TDOC has two business segments:

Integrated Care

BetterHelp

Utilizing the image below, you’ll note that their Integrated Care segment is growing members (4.1% YoY), while BetterHelp is bleeding out paying users (-13.3% YoY).

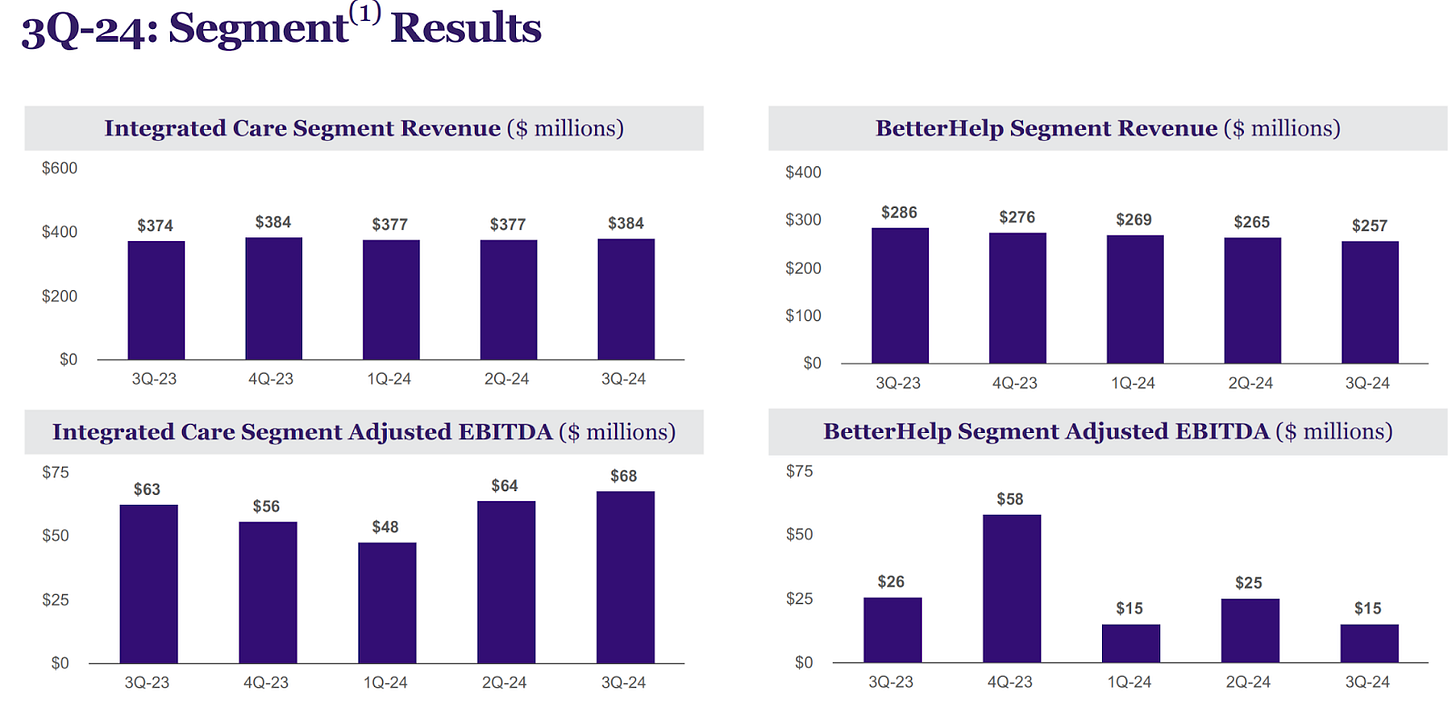

Integrated Care’s revenues and AEBITDA were both up on a sequential and YoY basis.

Then you have BetterHelp. With declining revenue and AEBITDA on both a sequential and YoY basis.

The bright side of this is that as the BetterHelp segment shrinks it’ll make less of an impact on the financials.

