This will be brief and to the point (mostly).

With many news events I often wonder how I can make money from it. With the talk of hurricane Milton becoming a category 5, I once again found myself wondering that very thing.

More specifically, this seems to be a central/southern Florida play.

And in my search I came across this.

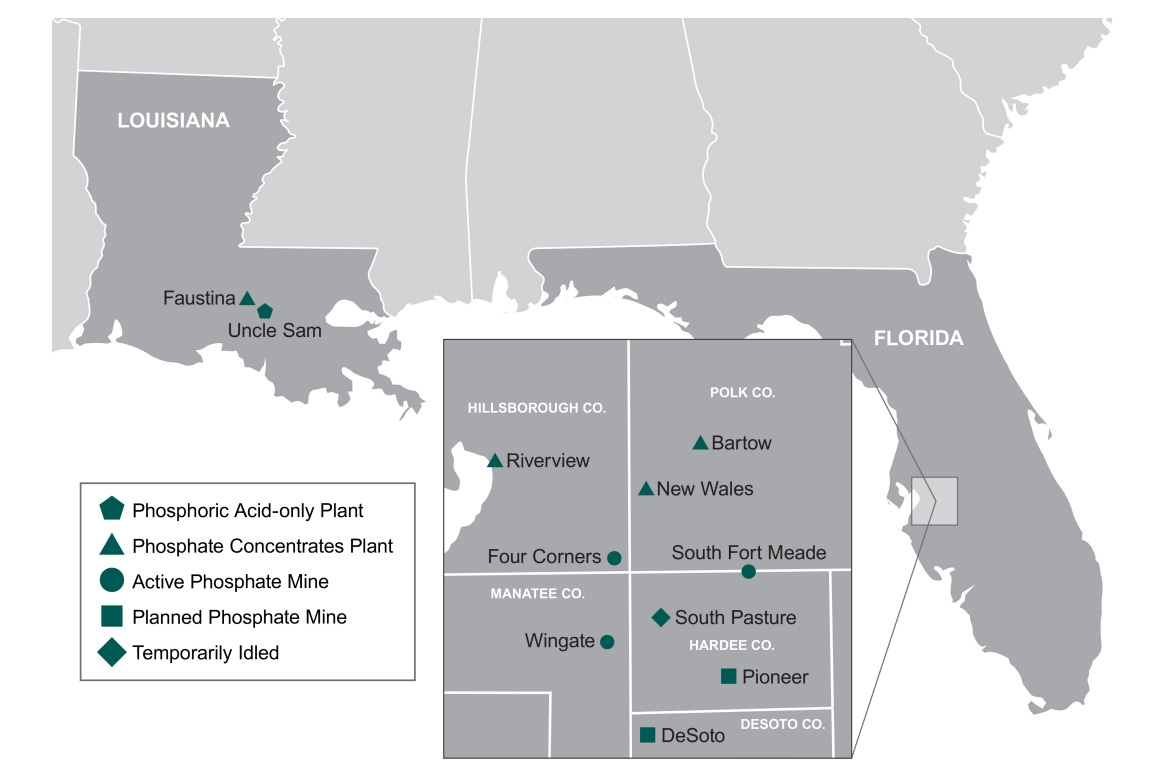

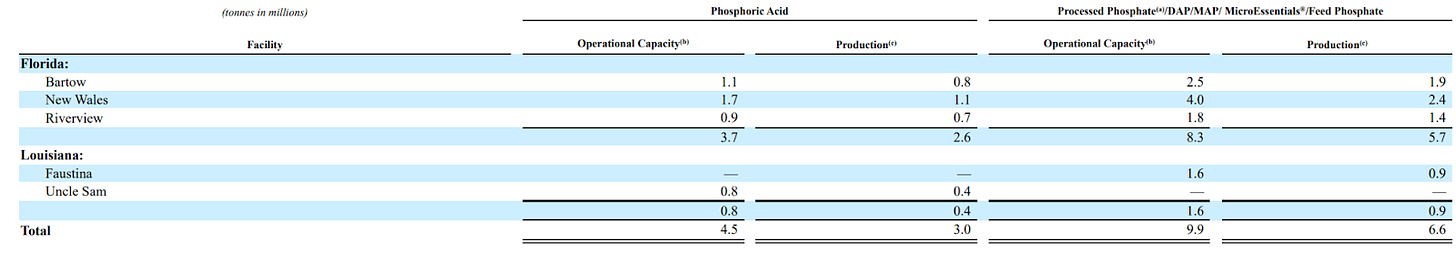

Mosaic $MOS has a great deal of Florida exposure with their phosphate mines and plants (10-K).

