#MSOGang unmasked: Refuges from Delusion

In the case of #MSOGang vs. Reality Check I’d like to bring to the stand Self-Actualization & Critical Thinking.

If you’re interested in learning what it takes to blow up your own trading account or how people help other people blow up their trading account then this article is for you. Although cannabis is a specific topic it provides us a good starting point to explore broader lessons and phenomena related to human behavior, psychology, and societal dynamics. By examining the intricacies and implications of cannabis stock investing you’ll be able to gain insights into larger aspects of how stock investing can go awry, how bubbles form and why seemingly very few people ever learn the right lessons. The things you’ll learn today are integrally associated but not mutually exclusive to the cannabis stock participants. In other words, even if you don’t care about cannabis, keep reading.

Jumping into things

When it comes to the cannabis industry, for the most part, the authors, Youtubers and podcasters and so on are predominantly filled with cope, fallacy and innumerate narrative. They’ve been spewing the same rhetoric and pablum for the last 5 years. Just enough numbers to post hoc rationalize and quiet their cognitive dissonance. With a large preoccupation with dangling hope in front of you around some new headline in regards to federal legalization. Although many of them have gotten their acts together in the last couple of years the damage they caused was mighty.

What I’ve largely seen is a disgraceful dereliction of duty and gross negligence. It’s a failure of journalistic integrity. But of course, this problem goes well outside the scope of cannabis. But if you allegedly want what’s best for the cannabis investing community then you need to tighten down the hatches and lace your boot strings up and not tolerate sell-side coverage that’s comparable to sewage waste.

In all fairness, things have improved over the last couple of years. Conversations are less about hope and more about business performance and reasonable stock metrics. It’s less narrative driven then it used to be. However, there is still a disproportionate amount of shoddy work and fixation towards narrative. But we mustn’t forget that many of the reasonable publications I’ve seen of late are from the same people who are bag holding massive losses from poor decisions prior. They’re learning as they go it would seem and that means that they’ll likely never be ahead of the curve. Their actions will be in response to and not in preparation of headlines. That’s a difficult way to make money in the markets.

People will say, “We all got carried away.” Not only is that not a true statement but such a statement tells me that they learned very little from their errors. Today's article is an in depth deep-dive as to what really happened. Saying, “We all got carried away” is to say that they consigned their investing decisions to someone else who was pushing an emotionally resonating narrative and that they acted negligently in regards to their due diligence and justified their behavior via the bandwagon effect.” And that’s just for starters. Yet I see no one clearly delineating such things.

I’ve seen ample amounts of cope in such narratives as, “It was a time of easy money and we were all sitting at home with nothing to do.” Which is to potentially say, idle hands make the devil's workshop and I worked overtime for him because I am drifting in life, stumbling forward without much to contribute to society outside of my 9-5. And by the way, their excuse only applies to the Covid lockdown era and doesn’t bring attention to why they got involved in 2018 or 2019.

Like I said, we’re actually going to put real effort into understanding the deeper mechanisms, psychology and motivations that allow people to buy companies at 100x P/S.

Anyone feeling half-bad for the coverage they’ve put out might say, “I didn’t mean to.” Which leads me to ask the question, “did you mean not to?” As in, did you take the necessary precautions and measures necessary to minimize the probability of inflicting harm.

Such as:

Not getting emotional. Not using a bunch of emojis and qualifiers.

Presenting the negatives alongside, intermingled or within the same article as the good.

Helping people manage realistic expectations.

Taking a measured and cautionary approach.

These are worthwhile questions to ask yourself when you do your own research on a company that you’re interested in purchasing, let alone when writing a piece in the public space knowing that other people will be reading it.

It’s worth keeping in mind that most people are trying to convince themselves as much as they’re trying to convince you. So by tricking you, you then validate them and that makes them feel better. What a toxic mess. But that’s part and parcel of us being social creatures who seek peer validation and third party confirmation to provide us with confidence. And if you refuse to reflect their beliefs back at them they’ll often manufacture indignation and move on to someone else who is willing to entertain their fantasy.

But it’s not just the fault of the people who are in the media. I believe in large part they weren’t trying to hoodwink anyone and were seeking out an echo chamber or writing about the hot topic at the time in a particular way so they’d get more clicks. Which just becomes a degenerates game and race to the bottom, erasing and diluting any quality information that does get published. But they don’t feel bad about being the dilutive force making real research harder to come across. They might have set the bait but what made the individual investors bite?