Not to put words in their mouth but it seems like they’ve given up on BetterHelp. In Q2 they pulled their guidance for the segment, they didn’t reinstate guidance in Q3 and in their latest conference call they’re not providing any guidance for it in 2025. Which is to say that the guidance they’re implicitly providing is one of loss.

In better news, year-to-date, the Integrated Care segment accounted for 59% of revenue but a disproportionate amount of the AEBITDA at 76.5%.

Integrated Care has a 15.8% AEBITDA margin while BetterHelp has a 6.95% AEBITDA margin.

In regards to revenue and AEBITDA, BetterHelp accounted for all of the losses. The Integrated Care segment is better at offsetting it more so on the AEBITDA side due to the Integrated Care segment making up the bulk of AEBITDA.

YoY, Integrated Care increased revenues by $10M and AEBITDA by $5M. However, BetterHelp lost $29M of revenue and $11M of AEBITDA. Once we net that out you realize that all the losses are due to BetterHelp and thus it’s the BetterHelp segment that is suppressing topline and bottom-line performance.

At least, that’s what I’ve inferred out of the two below images.

I find this to be a worthwhile distinction to make because it’s in the details of that distinction that we discover the difference between a company falling into obsolescence and being competed away vs. what I loath to say which is a good Co. bad Co. dynamic playing out. Good Co. Bad Co. is the quintessential wet dream of value investors and it’s an overcomplication of matters which often doesn’t work out or such a strategy takes longer than desired.

If you let TDOC tell the story the weakness they’re seeing is due to softening consumer spend and inflation. But that’s what any dishonest ostensible double speaker does, you blame macro (which makes them the Aesopian equivalent of the boy who cried macro). Then you pivot for the double-whammy and scapegoat matters on consumer weakness. I’ve seen this playbook more times than I care to have experienced.

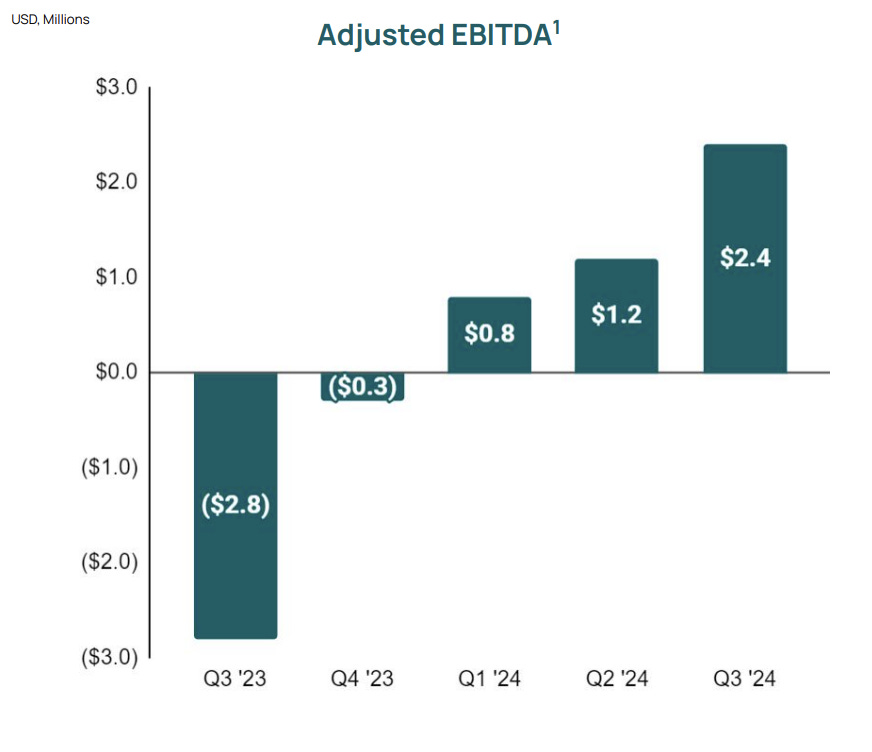

I say this because Talkspace (a competitor to BetterHelp) has seen their revenues and AEBITDA increase this year. Is Talkspace in a different macro with different consumers?