I started looking through articles about Mosaic and I find it quite interesting that none of the ones I read cited hurricanes barreling through Florida as a risk, odd.

What’s another way to play this?

How about citrus groves?

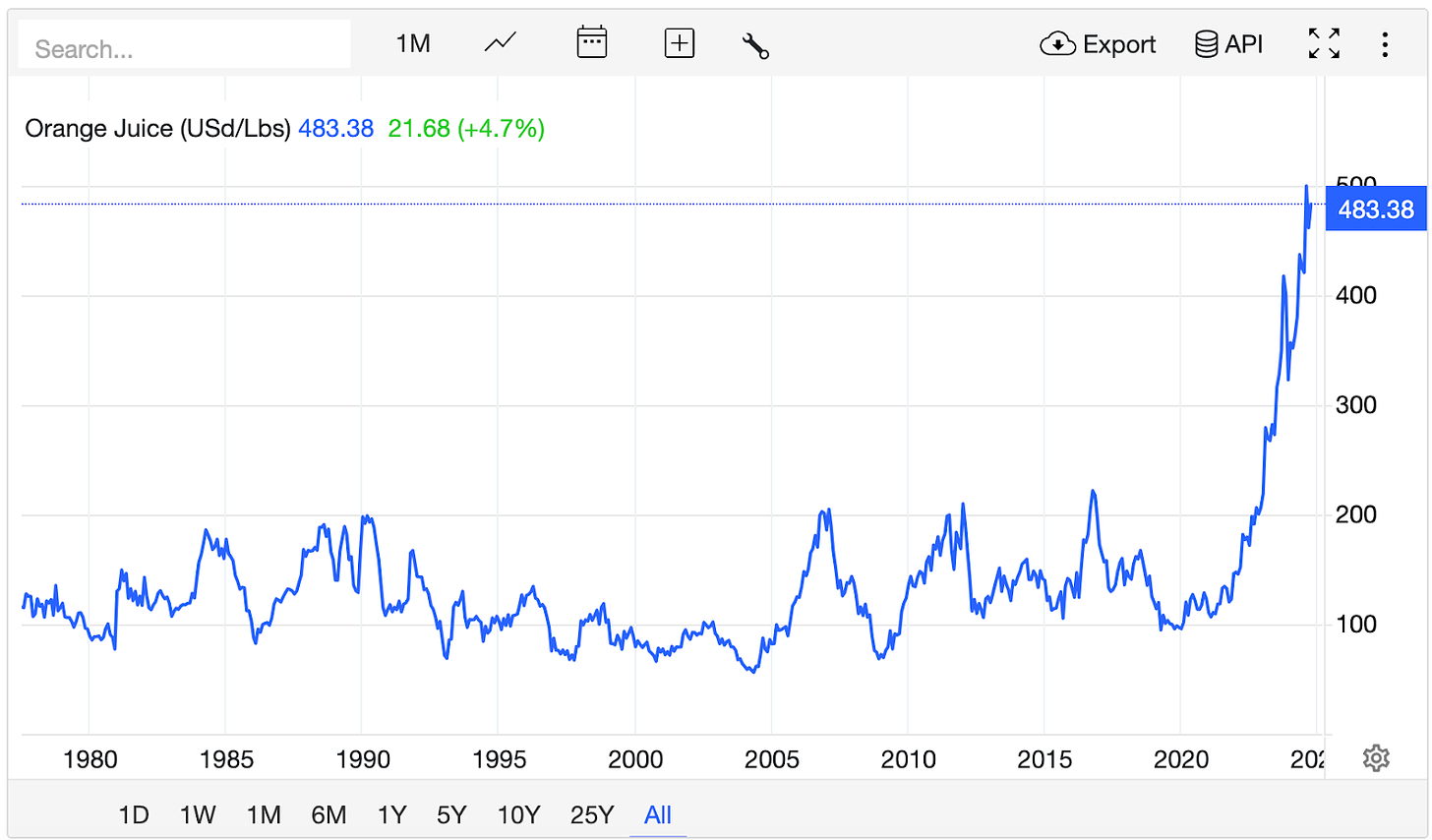

For those unaware, orange juice futures have been booming.

Here’s a handy county map to help you in the next section.