The cannabis story is a good story too. It really emotionally resonates with people which makes it all the easier to believe in. It resonates with me too. However, belief doesn’t require you to synthesize objective facts into a comprehensive framework. If it did, we wouldn't have half the nonsense that goes on in the world. Instead beliefs are about partially constrained story lines that are right at the exclusion of information. People will make a story using facts but then exclude any counteracting facts which wouldn’t be flattering to the underlying sentiment trying to be expressed. Which is to say fiction because although the facts provided were true the conclusion is false.

That’s how so many people told you that these cannabis names were Buys and Strong Buys for so many years. All the way down to where we are today. They bought their own bullshit and you probably bought it too.

Who thought paying 20x, 40x, 60x…120x P/S (price to sales) multiple was ok? And just as importantly, why did they think it was ok?

You might say that they were stupid. Or you might say that they were young and optimistic. But not so quick, we’re not letting them off the hook that easily. There’s an entire rat's nest going on here that we need to unpack.

Seeing that meme might make you think of evil WallStreeters or the Big Bad Banksters. But guess what, many of these analysts who offer you alleged alpha on your favorite crowd-sourced content platform operate under the same motto. They’ll appeal to the consensus and status-quo at the time and say, “Everyone was bullish.” in order to abdicate responsibility. The classics have all been said, “caveat emptor”, “do your own due diligence” and “this isn’t investment advice.” And although those statements are true it doesn’t speak to the garbage analysis that they put out in the first place.

If for the most part all the analysts are putting out bullshit sell-side coverage and you as a new investor stumble across this space it’s fair to say that you’re going to get blindsided. And that’s exactly what happened. They took their coverage and fees and you got left bag holding.

Do these people have no shame? Do they feel no ethical responsibility? Those aren’t rhetorical questions. The quick answer is that I think many of them duped themselves into believing what they wrote in large part. And if that’s true, then that means they had the best of intentions. We’ll get more into that later.

But first a quick disclaimer:

Heartfelt Plea

I write this as someone who’s recently deployed capital into the cannabis space. I write this as someone who’s been observing this industry on the sidelines for half a decade. I write this as someone who is a large fan of cannabis (however not currently a consumer). I suspect that this article will take the tone of a parent scolding their child for something they did that was incredibly reckless and thoughtless. I feel extremely let down by many things that have occurred in this space over the last half decade. This article, believe it or not, is coming from a place of wanting to see people do better and not from self appointed grandiosity.

However, the sins of the community must be accounted for. And not in the traditional scapegoating fashion (dang you federal government). There’s an entire swath of cannabis investors' track record unblemished by success. A devastating and gut wrenching 5 years it’s been for these shareholders and yet the audacity they still continue themselves with is both alarming and impressive. But nothing less should be expected from true believers and useful idiots who’ve subsidized the end consumer (we’ll get into that in a little bit, you’ll like what Green Thumbs CEO has to say).

The best I can tell is that the motto overlaying the cannabis investing community now is, “All our hands here are bloody so no one can judge me.” Well, I wasn’t a part of the blood letting, so I can and will be judging.

These people fucked up royale. There’s no averaging down that will save them. Their portfolios are a lost cause. But that doesn’t mean that a dose of truth can’t help them to turn it all around and become successful investors one day. And it also doesn’t mean that others can’t learn valuable lessons from it all.

I am NOT rejoicing in their suffering. There is NO schadenfreude on my behalf. I’m someone who wants the best for humanity and I’m wondering, “What the hell were they thinking?” I apologize for the condescending undertone of this publication, I seemingly am unable to remove it. I am so disappointed and upset with so many people and how they failed themselves and others.

For instance, many analysts are not innocent. They extrapolate linearly in their models. Always within a narrow range of where things have been. Because that’s the safe thing to do for their career risk mitigation strategy. Not because that’s accurate but because it’s the safe thing to do that offers maximum plausible deniability. And if they get it wrong they can say, “Everyone else also got it wrong too.”

But these analysts put together these projections because other people want projections. So what does a person who doesn’t know the future supposed to do? If your customers are saying give me a projection, then you best give them a projection. Because if you don't, someone will. If people want to invest in something you best tell them why they’re right. Because if you don't, someone else will. People are often less concerned with being right then they are with feeling validated.

So the analysts gamed the system. But that’s not quite right. The customers in some sense refusing to stop asking for nonsense got what they deserved…garbage. They essentially gamed the analysts. Looking at the incentive structures explains all of this. It’s not one of integrity or honesty but telling people what they want to hear with the occasional honesty sprinkled in. Of course the honesty that does get sprinkled in will be so faint and likely in the form of an insinuation that if you’re not paying attention you’ll miss it.

Russell Napier noted this in his book on the Asian financial crisis. He started seeing cracks in the system and was concerned with the valuations but his boss told him not to publish that sort of fear mongering. This isn’t a cannabis only phenomenon. Bank analysts or oil analysts do this in their upcoming year projections, almost all of them seemingly predict within a 5%-10% range, year after year.

