Todays honorable mention of Stupid Sh*t people say has been taken from a recent podcast I listened to.

“Nvidia may be America's top performing stock after more than doubling this year alone but if you’re holding Nvidia or thinking of buying it to get a stake in the 7 trillion dollar AI market you’re going to want to see [anonymous name] AI prediction first…”

Let's evaluate what they’re saying.

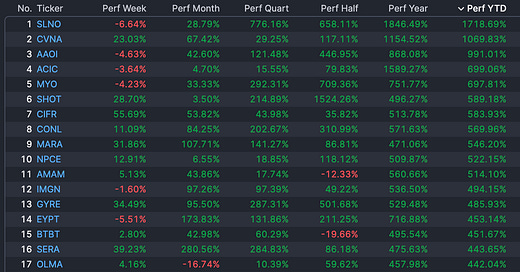

First and foremost the quote starts off with a blatant lie. Nvidia is not America’s top performing stock. At least not YTD.

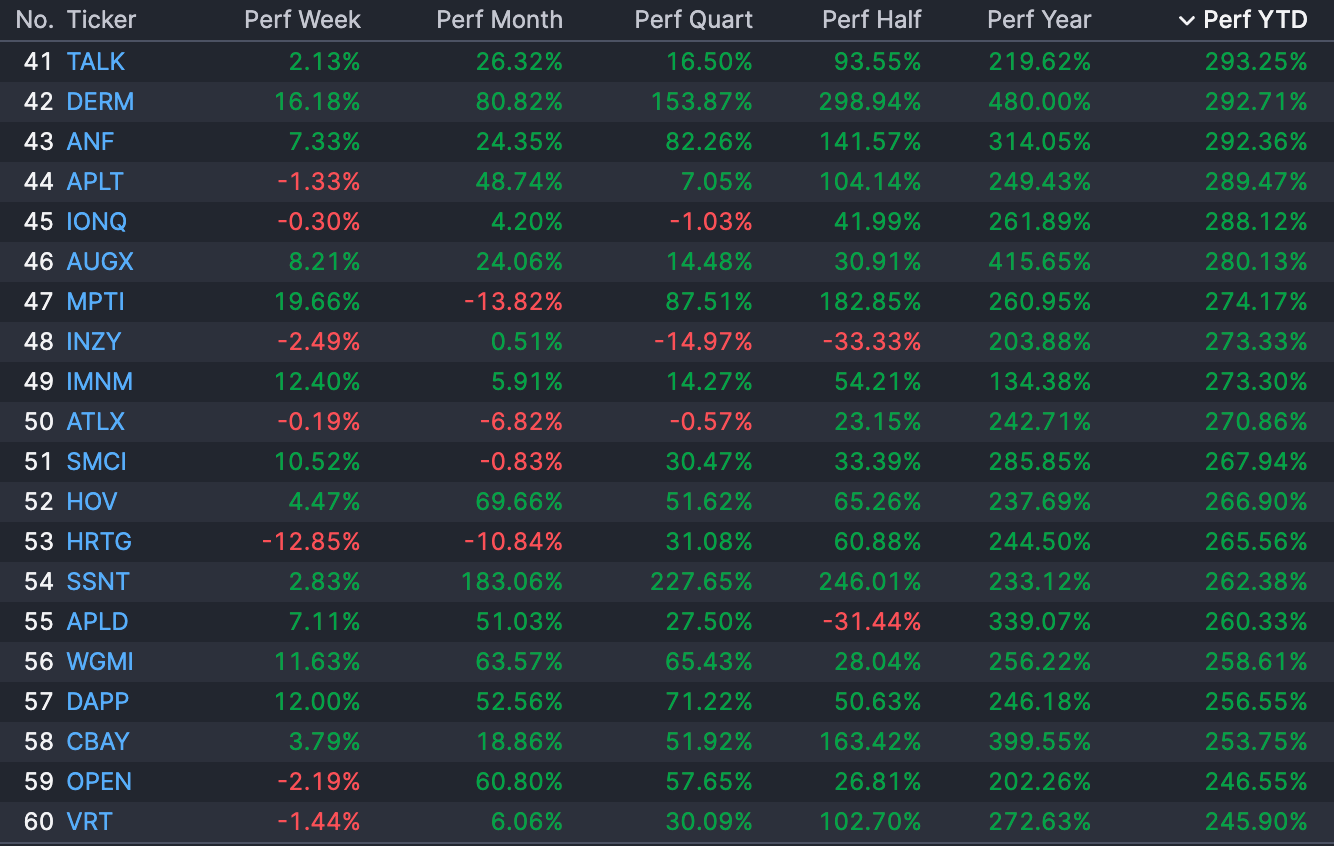

Matter of fact, it’s not even in the top 50 of America’s top best stocks YTD. For your viewing pleasure I’ve presented you with all the stocks that beat Nvidia. You’ll find Nvidia at 70th place.

Still not there.

And finally at #70.

Assuming Good Faith

This will be a rather short section. The question we need to ask is: how can we constrain and manipulate the data for NVDA to be “America’s top performing stock?”

To cut to the chase of all the ways we could finagle the data to make that a true statement I’ve landed on 2 ways. The first is the weaker of two arguments but sadly the more common form of reasoning. The reasoning lies in conflating categories and treating “the market” synonymous with “The S&P 500”.

The problem with this is that there’s more to the set of American stocks than the S&P 500. Insofar as American stocks are limited to the S&P 500 then Nvidia is indeed America’s top performing stock.

