let me show you the diligence (or lack thereof) being done in Minnesota and by extension its constituent MSOs versus other states and operators. As far as I’m concerned, Mr. Redmond’s overview is reflective of the general industry's focus (or lack thereof) and thus why I’m citing it.

He went on to detail the following.

Florida:

22M residence

137M tourists

Medical market is $1.8B

Almost 500 MSO owned stores.

Cansortium: 35 out of 38 stores are in Florida.

Planet 13: 26 out of their 30 stores are in Florida.

Ayr: 67 out of 94 stores are in Florida.

Trulieve: 70% of their stores are in Florida.

Pennsylvania:

13M people live there.

Medical market is $1.5B to $2B.

132 MSO owned stores.

Adult use is being done through a legislative process rather than a vote. Best guess is a mid to late 2025 start for adult use.

Trulieve is the leader with 21

Jushi has 17 stores, 47% of stores are in Pennsylvania, 131,000 sq. ft. cultivation facility

Cresco has 15 stores, which accounts for 21% of their retail footprint.

Ohio:

Adult sales are starting

Maximum number of doors allowed is 5 and tier 1 grow operators have better margins due to being vertically integrated but also because they’re allowed to participate in the wholesale market. Also, by having a Tier 1 grow you’re allowed an additional 3 stores.

Operators with 5 stores and a Tier 1 grow = GTI, Cresco, Cannabist, Acreage.

Operators with 4 stores and a Tier 1 grow = Vext

Operators with 5 stores and a Tier 2 grow = Verano, Ascend,

Minnesota:

Hemp derived market: edibles and beverages are allowable up to 5mg servings, 10 per pack, as well as THC beverages on tap.

“I don’t think Minnesota on a total MSO basis is going to be super meaningful. It will impact GTI and Vireo Health, or is it Vireo Growth these days? I forget the proper name. But those two stand out as having Minnesota exposure.”

Hemp, Hemp, Hemp, Hemp, Hemp.

By the order that these states and companies were discussed, as well as the subsequent lessening of information, you can tell that Minnesota isn’t getting much attention. You’d also think that with all the talk of THC beverages, perhaps a mention of Vireo’s Hi*AF and Boundary Waters branded beverages being launched in Minnesota on April 20, 2024 would have been appropriate.

So, let's try this again.

Minnesota:

5.7M people live there.

Medical market is $120M.

Adult use is starting in 1H 2025.

Vireo Growth and GTI are the only two vertically integrated MSOs.

Minnesota is surrounded by 4 states, none of which have adult-use.

Maximum number of dispensaries allowed is 8, 1 per congressional district.

Vireo: has hit their limit of 8 dispensaries.

8 of their 14 dispensaries are in Minnesota (57%) and if they manage to divest their NY assets, it’ll be 80%.

That’s much better.

I’m not here to talk about the pre–Feb 2023 Vireo. As far as I’m concerned, it was a poorly executed clusterfu*k. To me, this is a turnaround play, an inflection investing opportunity. Why Feb 2023? Because that’s when Josh Rosen became the CEO and the genesis of their CREAM & FIRE strategy happened. Do not confuse the Vireo of the past with the Vireo of the present or the future.

A lot of money can be made from the following developments.

Horribly fu*ked → sort of shitty → decent

In the spirit of full disclosure, it can also go the other direction, straight to bankruptcy Ville.

And who knows, maybe Vireo will excel past decent into a well-run, profitable and aspiring business. But let's not get ahead of ourselves.

Once upon a time isn’t present tense. As such, we shouldn’t confuse the two, although the past is often prologue. But sometimes it’s not.

Past: MN, NY, AZ, PA, NM, MD, NV and PR.

Present: MN (8 dispensaries), MD (2 dispensaries) and NY (4 dispensaries). With non-operating assets & liabilities in Nevada, Puerto Rico & Massachusetts.

Future: MN, MD...

Minnesota is going adult use in 2025.

Yeah, that’s a big deal, more than you might realize.

You have a company that’s going from illiquid and insolvent to liquid and solvent due to the restructuring of debt and the divestment of assets. You have a company brushing up against positive CFO due to Maryland turning adult-use last year and Minnesota turning adult use next year. You have a company that’s one of two vertically integrated companies in a state that’s getting ready to boom (Minnesota).