I’m really just saying the quiet part out loud. This is an open secret. The problem is that a lot of people are unaware of it.

The problem with this is that appeals to authority are made to justify decisions. Also, it contributes to the overall atmosphere of complacency. Meaning, that many authors and journalists were complicit in the failings of their readers. Of course they’ll take no accountability for that with the cop out that we’re all autonomous individuals who are responsible for what we do. As though we’re not incredibly social creatures who are greatly influenced by what our peers and authority figures say and do. Get real.

But at some point in time you have to hold the individuals who got suckered accountable too. Those in the media had many chances to sound the warning alarms but didn’t. They have the audacity to talk about social responsibility in regards to the cannabis industry and yet turned a willful blind eye to the writing on the wall and their role as a media influencer or analyst.

The problem with the last paragraph is that it’s in the past tense. It’s just as real a phenomenon now as it has been in the last 5 years, albeit to a lesser magnitude. But the underlying errors still remain and live as strongly as they ever have, it’s merely the sentiment that’s calmed down. Meaning, the cope, fallacy and bias that I’m outlining today will be the architecture used in people's decision making processes when sentiment does come back.

There’s nothing like a 90% loss to change a person's tune from, “This is a once in a lifetime generational opportunity” to “I can’t take this beating anymore, I’m selling all my shares.”

I’ve been needing to get this off my chest for some time. About once a year I dedicate a couple of days to weeks looking at how things are going in the cannabis space. 2023 was the first year that things looked interesting. Don’t get me wrong, I think a lot of cool things are happening in the cannabis industry. I definitely see the appeal which has led to many being swept up by it. But I can’t let that happen to myself. It seems to me that it’s a dangerous game to become overly affectionate to any investment. And I most definitely could see myself having a conflict of interest as a result. Therefore I have to stay cold and calculated and not get too caught up in the weeds. I quite literally can’t afford to become a true believer.

I know that so far I’ve been beating up on people in the media. Don’t worry, I’ll be getting to the ideologically possessed true believers later. But with that said, I have come across a few excellent Substack publications on the cannabis space. I do want to repeat myself here, there are some cannabis investor Substacks that are chalk full of good information. Today's piece will not be about them but the rest.

It’s only in the more recent times, call it the last year or two, that ideas like balance sheets and cash flow from operations came into the picture. It wasn’t because those didn’t matter but because people didn’t need to resort to them to justify their thesis. When it’s rocket ship emojis and to the moon expressions all you need is a story. Especially when the stock price is reflecting your narrative.

2018-2021: What a time

You might note that this article focuses on the 2018-2021 era. In which you might say, “That’s in the past, leave it alone and stop picking on people.” I might agree with that if I thought that anyone learned their lessons.

But I don’t.

Just this week I listened to a podcast where the host said, “So you’re bullish on these charts because they look horrible and that’s in itself kind of a reason to be bullish. Tilray is down 97%.”

Then the guest says, and I kid you not, “Yeah, it can only go so much lower.”

These sort of statements as far as I’m concerned make you an enemy of the public good. How much lower can it go you ask. It can go 100% lower. These sorts of statements are founded in some sort of delusional belief that the stock should mean revert for the sake of mean reversion. Statements like these are often the consequence of subjective relativity. Someone might say, if it once traded higher why can’t it go up there again? Well, all else being equal, there’s twice as many shares outstanding. Also, don’t forget that the ATH stock price was largely the part of an extremely small float of publicly available shares that allowed the stock to get squeezed higher.

He went on to say, “If you have any hope for the cannabis industry then this seems like a home run play.”

Any hope? Hope how? Even if he has some magical reason as to why Tilray is the way to play it his statement still is foolish. An industry can do well while the individual players in that industry suffer to the point of bankruptcy. And bankruptcy can actually be a good thing for a company. For instance it cleans up the balance sheet. But you might not care about that since you’ll get wiped out as an equity shareholder. A good company doesn’t mean a good investment. And a good industry doesn’t mean that any particular participant is a good investment. This is investing 101. We’ll be getting into this more when we discuss the Arc of Development of New Industry.

The conflation of categories where there's a false equivalence between a successful industry and a successful company is nonsense. There is a distinction with a difference although there are shared similarities. This is a clear oversight of reality, history and base rates.

But it doesn’t stop, he had more to say.

He said, “Canopy and Tilray have made it this far and are doing all they can to weather the storm.”