Ah, the things we can discover when we keep constant our comparisons and control for the variables.

You’ll note that Talkspace is up sequentially and YoY in both revenue and AEBITDA.

And

This is all to show that BetterHelp isn’t doing well and there’s more at play than “macro” and “weak consumers”. But this isn’t a stock pitch for TALK (unless it is also…).

The best I can tell, they’re letting BetterHelp die off (but they can’t say that because that’s not cool or palpable) and they’re doubling down on Integrated care via the Catapult acquisition (rightly so). As BetterHelp shrinks, it’ll become less impactful in a negative way and thus will allow Integrated Care to shine through. However, optically it won’t look nice because top line revenue growth won’t look so appealing due to BetterHelp still contributing 41% of revenue. But remember, it’s only 33.5% of AEBITDA.

Those who are abstaining from this name due to the past baggage won’t care to dig deeper into the financial statements to realize that stagnate revenue growth is a good thing in the sense that there’s a turning over of segments, as one takes lead. Meaning, it’s not a bad business per se but a bad segment dragging down the overall business. This implies that given enough time, the bad segment won’t matter and the good segment is all that’s to matter. And it's our jobs as investors to get in before this reveals itself. Although, I suspect people have caught onto this since the stock is almost 100% off of its lows.

I’d also think that the Catapult acquisition will help cover up some of BetterHelps' nastiness but with it only having $30M of trailing 12-month revenue that doesn’t seem likely. Since they’ve provided limited information on Catapult, it should be interesting to see if it’s accretive vs. them buying back their own stock, for instance. TDOC, which is trading at 1x P/S is buying a company for $65M, which is 2x P/S. Not that using that money to buy back 2.88% of their market cap would make much of a difference. It’s just a way to think about all of this.