Minnesota

Minnesota by many standards has a restrictive and more heavily regulated medical market. This has caused people to get faked out into thinking that the adult use market won’t be that large either. I think they’re terribly mistaken. I think that adult use legalization will open the flood gates due to the suppressed & pent-up demand that didn’t want to jump through regulatory hoops or couldn’t qualify due to the less than lenient medical hurdles & dispensary locations.

Here’s a chart depicting growth expectations for when adult use turns on.

That’s a 323% YoY rise in sales.

If we use a sample size of one (what could go wrong) and examine their Maryland operation when adult use became legalized, we’d discover that they not only kept pace but exceeded the states total market sales. So that’s worth thinking about.

Images like this make me optimistic too.

Let me draw your attention to the east and southern flanks of Minnesota. There you’ll find Wisconsin (no medical cannabis) and Iowa (a very restrictive medical cannabis state with a total of 5 dispensaries).

You’ll note that the majority of their dispensaries are within a roughly 30–40-minute drive to the Wisconsin (most prohibitionist of surrounding states) border. That should bode well for them to an indeterminate extent.

Another narrative heavy & numbers light consideration is how many of the THC beverage consumers might be canna curious and explore alternative form factors. Because after all, aren’t low-dosed hemp derived THC beverages the real gateway drug?

Being that they’re only allowed 1 dispensary per congressional district and that they’re relocating their Moorhead dispensary, I’m curious as to where the next Green Goods dispensary will go.

Here’s a map of the congressional districts in case you’re curious.

THE OPPORTUNITY

Maryland turning to adult-use allowed their gross profit margins to go from 46% (2023) to 54% (2024).

10-Q:

But look what happened to their EBITDA margin! It went from practically zilch to 23%.

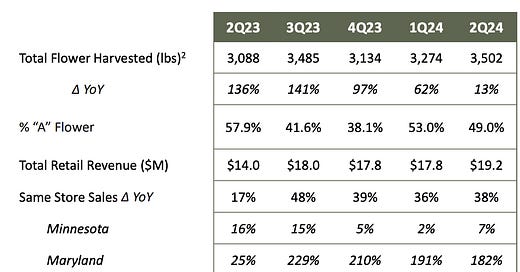

Now let's look at what the MN market is doing currently, keeping in mind that it’s not adult-use yet.

Minnesota is currently 48% of revenues.

10-Q:

If we simply double their first-half MN revenue for the year, that comes out to $46.4M. Now let's assume that they grow in Minnesota in-line with the overall projected market growth (323%, as noted earlier). This would imply that they make $196.27M in revenue. If they maintain their current EBITDA margin of 23% (although currently that’s largely due to Maryland but I’d imagine MN might have similar margins) then that brings us to $45.14M of EBITDA extracted out of Minnesota once they turn adult-use.

Thus far this year they’ve made $8.13M in EBITDA. All else being equal, and we double that then they’ll end 2024 with $16.13M of EBITDA.

Which is to say that they’ll grow their EBITDA from $16.13M in 2024 to at least $45.14M by late 2025 or early 2026. That’s 200% growth that’s not even factoring in Maryland in the final equation.

Look, there’s a ton of assumptions in here. Will Maryland prices compress by then, thus offsetting MN gains? Will MN pounds be more than Maryland pounds, thus offsetting the price compression in MD (some suspect that a pound could go for $5,000 in MN)? Will they have capacity to fully capitalize on the MN market? Will MN start late? Won’t MN EBITDA margins rapidly expand thus making my estimates conservative? Etc.

Regardless, I do believe my numbers to be good enough in both direction and magnitude. I would like to compare my analysis to others’ analysis, yet I can’t find anyone else’s analysis.

The point is that they’re looking to put up some big numbers in the upcoming future. Everybody is doing this sort of math (or pretending to) when it comes to Florida and it’s ok then, so why not now? The difference is that Minnesota isn’t relying on ballot outcomes.

Hell, around the cannabis space it’s practically all narrative and no numbers. But when it comes to Minnesota the narrative gets hijacked & bastardized to hemp beverages. The narrative of big headline numbers & macro narratives that don’t show the underlying math (common cannabis rhetoric) aren’t even happening when it comes to Minnesota.

To most Minnesota = Hemp. When it should be, Minnesota = A BIG deal for Vireo.

What I’m getting at here is that people aren’t paying attention.

VIREO GROWTH

Insofar as Minnesota is concerned, they're allowed to co-locate their medical & recreational dispensaries, so that’ll help on the capex side. Plus, as Josh Rosen noted in the Q1 conference call, due to the restrictive nature on the medical front, they currently can produce more than they can sell.