Ummm… making it this far doesn’t mean you’ll continue to make it. And doing all you can to weather a storm doesn’t mean you’ll survive the storm. This is more narrative BS grounded not in substantive reasoning but is one of a thought terminating turn of speech. I don’t make investment decisions based upon such obvious cope and fallacy. It’s misplaced and inappropriate. Just because a company has been around doesn’t mean that they’ll stick around. And just because they’re doing all they can doesn’t mean it’s good enough. Effort doesn’t necessarily translate to results.

Appeals to intentions and appeals to efforts are good enough for participation trophies but aren’t good enough for my hard earned money. And this is all before bringing into question the premise of his statements. Because I think there’s quite an argument to be had that they have not done all they could. It also looks past the fact of how they contributed to the storm that they’re in. Nor does any of this address the opportunity set in which other operators might offer better value.

Maybe low interest rates and the Covid bump bought them time. And maybe that’s why they’ve stood the test of time thus far. Not because of their merits or management. I also wouldn’t call half a decade “time”. Have we even had a real economic cycle in that time? But I don’t see variables being controlled for. Nope, just some quick, glib, superficial pablum that’s artificially propped up with a specious plausible sounding explanation which it ignores entire areas of reality. You might recognize that last sentence as a key tenant in propaganda that ideologies require to maintain conviction in their beliefs. In other words, turning a blind eye to what you don’t like and then pretending like it doesn’t exist. We’ll be getting into that too.

What this individual put forth is not an argument to buy a stock, matter of fact it makes me want to buy it less. If it had so much good going for it wouldn’t he provide a merit based argument that would warrant my attention to it as well as my capital instead of these weak rhetorical bromides?

Anyway, this is the sort of tone that this article is going to take. There is so much nonsensical garbage in this space that I can’t let it go unaddressed. Sadly, you can find this sort of speech in other investing niches too. It’s integrally associated but not mutually exclusive to the cannabis space. But I don’t care about the tech bros, I do care about the cannabis community. And I see a glaringly obvious disservice being done to people, listeners and investors via the corruption and pathology of speech in many analysts and media influencers mouths.

I’ve not provided any names of particular individuals that might come to mind in this publication. The reason is simple, this is beyond the folly of any one individual. This is an observation on the human condition contextualized in the realm of the burgeoning cannabis industry. You could just as well replace the word cannabis with canals, railroads, rubber, bowling alleys, dot-com, 3D printers, EVs, SPACs and so on.

Let's start with a seemingly simple question.

What were these cannabis investors thinking?

A common response is to say that they weren’t thinking. But that’s the wrong take. They were thinking and their thinking was logical.

Whoa, what?!

We must never forget:

The logical validity of an argument is a function of its internal consistency, not the truth value of its premises.

I invite you to get on the most popular crowd sourced financial analysis website and look at all the buy and strong buy recommendations for the past 5 years. Read the articles. Are all these articles what you would describe as not thinking? Far from it, I’d say.

So we’re piecing this together. People feel ok to say Buy and Strong Buy because they in fact used a set of facts and strung them together in a logically valid form. And when presented in this fashion it suggested that these companies were a buy.

But how did they feel comfortable excluding a bunch of other facts that would have conflicted and nullified the facts they included and thus led them to either a neutral or Bearish recommendation? We’re getting there.

Thesis, Antithesis, Synthesis

Narrative, narrative, narrative. Why are the investors so obsessed with narrative.

The simple answer is that you really have had to torture the numbers historically speaking for it to align and converge with the narrative. So naturally, people who want to believe something turn a blind eye to that which isn’t flattering. And whatever facts remain are what’s focused on.

Emotionality is a wonderful contributor for ratcheting up an experience. However, it’s not without its setbacks. People who said that they loved cannabis should have said they lust cannabis. The comic denotes how cannabis investors have been focusing on the butt of the cannabis industry and thus getting all riled. And all the while, ignoring the less flattering parts of the industry or as the comic called it the tedious little bits.

So back to this topic of thinking.

It might be wise to question the concept in a statement as much as the statement itself. It begs the question of what one means by the phrase “to think.” When a criterion is based upon adjectives it’s bound to be ambiguous. We’ve demonstrated already that all of these Buy and Strong Buy articles seemingly layed out an article which displayed thinking. Right?

Yet their thinking was sufficient. Sufficiency could be defined by whether it was profitable.

You come to find that most people are right at the exclusion of information not the inclusion of information. They didn’t have a comprehensive overview of the variables and factors. They didn’t factor in how things could go wrong. They found the facts that were bullish and ignored the facts that were bearish. They played up the bullish parts and played down the bearish parts. They would in a specious and ostensible fashion “address” the bearish facts by straw-manning them to afford themselves plausible deniability in saying they did their due diligence and factored such matters in. But they didn’t, they just pretended to.