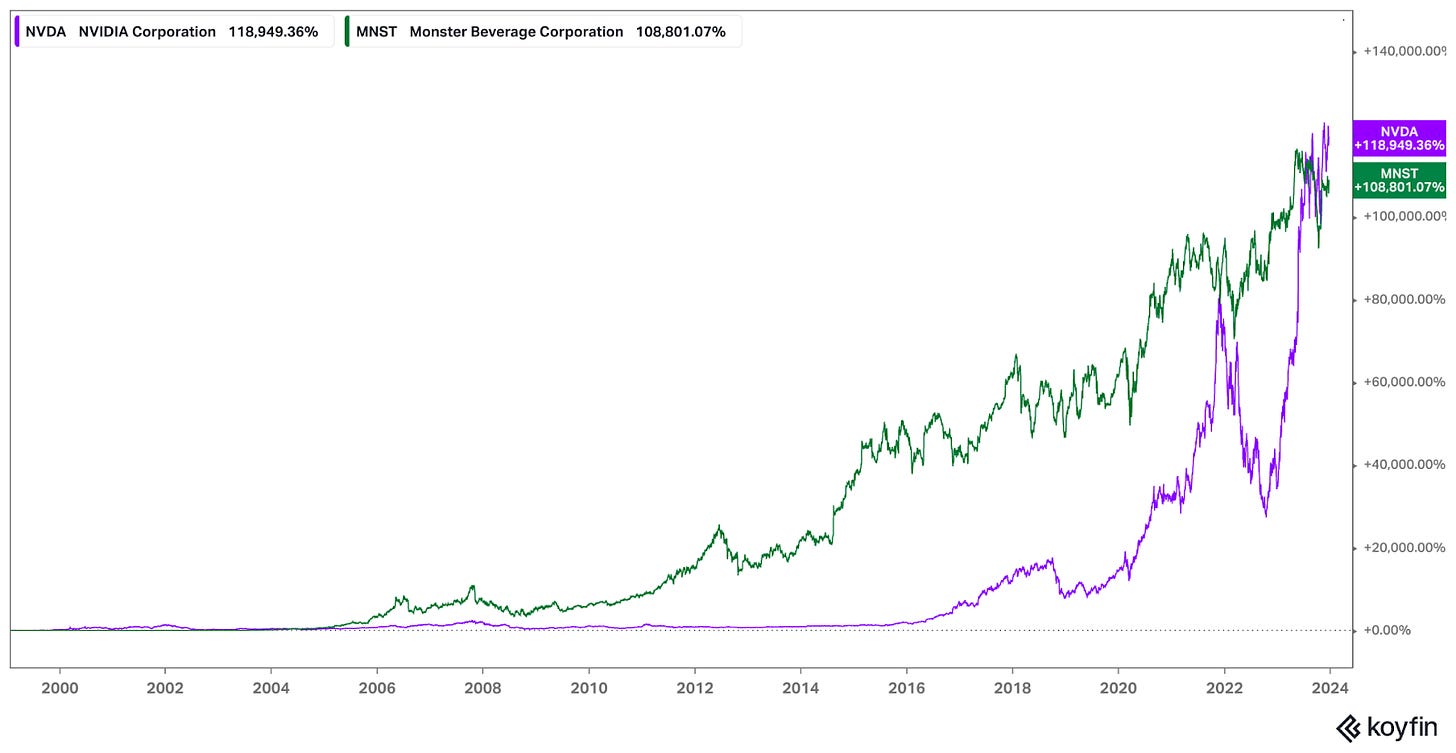

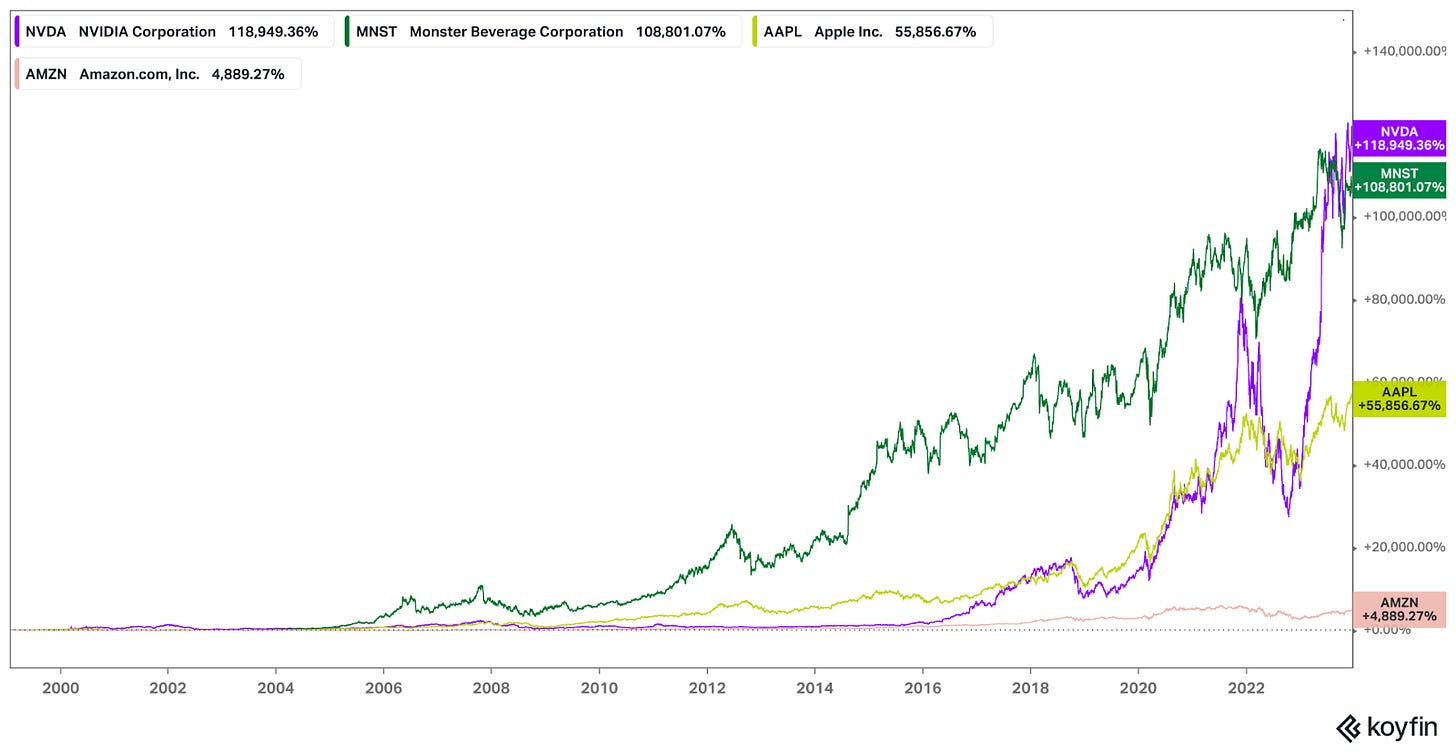

Another thought I had of how to make it a factual statement is that perhaps it’s the best performing stock in the American stock market historically. Unfortunately, it’s not. Here are just a couple of stocks that have a greater return than Nvidia.