LIGHTNING ROUND

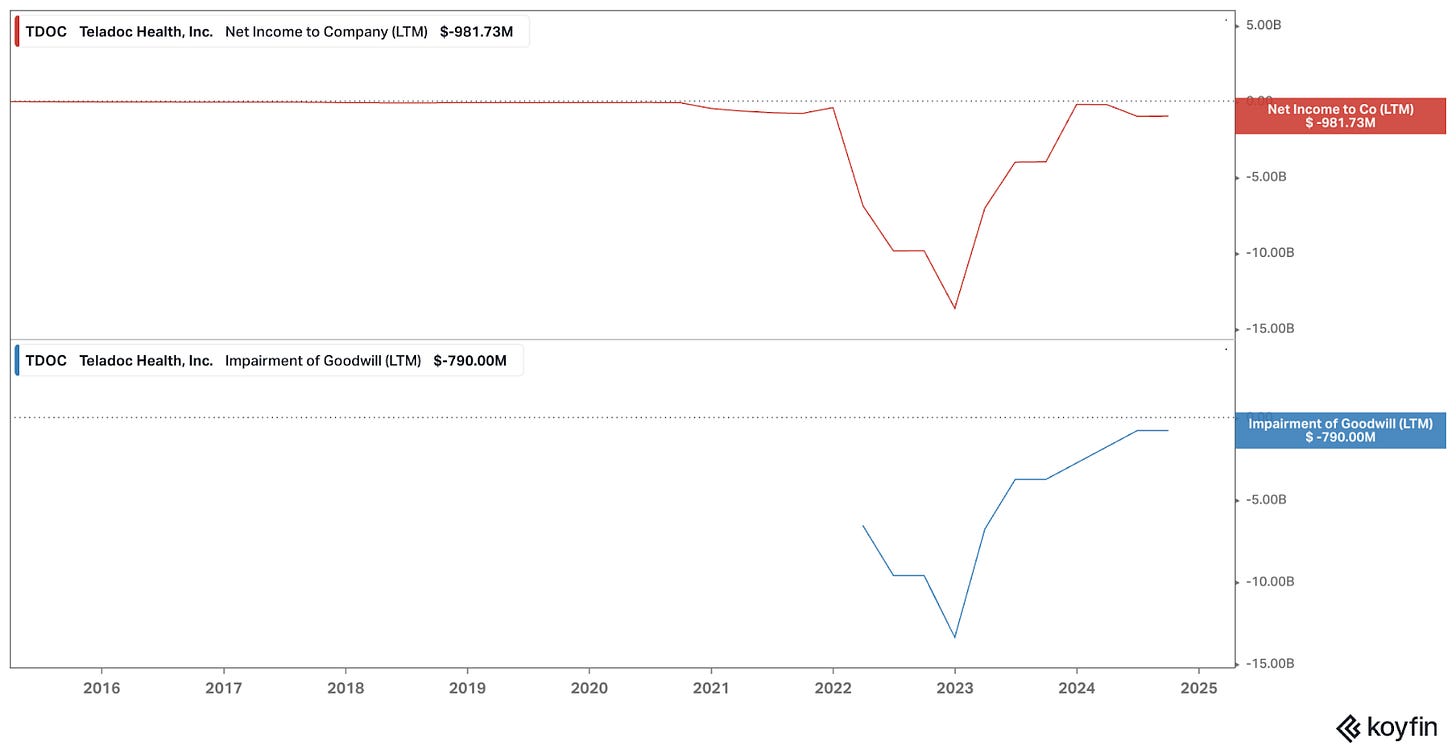

Just by virtue of them getting past their Livongo fiasco (via a boatload of write-downs) has helped improve their net income position considerably. Correlation is causation in this case.

Although their SBC is 6.4% of revenues and half of FCF it has been coming down over the years. Their SBC is also close to 6.4% of their EV which should tell us that it’s trading for roughly 1x EV/S, which it is.

A 1x EV/S is understandable once you recognize that their revenue has flatlined in the last year (no thanks to BetterHelp). But what isn’t flat lining is their net income losses (this could be considered damning with faint praise but I swear it’s not). I even drew an arrow to note the trend.