You see this all the time in the investing industry. It’s the classic bull case partial narrative or bear case partial narrative. They’re both biased and largely ignorant of the other side. The ability to play devil's advocate is a crucial component of success.

Most people have an emotionally charged idea and they then conflate their emotionality with rightness and confidence. They use their emotions to judge the quality of the idea. And since most people think they’re smart and have good intentions they don’t stress test the potential issues of their idea. Most people act on the following template: I’m a good person who means well and my emotions are validating an idea I have so therefore I’m going to act on it. Of course different people have different capacities for controlling their impulses. But the ones who seemingly participate in this sort of narrative driven hype aren’t those people. And anybody who’s trying to do well in the world should try to have a better understanding of their susceptibilities and risks to things, which in large part is why I’m writing this publication.

What people fail to do is engage in the 3 part dialectic reasoning process. Let's see what that might look like.

Thesis: Cannabis companies are poised for great success due to the increasing legalization, expanding market, and shifting public attitudes towards cannabis.

Antithesis: However, challenges such as regulatory complexities, limited access to banking services, and uncertain federal policies pose significant obstacles to the growth and profitability of cannabis companies.

Synthesis: By actively engaging in advocacy efforts, collaborating with policymakers, and implementing robust compliance measures, cannabis companies can navigate regulatory hurdles and establish a stable operating environment. Furthermore, investing in research and development, diversifying product offerings, and building strong consumer trust can position them for sustained growth and success in the evolving cannabis industry. However, this is predicated upon willful cooperation at the government level. If such cooperation gets dragged out these cannabis companies will struggle to be profitable entities and prove a viable business model.

Now, the synthesis in this case could be considered a generous one but it would temper your expectations. What a lot of people do is generate a Thesis and immediately jump to conclusions. Their conclusion is often indistinguishable from their thesis.

In the dialectic process, synthesis refers to the combining or reconciling of opposing ideas or contradictions to form a new, higher-level understanding or resolution. It is a step in the dialectical method, which involves the interaction and resolution of conflicting viewpoints.

Synthesis is not the same as making a conclusion in the traditional sense, although it can be seen as a conclusion reached through a process of thesis, antithesis, and synthesis. The synthesis represents a higher-level understanding or resolution that emerges from the clash or interaction of the thesis (an initial proposition or idea) and the antithesis (a conflicting or opposing proposition).

While a conclusion often refers to a final statement or decision reached at the end of an argument or analysis, synthesis in the dialectic process is more about reaching a new understanding or perspective that incorporates elements of both the thesis and the antithesis. It goes beyond merely choosing one side over the other and seeks to find a more comprehensive and inclusive viewpoint that transcends the original contradictions.

What this means is that the synthesis is not a conclusion. It is a more comprehensive framework that enables you to do further research to come to an actionable conclusion. This is the whole philosophical conundrum of deriving an ought from an is. The synthesis is the is. But all it does is say here’s a more nuanced detailed understanding of the variables at play. What it doesn’t do is tell you to buy or sell, that’s the ought. Synthesis is a starting point that provides you a jumping off point due to how it provides a more real contextualized representation that offers you points on both sides to consider when doing your research.

Reconciling opposing views is a trait very few people have. Instead they reach a false compromise under some platitude of “We all have the right to our opinion” or “We’ll have to agree to disagree”. Although those statements can be true they’re often presented in a thought terminating cliche fashion. They’re not interested in your facts because by contrasting their facts with your facts they might be wrong.

We can chalk all of this up to the human propensity to oversimplify in a heavily biased way which cancels out the necessity for critical thinking.

It’s crucial to see the webs people weave. People, unbeknownst to themselves, have faith in unfalsifiable claims. When people choose to (as though people make a conscious effort) to make their beliefs immutable and immune to evidence and counter arguments they have for all intents and purposes created an unfalsifiable claim. It’s not because the claim is true but because they exclude any information that makes it false. They’re right not due to being objectively true but internally consistent in their storyline or arguement. And they managed this by excluding disconfirming information. Oftentimes, they will include the disconfirming information but it’s in such a strawmanned, weakened version that it’s easily refuted. This paragraph explains any bull case which overlooks the bear case and vice versa.

Now that we have more clarity and context let's revisit the phrase that you must come to terms with.

The logical validity of an argument is a function of its internal consistency, not the truth value of its premises.

This is how you can have such a bullish article written on something. What makes it even more bullish is the absence of contentious facts. This creates an artificial contrast and heightened state of bullishness.

People aren’t genuine truth seekers. They busy themselves with confirming their beliefs. And if there’s a set of facts out there which stand on solid ground how can your weaker argument contend with them? It can’t. Therefore you either need to update your modeling of the world in a more comprehensive fashion. Or, to use every trick in the book (the book being titled Cope, Fallacy and Bias: how to be “right” at any cost).