Total Return:

Price Return:

As a side note, gathering information is often an interesting and frustrating task. I try to share with you the challenges associated with investing and today's topic is no different. Let's take Apple for example. Koyfin starts the chart timeline on Oct 4, 1982. The Google graph image below shows it starting on Dec 23, 1983. And to make things even more confusing if you Google when did Apple IPO it’ll tell you Dec 12, 1980.

This means that there are numerous timelines for Apple, at least 3. Then you try and compare “Apple” to another stock. Then you have to ask yourself if the same problem exists for the other stock you’re trying to compare it to. I put Apple in quotations because it’s as though there’s a multiverse of Apples. Different Apples with different timelines that’ll subsequently show different performance results. Then you have to mix and match this multiverse Apple stock with a multiverse other stock. It’s irritating as hell to say the least. A way to sort of keep constant your comparisons and control for variables is by using the same data service provider.

If you did a quick Google search to compare Nvidia with Monster since Nvidia's IPO you’d get the following chart.

But if you do the same thing on Koyfin you’d get this chart.

The difference is drastic. The disparity between Google and Koyfin is 3,119% and the difference for NVDA is 57,239%. This isn’t a mere rounding error. It also provides conflicting information. One chart would lead you to conclude Monster has outperformed while the other chart suggests that Nvidia has outperformed. My side note is done and these two charts translate nicely to the next point.

You might say that comparing Nvidia to Apple, Monster or Amazon is not a fair comparison because they all got a head start since they IPO’d earlier. Ok, let's constrain the variables and limit it to the time since Nvidia has become a publicly traded company. If you do that then Nvidia is indeed America’s top performing stock.

Due to my lethargy and ignorance, necessity to simplify matters and for sake of argument I’ll concede that Nvidia is indeed America’s best performing stock with the caveat that we start our measurement as of January 22, 1999.

Given enough data dredging anything is possible. This also supports why I emphasize paying attention to the level of analysis you view things on, questioning the concepts and preconceived notions in a statement and keeping constant your comparisons and controlling for variables. You must always ask why this particular information is being presented in the way that it is. Not just, what is this presented information telling me. You must go deeper.

Don’t believe how important it is, check this out. The image below starts the timeline only a few short months after Nvidia’s IPO. The image below starts Jan 1, 2000.

You’ll notice that Monster radically outperforms if you advance the beginning of the timeline by roughly 11 months.

If you started your comparison timeline when the Nasdaq hit its low on Oct 9,2002 you’d have seen these alternative results.

Now not only has Monster outperformed Nvidia but so has Apple.

To sum it up:

Different timelines = different results

Different results = different interpretations

Different interpretations = different investor behaviors

So, to finish this section up, one could argue that the implicit supposition in the statement “America's top performing stock” was that their comparison was based upon Nvidia’s performance relative to the broader market starting on the date of its IPO. In that case, they made a true statement.

Assuming Humanness

We’ll never know exactly what they meant by America’s top performing stock nor how they measured it. Honestly, it’s the least of my concerns. In this section I want to pay attention to the structure of the idea they pitched.

Why did they mention Nvidia at all? What was the purpose and function of mentioning Nvidia? What role did Nvidia have in that paragraph? Couldn’t they have not mentioned Nvidia and said something along the lines of: We have a stock that’s part of the $7 trillion AI industry.

Why did they provide us with the following variables:

Nvidia stock

Nvidia stock doubling this year alone

America’s top performing stock

$7 trillion dollar AI market

Mysterious company they want to tell you about

I’ll tell you why. They wanted to preference the mystery stock by framing it in the light of a multi trillion dollar TAM that is also an AI company. Then you’re supposed to compare the similarities (not contrast the differences) between the mystery stock and Nvidia. And since Nvidia is America's top performing stock you’re supposed to make a false equivalency through hasty generalization and jump to conclusions that the mystery stock could also perform well like Nvidia has.