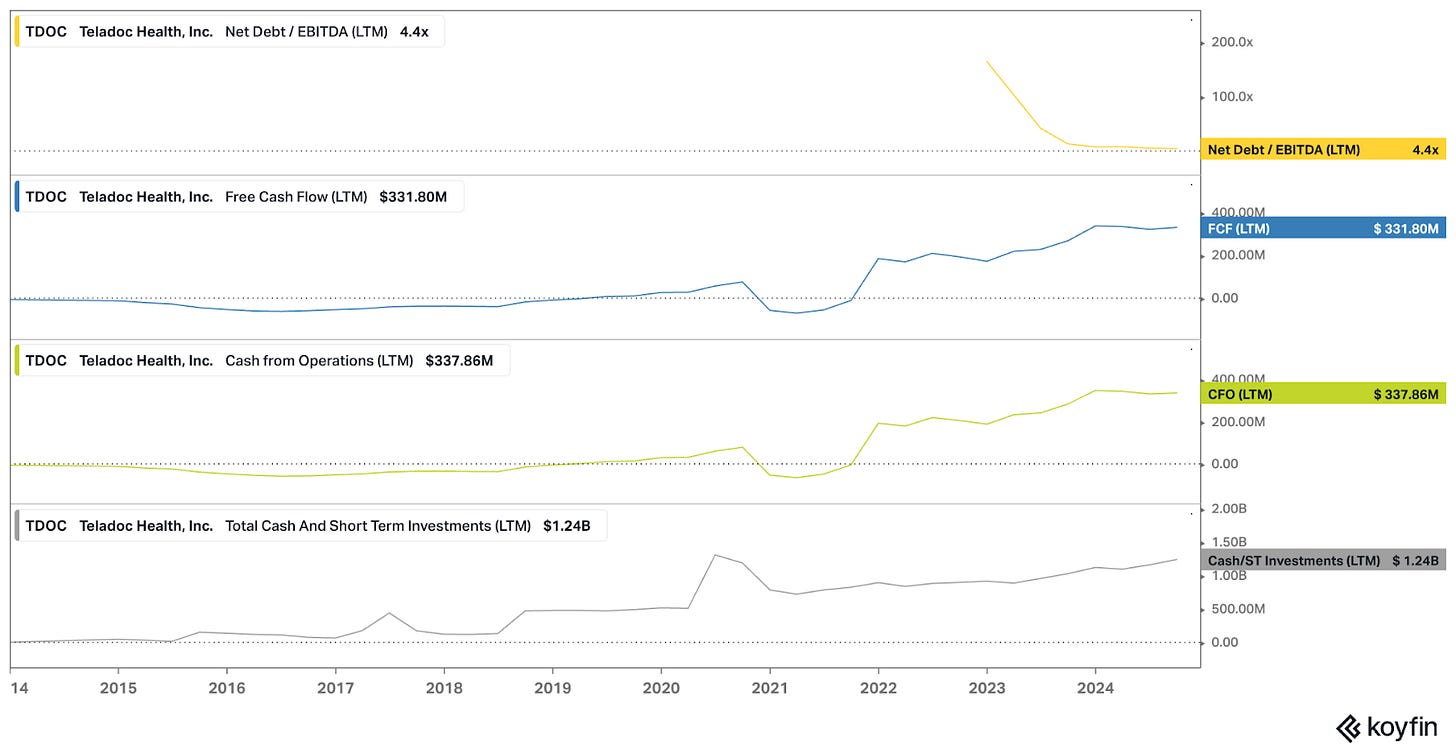

Before you exit out of this article with disgust and being insulted that I’m pitching a net income losing enterprise, they’re trading at an 8x EV/FCF. And FCF has grown 24% in the last year. Yes, this is one of those GAAP accounting mental gymnastics companies.

People can get tripped up on these charts because the CAGR looks to be collapsing. I have two things to say about that.

Anyone who thinks a triple digit FCF CAGR is sustainable, doesn’t understand business.

Although the CAGR is smaller in percentage terms its impact is felt on an overall larger dollar amount.

In the image below, you’ll see the red circles and the black circles. In the red circle the FCF CAGR was substantially higher than in the black circle, yet in the black circle the dollar amount was 100s of percent more (the red circle saw FCF grow $20M, while the black circle saw FCF grow $100M).

Looking at the same thing in different ways is a good idea and helps us conceptualize things better. In the below image, we’re comparing the red circle with the black circle, just like we did above. I hope you now understand what it is that I’m saying (a picture is worth a thousand words).

These are rough numbers but the red circle saw FCF go from $7M to $75M ($70M gain or 1,000% growth) while the black circle saw FCF go from $185M to $270M ($85M gain or 68% growth). This is part and parcel of getting in on companies in their earlier stages as their growth decelerates but the dollars they’re making grows. Many people are accustomed to only investing in more seasoned and mature equities where this sort of realization isn’t a prerequisite in understanding the stock or company. In earlier staged companies like TDOC there’s a monstrous disparity in growth rates within a matter of years. In this case 1,000% to 68%. In more mature industries and companies, the numbers are smaller and closer together 10% - 0.68%.

I didn’t choose 10% - 0.68% by accident.

It’s the same difference as 1,000% dropping down to 68%.

The perception of scale can throw a lot of people off. A reduction from 1,000 to 500 is a halving, just like going from 100 to 50. Both represent a 50% decrease. However, we perceive the impact to be more significant in the first example due to the absolute size of the number.