I recall recently reading about Alico in an Undervalued-Shares publication.

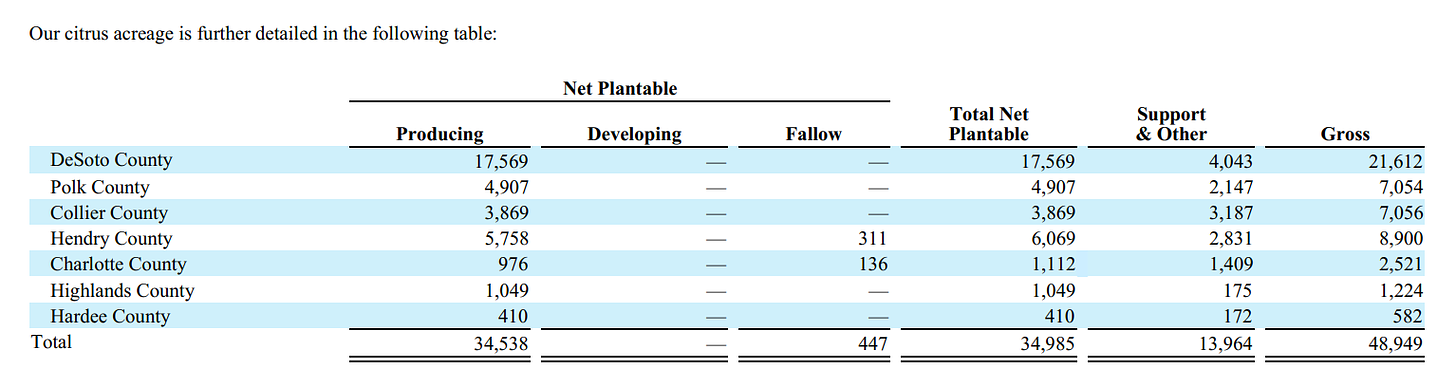

Below you’ll see their production per county (from their most recent 10-K).

Many of Alico operations sit farther south than the Mosaic operations do. Desoto County has the largest impact on Alico.

However Mosaic's New Wales production facility is their largest contributor in Florida which is in Mulberry city (Polk County).