This occurs when you broaden out the category to a more abstract level (AI stock). They’re implicitly guiding and coercing your attention knowing that many people will fall for it. We as humans fall for it because thus far we have incomplete information. So our brains try to forcefit narratives into what we know. And we know all these details of Nvidia and know that this mystery stock has a lot of similarities. So we take a few leaps and bounds in our brains to make sense of things and fill in the blank regardless of whether we have enough information to come to an informed decision.

Why else would they say it the way they did?

If I assume good faith they at best are alluding to the belief that AI technology is in a secular trend with favorable tailwinds. They then use Nvidia’s stock performance as an example of how it’s translating to shareholder returns and profits. You might have heard this idea expressed under the following phrase, “a rising tide lifts all boats.”

The Fallacious Nature of Their Reasoning

Nvidia stock is an AI stock and it doubled.

Mystery stock is an AI stock and you’re supposed to infer that it could double.

Just because a stock within a sector has performed well doesn’t mean that other stocks within that sector have performed well or that the overall sector has performed well.

A trait which is true for an individual doesn’t necessarily hold true for the broader group in which that individual is a member of. That would be called a stereotype. And aren’t we supposed to judge a stock by the content of its character and not by the industry that it’s in.

There’s a larger cultural phenomenon going on here that the advertisement is taking advantage of. They know that Nvidia is being used as a synthetic proxy and placeholder phrase for the AI industry. The broader abstract category of AI subsumes Nvidia within it. Over time Nvidia and AI stock become interchangeable and synonymous. After enough people, enough times, bastardize and co-opt their speech you’ll hear talk about an AI stock and you'll think of Nvidia's performance or vice versa. Then when I tell you that something is an AI stock you’ll correlate that with Nvidia's performance. So they’re playing on that already heightened sense of awareness and correlation. But just in case, they overtly mention Nvidia to prime you to start thinking that way.

Think of when someone says tech stocks are doing well. Most people will think of the Mag 7. Now… if I say that the Mag 7 is doing well you very well might say something along the lines of “tech stocks are doing well.”

But are tech stocks doing well? Are all tech stocks doing well? Is IBM and Intel doing well? After all, they are tech stocks. This is what happens when you speak in absolutisms and oversimplify things. You could merely alter your speech to be honest but people rather lie through omission or hyperbole than simply be honest. What you should say is that some tech stocks are doing well.

This is how lazy humans are.

Tech stocks are doing well

Versus

Some tech stocks are doing well.

God, why is it so hard to add a single word to a sentence. Especially, when a single word separates fact from fiction.

Think of the example: Lift with your knees not your back.

People could make that a true statement by substituting the word “and” for the word “not”. We’ll get into that more in a moment.

The problem is that people are pathologized. And like any good pathologized person will do, they'll defend their speech rather than correct it. You might accuse me of splitting hairs and nit picking.

I would find such accusations comical. You know why? Because if your boss said, “we’re giving our employees a raise” and you then don’t get a raise you’d be upset. But why? Well, it’s obviously because you’re splitting hairs and nit picking. You definitely wouldn’t be upset that they spoke of a broad category when they meant that only certain members of that broader category were getting raises. But it’s the same difference.

Tech stocks are doing well.

Employees of the company are getting a raise.

Versus

Some tech stocks are doing well.

Some employees are getting a raise.

But I digress.

I would myself identify what the sales pitch did as propaganda. They structured the information in a fashion that would provide a biased and misleading result in order to promote and publicize a particular point of view. A point of view that allowed them to segue into the stock they were trying to promote and the email they wanted to harvest. They do this through time tested techniques of funnel marketing. They get you curious about a stock, you give them your email and then they bombard you with advertisements and discounts to buy their products.

The sales pitch made a major error. Most grifters know to speak in vague, ambiguous and general terms. They know they should stay as decontextualized as possible.

The Art of Seduction by Robert Greene made this clear. The beginning of chapter 10 (Use the Demonic power of words to sow confusion) starts off with the following:

“Keep your language vague, letting them read into it what they want. Using writing to stir up fantasies and to create an idealized portrait…”

Seductive oratory is a thing of beauty.

You might ask, what does Nvidia have to do with anything?

It’s a subtle and plausible deniable conflation of categories. Is Nvidia an AI stock or are AI stocks Nvidia. Just because Nvidia did well doesn’t mean other AI stocks will. So why bring it up. As though Nvidia is preordained and has blessed and given permission for other AI stocks to go up in share price. Nvidia is a sub constituent of a broader class of AI stocks.