To sum up this section we can say that people misrepresent reality by excluding disconfirming information to preserve their beliefs. And since there’s so many facts in the world you can construct a whole story around what you believe while cherry picking facts that you’ll convince yourself that it’s actually true.

The problem is that it’s not true. And that might lead you to Yoloing call options because “cannabis stocks are a once in a lifetime generational investment.” Well, that once in a lifetime has lasted 5 years so far. That kind of seems like more than “once.”

And don’t tell me that I’m making stuff up, people actually say this shit.

Here’s a fan favorite of the cannabis industry back then. I know it’s cherry picked but there’s a lot of stocks that look similar to this. Plus I told you this article focused on the hype and the hype was in the Canadian names. That’s why the Canadian names often had 10x more trading volume. Look at that once in a generational investment, down 93%.

Long Term Investor

One moment these people will use price action to confirm that they’re right. But once the prices start falling, they’ll switch the story up and say that this is a long term investment. The irony and fallaciousness of this seems to miss most people.

Talk about the selective use of evidence. These people's confirmation bias is working overtime. Their willingness to use price action as a gauge of rightness in thesis one moment and then disregarding it when it no longer confirms it knows no bounds.

When the price of a stock rises, individuals may be prone to attribute it to the correctness of their thesis or investment strategy. They selectively highlight positive price action as confirmation of their beliefs. However, when the stock price falls, they shift the narrative and claim that their strategy is focused on long-term gains, conveniently downplaying the negative price movement.

This behavior can be seen as a form of rationalization or post hoc reasoning, where individuals retroactively adjust their justifications to fit the observed outcome. It is a fallacy because it disregards the need for consistent and objective evaluation of one's investment thesis, relying instead on hindsight and cherry-picking of evidence. This is how you’re able to maintain a belief even when reality is telling you that you got at least some part of it wrong.

The reason this exists in the first place is because their investment was predicated on a malformed, unnatural distorted framework that lacked comprehensive understanding. And that’s what’s required of an ideologue and true believer, unshaken faith and ignoring reality when it’s unflattering and contrary to your narrative.

Quaint Little Sayings

Saying they're long term oriented is done to allow themselves and the stock to move against them and to not identify their error. Worse yet is that they lack the foresight and insight of not knowing they’ll dump at some point. The lack of pre-mortem or awareness to do one in order to preserve their precious comforting lies is not to their advantage. They’ll bastardize and misappropriate sage wisdom of the investing industry while conveniently ignoring other aphorisms. Then they’ll force fit that quote to fit the structure of their ideology in a purple pilled fashion. They make an appeal to authority to be able to externalize responsibility and consign their investing decisions. They’ll say that they’re not saying that this is good advice but that more successful people have proven the soundness of the advice. Implicit in this is that they’re smart enough to adopt such sound investing principles. They’re implying that they’re merely allowing the proven wisdom to channel through their body.

Take for example:

“Buy great businesses at a reasonable price.”

Of course they dig no deeper as to how the businesses they’re buying aren't great (antithesis) and they ignore or justify the price through some desperate metric to obfuscate matters.

Fundamentally it’s a rhetorical smokescreen. People often appeal to standardized wisdom to skirt responsibility in an ostensible and specious fashion which affords them plausible deniability. They’ll use words with ill-defined definitions to maintain wiggle room. They do this by being as abstract and ambiguous as possible. This is why you must question the concept in a statement as much as the statement itself.

It’s also worth noting how in the last year or two I’ve seen a lot of cannabis investor groups start referencing value investor quotes and using their metrics to gauge the quality of companies, such as cash flow or balance sheet metrics.

But I want to be clear. It is not because they learned their lessons. The last two paragraphs of the section before this tells us what’s happened (retroactive frame shifting to maintain their beliefs). I would recommend going back and re-reading that paragraph to see why they’re adopting value investor metrics and aphorisms. It’s out of necessity not because it’s the right thing to do. They’re now right for the wrong reasons.

It isn’t that they’ve learned that all along this was the correct way of doing things. They are doing what I’ve already discussed, they’re frame shifting the metrics they use to justify and validate their beliefs. That belief is that cannabis stocks are where it's at. They can’t let go of the cannabis narrative and its accompanying belief systems. This is a crucial distinction with a difference. Under the section “True Believer” we’ll talk about what a cannabis investor's religion is and you can better see how they’re such zealots, although I’ve thus far have given you a rather accurate representation of that on the symptom level.