But how much is the question and isn’t a question I have an answer for.

But I’ll try.

If Grown Rogue is building 50,000 sq. ft. facilities which produce roughly 1,000 lbs a month (on the low end) then Vireo’s cultivation facility (90,000 sq. ft) could produce 1,800 lbs a month. That would be 21,600 pounds a year.

We’ll use the 2Q24 “Total Flower Harvested” as a run rate figure for the following math. If we assume that they can keep up their Q2 poundage that gives us 14,000 pounds a year. Meaning, that they theoretically have an additional capacity of 7,600 pounds or 54% potential growth. I see two problems with my math.

I don’t expect their facility to be as efficient as Grown Rogues, although Grown Rogue is helping them where they can.

A 54% increase of production isn’t going to capture much of the market if the market does indeed grow 323% YoY due to adult sales.

Although I don’t see any press releases from Vireo on the matter, nor can I find it in their 10-Q or conference call, there does seem to be the Elk River, Minnesota cultivation facility in development.

The only official mention of it I’ve come across is in a recent S-3 filing. Of course, I didn’t find the S-3 filing on Vireo’s website like one might expect but it instead required a direct search of the company on the SEC website. Ugh.

Doing a little Googling, I found numerous articles from around March 2024 mentioning this plan but no further updates. Here’s one such site.

Just like their Otsego facility (87,232 square-foot greenhouse cultivation facility with an adjacent 20-acre parcel for potential expansion), I can barely find any mention or details on these matters. So, with that said, I’ll end this section here.

IMPROVEMENTS

Margin improvements can be tricky because you can improve your margins without growing the underlying margin metric. For instance, you can improve EBITDA margins simply by reducing SG&A. But to see both EBITDA as well as EBITDA margins improve is a sign of improving health. You’ll note below that their Revenue, EBIT and EBITDA are up and to the right as well as the margins.

You’ll also note that SG&A margins are decreasing. This is the quintessential example of operating leverage. I’d like to think it’s due to increases in efficiency and fixed costs being spread over a higher revenue base. Of course, Maryland starting adult use sales in July 2023 helped immensely. So, I’d say, it’s a combination of opportunists meeting opportunities.

I suspect that this chart will remain up and to the right due to Minnesota coming on-line in a couple of quarters.