In both cases, the relative percentage decline is the same, 50%. This illustrates that they are proportional to one another. The math remains unchanged; what varies is our perception of that math based on the size of the numbers involved.

This principle holds true in reverse as well: whether starting from a large or small number, the nature of the percentage change is consistent, but our perception can lead us to interpret the significance differently.

I was going to title this: “Proportionality, Perception & the Constancy of Mathematical Principles” but I figured that would dissuade people from reading it.

Alright, let’s move on.

Although some people still think that SBC is still too high, it is coming down. It’s also important to highlight that FCF is increasing more than SBC is declining.

Which is to say that the FCF isn’t illusory, as I know many like to adjust FCF for SBC. However, their FCF isn’t just a function of SBC coming down. Which is to say that FCF is organically growing.

Yes, net income is negative. However, once these damn goodwill impairments stop happening (they’re happening less frequently and with lesser magnitude) they will be close and I dare say net income positive (and remember this is all while BetterHelp is declining).

Most recently, they took a goodwill impairment in June for $790,000. It’s worth noting that this was an impairment to their BetterHelp segment. It’s but another tacit admission of its deterioration.

Or, more optimistically, BetterHelp is in an intermediary pause and they’re regrouping to take it up a notch once they get their bearings straight.

You’ll note that TDOC has been flirting with net income profitability since their IPO. Yet, one of these years isn’t like the others.

That would be due to the impairment they took for their Livongo acquisition.

But hey, look on the bright side, it creates tax loss carryforwards. I’ll let Cathie Woods explain.

Kidding aside, their margins have improved over the years and the impairments have to stop at some point, right…right?

As shareholder dilution is concerned, it has been inching up over time (SBC doesn’t help), but since the Livongo disaster, it’s been tolerable enough.

Which brings me to our next point…cash.

55% of their market cap is in cash. The recent acquisition for Catapult cost them $65M. So, their market cap to cash ratio is still in the 50% range.

But cash shouldn’t be viewed alone, perhaps we should look at the debt.

This gives us net debt of roughly $345M. That seems manageable.

But what about the debt maturities? Oddly enough, their debt maturities and the risk of equity dilution has been a meaningful pillar of bears. I suspect that’s due to their superficiality in regards to narrative rather than an argument grounded in arithmetic.

Oh boy, we’re coming upon a maturity wall of convertible notes coming due.

Simple math and a cursory glance would indicate they have $837M coming due this year.

2025 Notes: $287.5M

Livongo Notes: $550M

Total = $837.5M

Their 3rd series comes due in June 2027.

By the looks of it, these will not be converted to equity. If they somehow did, I’d be more than ok with that because it would mean that the stock is ridiculously higher.

The following “strike prices” sound ludicrous to me, so I’ll assume my math is wrong. Nonetheless, it would appear that in order to make it attractive to convert the notes, the stock prices would need to reach the following prices.

2025 Notes = $53.61 a share

Livongo Notes = $71.75 a share

What makes me think my math isn’t wrong is considering the price that these stocks closed at on the day of the note issuances and in the case of Livongo, the amount of dilution that was getting ready to take place.

2025 Notes: stock closed at $45.30

Livongo Notes: stock closed at $157.15

But it’ll be ok, as we discussed, they have the cash to pay their notes.

From their Q3 conference call:

“With respect to the convertible bond coming due in June 2025, we currently anticipate retiring that with cash on hand at maturity.”

UTILIZATION

Their utilization calculation is disingenuous because it annualizes the result, as though each and every quarter will be the new annualized run-rate. It’s very odd to do that as far as I’m concerned. It’s also interesting that they stopped recording utilization rates in Q4 ‘22.

Q2 ‘22 seemingly saw the peak in utilization rates at 24%. As of Q3 ‘24, utilization rates are 17.17%. We do need to keep in mind that Q3 is historically their lowest reported utilization quarter of the year, though.