How about the popular phrase, “buy the dip”? Let me ask you this, what is a dip? How do you define dip? I’m asking what quantitative or qualitative measurement do you specifically use to know it’s a dip. This might be helpful to avoid prematurely buying falling knives. But of course, when you act as though a stock is worth infinite I suppose any price is reasonable to buy at.

Take for instance the following two phrases:

Buy when there’s blood in the streets.

Wait for the dust to settle.

If you think what differentiates these two expressions is context you’d be right in theory. But in practice how it often plays out is whether it validates a person's initial beliefs or their current emotional state. During this last half decade of tumbling stock prices the number of times I’ve heard, “Buy when there's blood in the streets' ' has been the motto that allowed them to not question their decision based upon fundamentals or valuations. That expression is merely another appeal to the wisdom of the markets, whatever that means. And dip buying is more emotionally triggered than it is a consequence of conscious consideration and cognitive effort. People pick and choose what sayings they want to use when it’s in alignment with their present emotional state. They’ll often follow it up with, “It’s darkest before dawn.” But guess what, it’s also darkest before pitch black.

Imminent doesn’t mean immediate.

It’s in this rat's nest of convoluted ideas and partially accounted for narratives with massive leaps of logic and not questioning the premises of beliefs that we can start to see how these “investors” made such sense of matters.

Like I said, they didn’t not make sense, oh far from it. They had logical reasons that stretched on for miles.

ChatGPT gets it, why can’t people?

Arc of Development of New Industry

I remember back in late 2018 or early 2019 I was having a conversation with someone about their cannabis holdings. They said to me and I quote, “These things can only go one way and that’s up.”

Here’s an image of me at that moment.

Naturally, he went on to take massive losses. FYI, he owned HEXO. Why did I say “naturally”?

If you ever find yourself uttering such a foolish statement as, “This stock has only one way to go and that’s up.” you need to immediately close out your position because the probability of you being that severely diluted and delusion and successfully executing a profitable trade is near zero.

What all the true believers and useful idiots failed to understand about the cannabis industry can be summed up by The Arc of Development of New Industry. It is this one idea that saved me from ruin in the cannabis industry (so far). The crazy thing is that I tried to warn others but none of them would heed my pleas. Which is interesting because at first you could chalk it up to people not knowing any better and being naive or innocent. But even after I spoke with them they refused to budge. Meaning, that they now knew better yet refused to do better. They all stuck to the same script of it being a “movement”. That strips their naivety cop out away. So what remains? Ideology and emotionality. They wanted to believe and they weren’t about to have some non-believer confuse them with facts.

Simply put, the Arc of Development of New Industry is:

A flood of cheap capital pours into a new sector or industry. This leads to over-investment, which leads to over-expansion, over-production and over-capacity. At the onset, demand outweighs supply. This leads to the first movers making profits. The analysts normalize those profits for future projections. But the profits will soon disappear. Because as often is the case the market is heavily fragmented. In the case of cannabis, this leads to each player saying something along the lines of, “Look how much money we’re making on a 10,000 square foot grow just imagine if we expanded to 100,000 sq. ft.” The lead time to build gives a false impression at sustainable profits but inevitably a deluge of supply comes on line. Such projects are expensive so they’re interested in undercutting competition to recoup their capital. This flood of supply overwhelms demand, profits get competed away, margins compress from positive territory to negative territory, they take on debt to stay afloat and inevitably bankruptcy and consolidation occurs in the industry.

I’m sure the 2018 pot stock crowd already knew this because according to them they were informed investors and the cannabis industry was a no brainer. I’m sure they researched the auto industry in the early 1900’s. Or perhaps the bowling alley boom of the 1960’s. I’m sure they’ve studied up on behavioral economics and game theory. Doubtful though, most people are personally incredulous, historically ignorant and emotional. Do you think they learned anything from the cannabis blow up? Doubtful. Many of them went to play in the SAAS or EV names only to suffer for the same reasons. A hard head makes a soft ass.

This phenomenon also explains most commodities. And what is cannabis but a commodity? I bet that rubs some people the wrong way.

I already hear people saying, “It’s more than just a plant. It’s a miracle drug and a lot of people with disabilities like PTSD can benefit greatly from it.”

As though corn, sugar, wheat, soybeans, cattle, hogs etc aren’t intricately tied to millions of people not dying? Or the shipping vessels that carry those products aren’t crucial in transporting them in order to prevent mass starvation. Yet somehow, all of those commodities are subject to the commodity cycle. Being a miracle cure doesn’t prevent you from the vagaries of markets. Get real. Literally, get real. As in stop being so detached from reality and being fallacy filled with deranged dogma.

What happened in the cannabis industry is simply one of game theory.