In order for Nvidia to be “America’s top performing stock” you’d have to measure it in a way that practically no one would. When people are comparing stocks they don’t compare it to the date of the most recent IPO participant. If you’re going to do that, then you’d need to communicate that since it’s not a conventional traditional practice. Of course that presupposes that the advertiser has integrity and the desire to be intellectually honest.

Fallacies Galore

A = B

B therefore A

Topically applied it take the following form:

Nvidia performance = AI stock

AI stock (mystery stock) Therefore, Nvidia like performance.

This looks like someone jumping to conclusions as to what an AI stock might do based upon what Nvidia has done. I noted above about how words and ideas get fused together and become interchangeable. Mag 7 becomes interchangeable for tech stocks. Or in this case Nvidia becomes interchangeable with AI stocks. The problem is that it’s just not true. Another problem is that everyone thinks that they’re so smart and don’t fall for such nonsense.

Nvidia has certain qualities and characteristics of AI. But that doesn’t mean that other AI companies share in all the same attributes, traits, qualities, properties, similarities or characteristics as Nvidia.

A = C

B = C

But A doesn’t necessarily equal B.

Nvidia = AI stock

Mystery stock = AI stock

But Nvidia’s performance doesn’t necessarily translate to mystery stock performance.

And what the hell is an AI stock anyway? It’s a broad, ambiguous, vague and ill-defined category by most. Is Whirlpool an AI stock? Why wouldn’t it be? What does it mean to possess the essence of AI?

It also comes close to being a false syllogism.

All AI stocks are or will be doing well

Mystery stock is an AI stock

Therefore, the mystery stock is doing or will be doing well

The alleged proof for the above statement is the fact that Nvidia is doing well and thus supports the implicit argument that all AI stocks are doing or will be doing well. This is why Nvidia was included in the sales pitch. This comes as a consequence of how the word Nvidia and AI are used interchangeably as a verbal shortcut which leads to corrupt, distorted thought.

Quite frankly, I hate how humans talk this way. In an upcoming article I’ll be writing on this very phenomenon. A couple of quick examples of this sort of bastardized absolutist speech that you’ve mostly likely experienced:

“I never get what I want”

“Lift with your knees not your back”

“Masks don’t work/masks work”

“Sugar is bad”

And finally we’ll discuss the Texas Sharpshooter Fallacy. This is an informal fallacy that occurs when differences are ignored but similarities are paid attention to. The point of this is to coerce your thought to mislead you to infer a false conclusion. Once that happens you’ll be more than willing to click on their link, which is the goal of their funnel marketing.

It’s a common practice of people to under-represent one point to over emphasis another point. People don’t stop with that though, they take it a step further. They’ll try to eradicate a point to emphasize another point. That’s called lying, misleading, distorting, misrepresenting, just to give it a few words. Take the example: lift with your knees not your back. Another common phrase I’ve heard is, “it’s not what you know but who you know.” They’re both exaggerative misrepresentations and factually false statements of reality. These phrases are spoken in this way to emphasize the latter by diminishing the former.

Another problem is that people start taking these literary tools literally. I’ve seen people who perceived their hard work as not paying off and were becoming nihilistic and despondent say, “what’s the point of working hard when all that matters is the connections you make with upper management.” They’ve actually come to believe the non-literal phrase. They made the one error you should never make, they bought their own bullshit.

The best way I can demonstrate this idea is by showing you a picture.

Complementary color combinations are the colors that sit on opposite sides of the color wheel. Combining these colors creates an effect of high contrast, catching the eye and leaving quite an impact. Examples: red and green, yellow and purple, orange and blue.

It’s based on the relationship between two colors that are opposite each other on the color wheel. It’s based on the behavior of light and the perception of color in the human eye, and it’s used to create a strong visual contrast and a sense of depth and movement in a design.

Well, not only do we do this with colors but we do it with our speech.