This is to say that 1 out of every 6 employees utilize TDOC services.

Average revenue is $1.36 per month = $16.32 per year. So, 5 out of 6 employees don’t utilize it, meaning $81.6 goes to “waste” while $16.32 is used. Effectively, this means that the employer is paying $97.92 for a single employee per year. The question is: is that still cheaper than not having TDOC at all and just paying out of pocket for whenever an incident arises vs. covering all employees all the time? The answer seems to be yes, at least within the context of Walk-in Clinics, urgent care and primary care facilities which range from $100-$200.

I’d find it best to model matter back to the pre-Covid levels. All the Covid highs gave us was a cap on the upside (within the context of technological adoption at that time. Meaning, as technology and services such as TDOC is more normalized over the coming decades you could see a higher cap percentage in the future under similar circumstances).

The below image shows us that in 2018 and 2019 that utilization rates were between 7.8% and 11%.

Yet again, all this hoopla about how the telehealth industry has fallen off a cliff since Covid is technically true and factually correct but largely unhelpful in modeling much of anything. It’s the wrong framing. They went from 36.7M members in 2019 to over 90M members in 2024 and their utilization rate went from 8% in Q3 ‘19 to 17% in Q3 ‘24. Oh my, how terrible things must be for them (sarcasm).

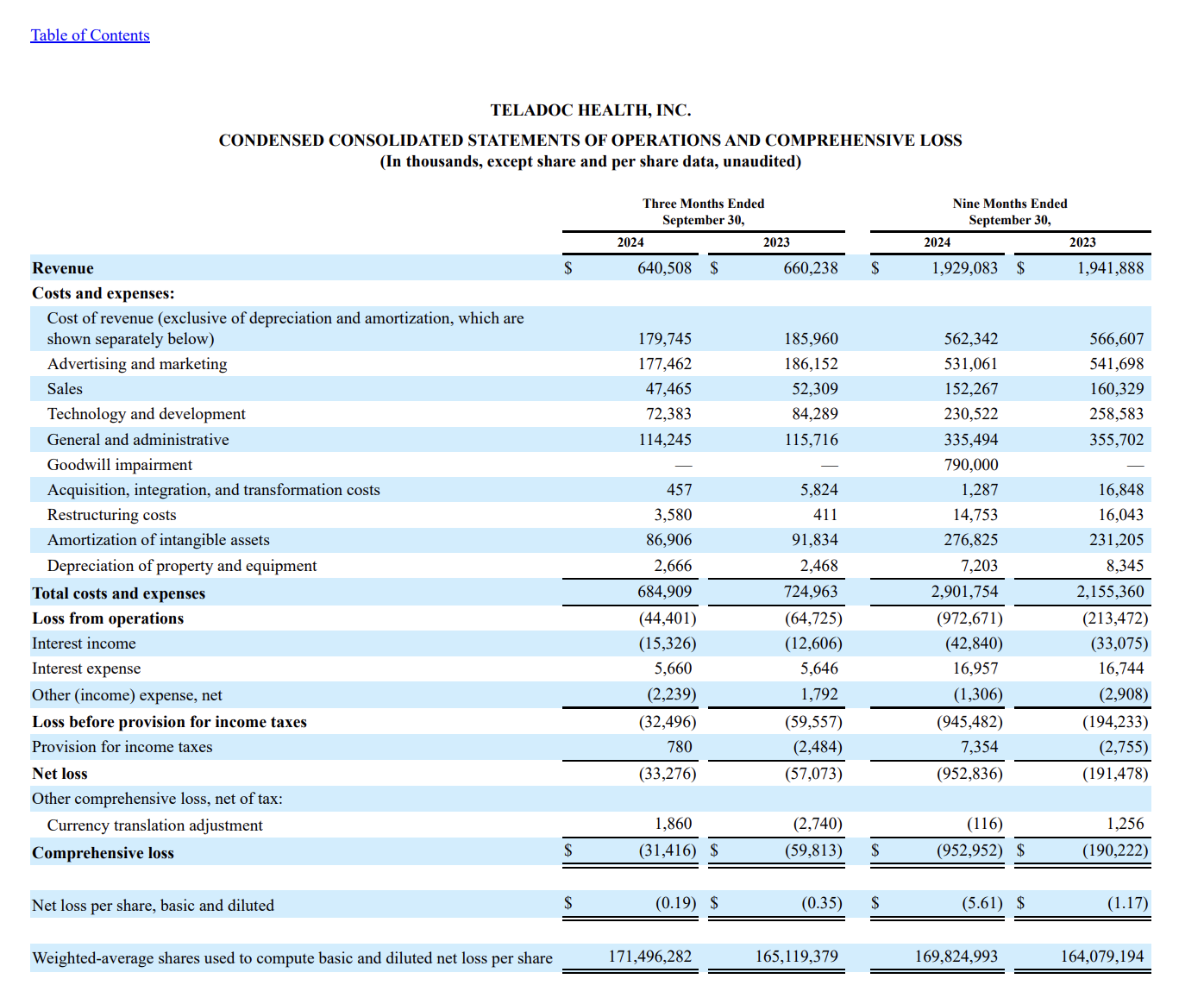

RESTRUCTURING

Utilizing the below image, if you back out their goodwill impairment of $790M for the nine-months ended Sep 30, we’d see a net loss improvement compared to ‘23 of $28M. But don’t be fooled thinking that it’s all due to their efficiency goals via general and administrative expenses being reduced in nominal or relative margin terms. Although it is due to that in part, another meaningful contributor is their reduction in advertising spend (related to BetterHelp) and technology and development.

What is the long-term cost of this reduction in T&D? I don’t know. However, it doesn’t immediately strike me as such a meaningful reduction that it would impair their future.