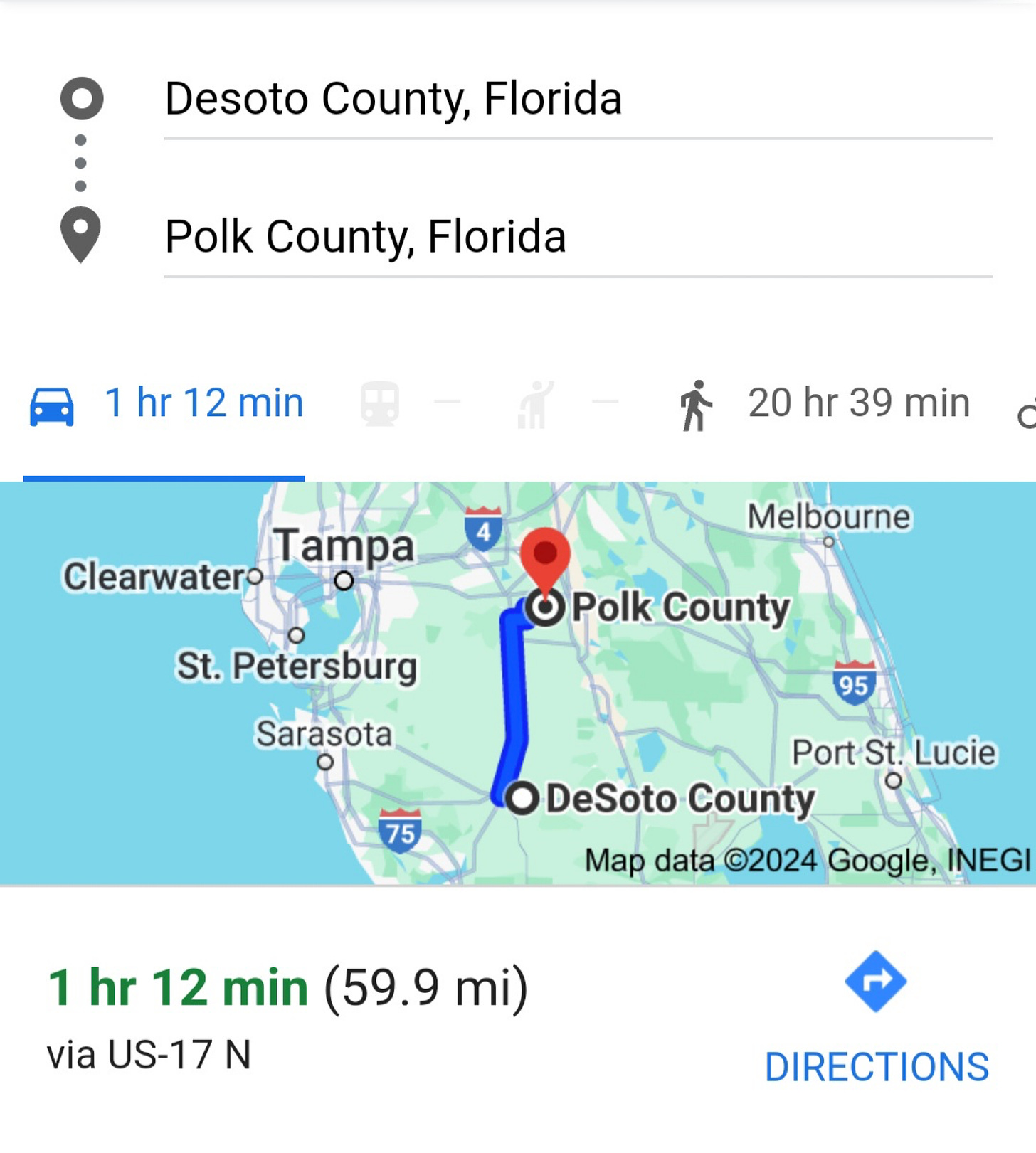

The distance between Polk County and Desoto County is roughly 60 miles. Meaning that they’re not too terribly far away from one another.

How much any one of these operations or segments contribute to overall revenues, let alone actual profit is not something I know.

As such, how could a reasonable person buy these stocks not knowing the financial impact that a temporary shuttering of operations, an Act of God or force majeure have on them?

That’s for you to decide and think about. I’m merely putting an idea in front of you. Perhaps you’ll read this and appreciate the thought process. Others of you might want to dig in and buy a position. Perhaps you’ve been looking to start a position in one of these names and think this might be a good time to get a starter position going. Others might find this to be a swing trade. Others will balk at the idea and move on in life.

Timing on this trade? Hell if I know. Could they dump another 5% and 10% tomorrow and the next day and the next day? Absolutely? Or it could get priced in by Tuesday, things don’t develop as terribly as initially thought and they rebound. It really all depends on you. I will say, if it’s a trade, position size accordingly and know when you’ll add to your position or dump your position. And just as importantly, respect those guidelines once you put them in place.

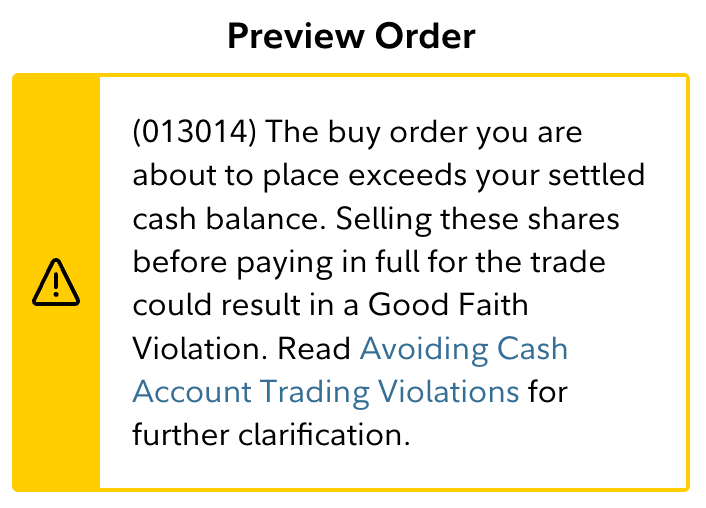

And please be mindful of such disclaimers as the one below. It’s not the wisest idea to get trapped in a trade with the alternative being a good faith violation.

To be honest, this seems like one of those widow maker trades. The asymmetry doesn’t seem the best. Catastrophe on one hand and reversion to the mean on the other hand. Nonetheless, it’s an idea and one to help people get the juices flowing.

I rushed this out so it’s not as thorough as I’d generally prefer but I thought it was worth putting on your radar.

Stay safe out there.