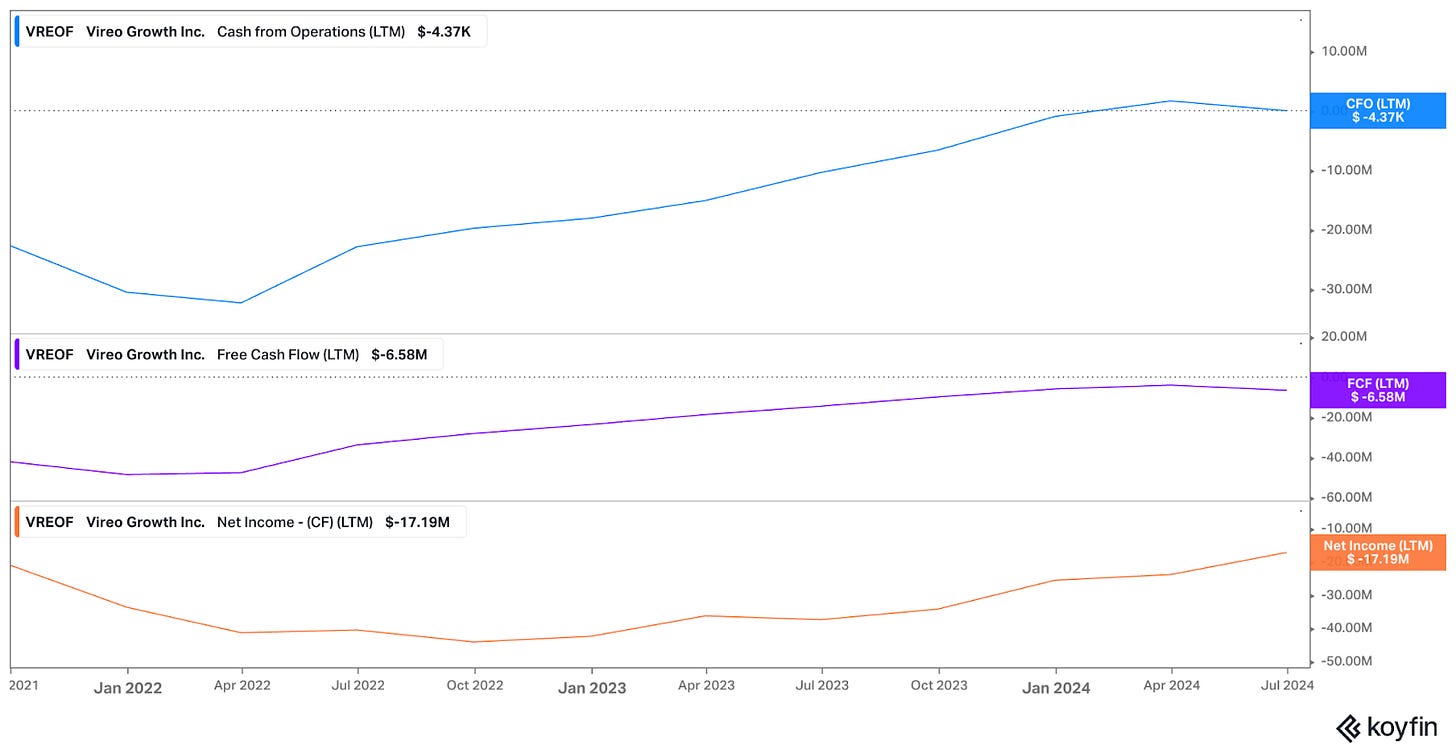

Between their divestments in other states, CEO change, their respective markets turning adult use, Grown Rogue advising them and so on, it shouldn’t come as a surprise that they’re now flirting and brushing up against positive cash flow from operations.

I just want you to know that their top line improvements are actually translating to bottom line improvements. Although FCF & net income are still negative, they’re improving. Both the absolute level & the rate of change are inflecting and have been inflecting positively. I expect that to continue happening into adult legalization in Minnesota come next year.

CONCERNS

I tried looking at the proxy statements and such for how management is incentivized and compensated but they seemingly don’t want you to know. Those who do want to make it clearly known, for instance, might show you a chart like the one below. The below image is Chesapeake’s FY 21 compensation structure.

It would be nice to see a chart like this in relation to the CREAM & FIRE strategy. But when a criterion is based upon adjectives it is bound to be ambiguous. But alas.