In some sense, it is nice to see them not throwing money at their BetterHelp problem, as many companies aren’t afraid to buy temporary business at un-accretive prices. BetterHelp is ultimately a CAC vs. LTV story that isn’t working out in their favor. But at least they recognize this and are reducing themselves from throwing good money after bad.

When these restructuring costs do subside, those one-time restructuring costs should continue on. Thus, making them upfront necessary expenses with long-term beneficial impact. At least that’s the ostensible story.

CONCLUSION

Ultimately, you can view things on a high superficial level such as the image below.

*Note* The below image ends on Aug 2024, TDOC’s stock price bottom.

Or, you can start understanding matters on a more individual level, which coincidentally, will help you better contextualize and understand the image above.

Fundamentally and simply put, were it not for the baggage of the past and the BetterHelp segment, this stock would be looked at in a much different light. Sentimental overhangs are overcome with time, especially if the management team executes. Time and good execution heal and repairs a lot of damage. The concern then is towards BetterHelp. It’ll take some time for it to deteriorate significantly to no longer be meaningful. Or, they could continue with acquisitions to the Integrated Care side to make the BetterHelp segment more negligible and marginal in its contributions (or lack thereof). But internal rate of return is a real concern for investors and thus some might wish to wait until then. Yet, the market in all likelihood will sniff it out ahead of time.

After all, this isn’t some undiscovered gem dusted over with cobwebs. It has enough attention on it for there not to be too much of a lag between performance and subsequent multiple re-ratings reflected in the stock price.

I feel like I’ve said enough to either pique your interest or not. I have other things I could say, but I wanted to get this article out sooner than later in order to provide you with enough time to come to your own conclusions before they report earnings next week.

Other things could include this:

It’s also worth keeping in mind the upcoming Medicare telehealth extension, or lack thereof.

With that said, I’ll end it here today.

Disclosure: I’m long TDOC.

too hard, but i read this as a bullish thesis for TALK