A simple way to make you understand this is if I shine my headlights in your eyes on a dark night versus the middle of the day. The headlights are “bright” in part as a consequence of the ambient surrounding light. This is what I mean by the framing effect. The environment that you present something in alters a person's interpretation of what’s presented. The lumens are the same, the headlight hasn’t changed. Yet, you’ll tell me that the headlights are bright in one scenario and not bright in another scenario. This is the consequence of your ineptness in regards to your ability to articulate an idea, not on the reality of the situation. We’ll get more into that as well in the upcoming article.

What’s the environment of the quoted stock pitch?

If you’re trying to paint someone a picture (figuratively) and you’re trying to tell them about red you might then contrast it with green. You’re trying to make the idea you’re speaking to “pop”. It’s a rhetorical device.

A rhetorical device (otherwise known as a stylistic device, a persuasive device or more simply, rhetoric) is a technique or type of language that is used by a speaker or an author for the purpose of evoking a particular reaction from the listener or reader or persuading them to think in a certain way.

The incredible thing is that most people are clueless that they do this or that they’re being influenced by such things. And if they do know, they seemingly don’t care. They don’t care because of their overestimation in their ability to identify manipulation. That complacency only leads to a heightened chance of them being manipulated. I’ve said this to many people and they seemingly don’t care.

As a side note: This has led to an interesting moral dilemma. If you tell someone that they’re easily manipulated for such and such reasons and then they dismiss you, is it ok for you to prey on them or to take advantage of them? After all, they’re now a willful participant, they do know better. You’re essentially taking advantage of the fact that they’re too stupid to know that they’re stupid. I’ve decided against it but there’s a strong case to be made.

In Conclusion

Just ask yourself this. Does the advertiser want to imply any correlation between the mystery stock and Nvidia’s performance? If not, then why did he bring up Nvidia in the first place? Does he want you to think that they’re inversely correlated, then he’d not mention Nvidia as an AI stock, because it would imply the mystery stock as a sell not a buy? So what does that leave us with?

I’d like to invoke the spirit of the Sherlock Holmes quote: “When you have eliminated the impossible, whatever remains, however improbable, must be the truth.”

That leaves what’s left, the advertiser wanting you to think of Nvidia and the mystery stock as being positively correlated.

Faulty analogy: they want you to assume that because two things are alike in one or more respects (part of a $7 trillion industry) they are necessarily alike in some other respect (stock performance). The very fact that this stock pitcher thinks that's even a remotely appropriate way to conduct themselves tells me that I should have nothing to do with them in either personal or business relations.

People feel the need to lie even when the truth is on their side. It’s so bizarre. The need for hyperbole turns a true and bullish statement into a false one. As far as I’m concerned, the quote started off with a false premise. The reason is simple, Nvidia isn’t America’s top performing stock. The reason for that is that no one measures or compares historical stock returns in the way that would be necessary to make it the top performing stock, as we did earlier in the first section. They could have told the truth by saying Nvidia is one of America’s top performing stocks. Simply switching out “may be” with “ is one of” would have made it nearly impossible to refute.

I asked earlier if Whirlpool is an AI stock. I wasn’t joking. They manufacture multiple everyday home appliances that use AI: TV’s, baby monitors, vacuums, speakers, washers, dryers, fridges. So, why isn’t Whirlpool getting an AI premium? I’ll let you think about that.