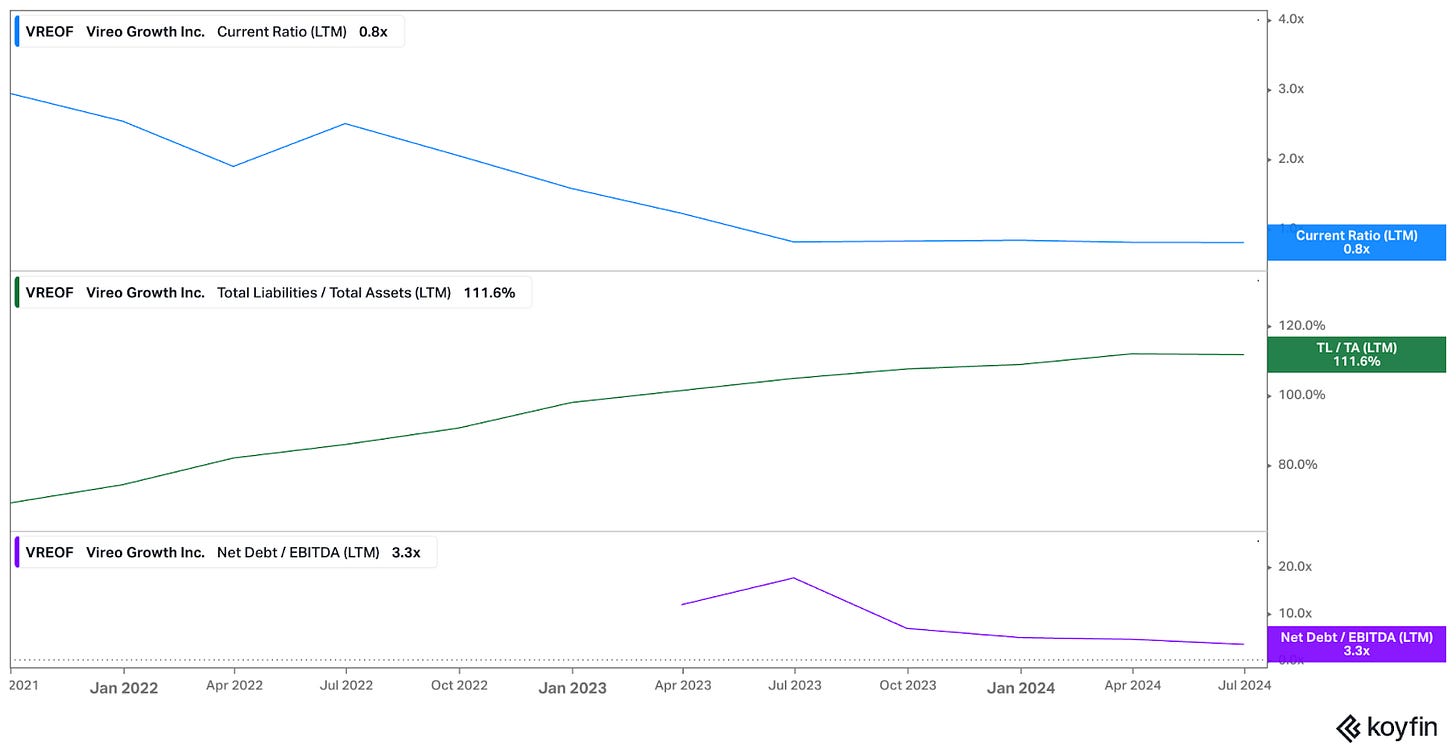

Another issue is that they’re illiquid and insolvent.

This kept me away for the longest time. One of the main reasons I’m writing this piece is because this company has redeeming qualities that seemingly no one can be bothered highlighting to any meaningful or comprehensive extent in the public spaces. As I noted at the beginning of this article, you can’t even count on the more prominent analysts and figureheads in this space to say much. It’s often the case that the devil is in the details but so is the saving grace. Between my superficial strategy of immediately dismissing illiquid and insolvent companies and my cannabis peers failing to meaningfully communicate positive aspects of the company & what’s going on, I’ve been slower to evaluate this company.

Back to the balance sheet. I will note that proforma due to some recent negotiations will allow them to be liquid but still insolvent.

Them selling their New York business would allow them to become solvent as well. However, as the months go by, I’m not sure if or when that will happen.

The above chart touches upon my next concern: Uncertain Tax Liabilities. Their uncertain tax liabilities are over twice their cash balance or twice their FY23 EBITDA. Yet again though, when venturing out into the deeper waters, games such as these should be expected. Personally, I’d prefer my federally illegal business to at least pay their federal taxes. To each their own I suppose. I understand the reasoning behind this strategy, it’s just not my preference. Also, it’s important to be mindful how not paying their taxes affects metrics such as CFO.

They’re also trying to claw back $12.3M of taxes paid between 2020-2022. Interestingly enough, it’s being claimed as income tax receivable and is being treated as an asset. Ultimately, you’re either ok investing in a company doing this or not.

Amber had this to say on the Q1 2024 conference call:

“We expect to file for tax refunds with the IRS for tax years 2020 through 2022 during the second quarter. And the state of our balance sheet accounts for an income tax receivable of $12.1 million as well as an uncertain tax position liability of $26.1 million as a result of this change.”

Another concern is shareholder dilution. It’s better to get in after the dilution occurs than before. I’m hoping that soon enough they’ll be able to sustain themselves with positive cash flows and the need to dilute their shareholders will stop.

After all, that’s why they’re publicly traded. It’s, in part, to raise equity capital. That massive spike up most recently is what the largest shareholder converting all of their convertible notes look like. It’s also what paying a pound of flesh looks like to the tune of 12.5M shares due to a ninth amendment on their credit facility.

But when the options are debt, dilution or receivership, most will choose the first two. And when the company is practically owned by three entities, you as the marginal shareholder don’t have much say. But such risks are expected when playing on this end of the pool. And when the vast majority of shares are locked up by a few concentrated players, it also should be expected that liquidity is going to be rather low and volatile.

It would only make sense that intraday volatility might be high sometimes.

For example:

In a world where people measure risk by volatility, it’s no wonder that these types of stocks are considered riskier. The trick is ensuring that the reward is commensurate with that risk. Also, I disagree with the notion that volatility = risk, but who am I to argue with the VAR bros. Of course, I’m pretty ignorant when it comes to parametric methods & Monte Carlo simulations, so take it for what it’s worth.

I want to bring up the New York branch of business one more time for emphasis.

April 1, 2024

ACE Venture Enterprises is supposed to assume the Innovative Industrial Properties (IIP) lease (Johnstown, NY cannabis cultivation and manufacturing campus).

The significance of this divestiture is that it’ll shed nearly half of the liabilities off of their BS and make them solvent.

According to Q4, 2023 10-Q

The problem is that this hasn’t happened yet. Not only would it help fix their balance sheet but it would also save them on interest payments.

Quote: (sorry, I do not know the source, perhaps Q2 conference call)

“This is where the sale of the New York Assets will be crucial. While we do not expect any meaningful proceeds from the sale, the transaction will allow the company to save over $10M in interest payments each year. It should also result in meaningful improvements in Gross and EBITDA margins, given that the New York market is by far the weakest of the three and almost certainly is not profitable for the company.”

To put that in perspective, that would afford them a monumental improvement in their cash flows.

Although Atlas asked for stronger shoulders and not a lighter load, the burden of New York is quite the weight to bear.

Along with them not paying their taxes and the optics that creates for cashflows, it’s also wise to recognize that their Grown Rogue warrants appreciating in value contributed a $1.6M gain to their EBITDA. Using their 10-Q EBITDA figure, this implies that the warrants contributed an extra 20% of EBITDA. This could just as well go in the opposite direction at some point in the future. I will say that as Vireo grows, this dynamic should contribute less to their EBITDA reporting's. However, if Grown Rogue keeps knocking it out of the park, these warrants still might make a meaningful difference to Vireo's earnings for some time to come.

Finally, a disclaimer that needs to be shared more often by me and others.

The charts I show don’t necessarily reflect the reality of the situation. Oftentimes, they’re directionally correct but can get the magnitude wrong, especially when it comes to EBITDA.

One of these is from Koyfin and one of these is from the SEC 10-Q filing. They both agree upon net income yet differ on EBITDA. Although I’m not following my own advice, I would recommend using the official filings. I’d also recommend that whatever you use, be consistent about it. Either way, be aware of this potential divergence.

Conclusion:

I should note that I have a positive bias towards their CEO. I’ve rather enjoyed his eclectic writings on Substack. I also enjoy the writings of Jerry Derevyanny, a partner at Bengal Capital. I think he’s one of very few people who actually gets it. Does this create a conflict of interest? No, no it doesn’t. People tend to conflate a potential for a conflict of interest with an actual conflict of interest. But humans are going to human, and this isn’t the time or place to further elaborate on such matters.

I know I left things out or didn’t sufficiently elaborate on other points, both good and bad. (For instance, I just realized that after 3,000 words I never once mentioned the Verano lawsuit. Or, how I’ve spent no time explicitly talking about the Chicago Atlantic Green Ivy credit extension, although I’ve noted it implicitly).

However, this isn’t a one stop shop for you to consign your investing decisions to me, it’s a place to pique your interest and act as a jumping off point, if you so desire.

I wrote this article for myself, trying to work through my own thoughts. But as far as I’m concerned, I might as well share these thoughts with others, to either complement, critique, add or subtract from my work. As often is the case, we jump steps and don’t overtly acknowledge information when we think. Thus, why writing is often so difficult. Today’s piece is a good example of how it can still be incomplete and unsatisfactory.

Most people have an additive bias. I’ve written to some extent on this topic in Friction & Fuel. You have to inverse the problem, “What should I subtract away to make things better.” This is often difficult for people not only because of their additive bias but also due to ego investments, pride and sunken cost fallacy. And thus, why new management is often required to turn a ship around. And ta-da… Josh Rosen entered the scene.

Vireo is a vestigial of what it once was but in a good way. They’re righting the ship, are a turnaround play and a bet on the underdog. However, you want to frame it, they’re out there making moves.

I’ll also note that Vireo is both in the $MSOS and $TOKE ETFs. That has to be worth something, right?

This isn’t a Vireo good or bad article. This is a, “Hey, pay some attention” article. I own some myself. Why? Because I think there’s some good that I can get comfortable with. Why is it not a large position? Because there’s some uncertainties that I can’t get comfortable with. The point of today's piece was to get people more up to speed and bring some light to a company that everybody seems to be brushing over (may I remind you of how this article started off).

In this article from Feb 2022, it ends with saying:

"It was never an afterthought ... down the line, Minnesota can be an unsung hero in the deal."

Well, guess what? We’re now down the line…