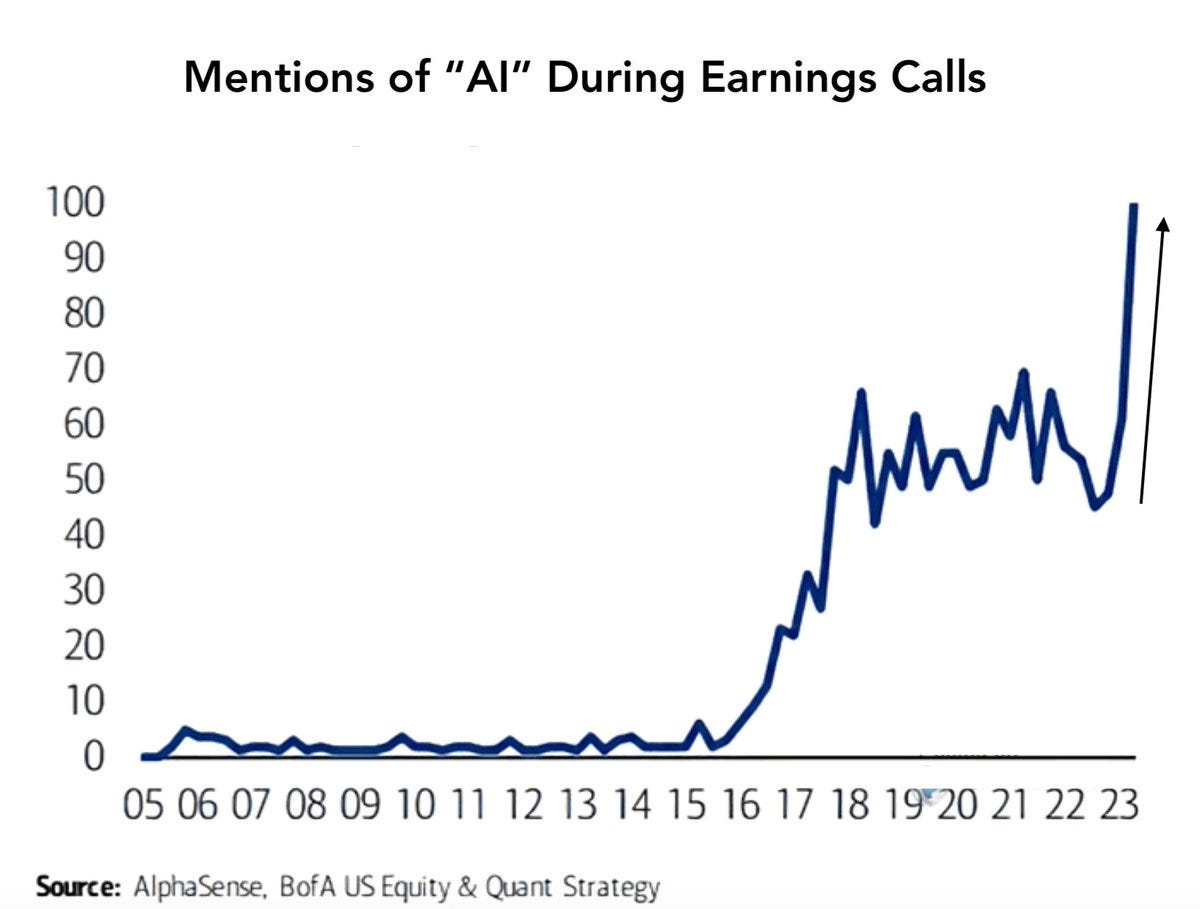

As often is the case, I like to escalate and abstract out. The ideas I’ve put forth today are scalable. If you’re an AI stock you get privileges in the form of a higher earnings multiple and thus a better stock performance and thus a richer payout via your compensation package, if you’re a C-suite executive. Hmmm, that sounds familiar to what’s chronically going on in the media headlines.

Elon touched upon this idea in the 2023 Dealbook Summit interview. At around 17:30 he had this to say:

“There is a natural affinity for persecuted groups. This has led to the funding of essentially any persecuted group or any group with the perception of persecution. This includes radical Islamic groups…if you generically, without condition, fund persecuted groups in general, some of those persecuted groups unfortunately want your annihilation.”

Put differently, Indiscriminate hasty generalizations that are oversimplified and thus decontextualized lead to poor decisions and outcomes sometimes. So what do you think happens when you fund an AI stock that is masquerading as an AI stock when at best it’s tangentially associated? It runs the risk of annihilating your money. Is there a difference of magnitude between genocide and losing money on a stock pick? No shit. But that misses the point. The point is that these fallacies, biases and cognitive errors express themselves everywhere. And you’d be wise to recognize them in all of the ways they’re expressed. And the better you become at identifying them the better off you’ll be and society will be.

This is the beauty of intersectionality and identity politics. Preferences and discriminations are predicated upon your identity class to a small niche group. And that small niche group seems like a moving goal post. This is why even poorly run AI stocks have had a massive repricing lately. It’s why cannabis stocks or EV stocks had a bubble. They were for a short period of time the identity class to be a part of. It goes to reason that if you identify as an AI stock then you get an AI premium, perhaps larger than just being a tech stock. It’s these sort of identity politics to seek the favor of the rulers (investors) that causes these sort of linguistic games to get played.