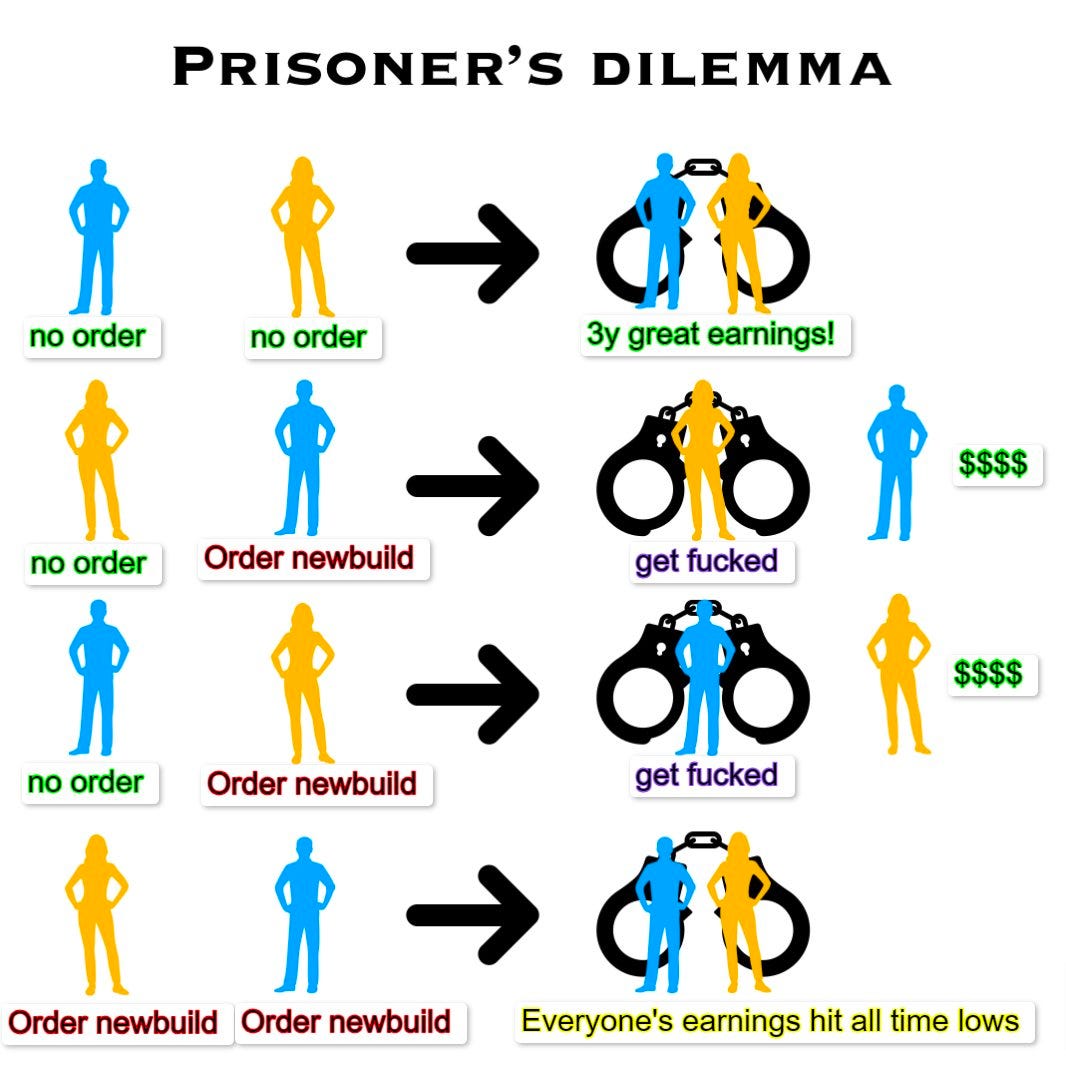

The above image is in regards to the shipping industry but the same principles and thus lessons apply just as much to the cannabis industry. The cannabis companies en masse took the “Order newbuild” route. Not only did they build and build and build but they built bigger and bigger and bigger.

The Winston Churchill quote holds just as true for cannabis companies as it does for America. Just replace the word Americans with Cannabis companies.

And so the cannabis companies as of late have been doing the right thing. They’ve been laying off workers, shuttering operations, pulling out of states, selling off never profitable assets and so on.

You could say I’m a GARP guy (growth at a reasonable price). But most of the tourists who flood new industries are what I call GAAP investors (Growth At Any Price). To them, the means justify the ends. And it’s that very attitude that often ensures they never make ends meet.

The idea of growth at any price is just silly from a stock shareholder perspective. But if that’s what you want to incentivize then management teams will be more than happy to do it for you.

It goes to reason that you will only grow your business to the point that acquisition costs don’t make any sense. But hey, when you find yourself holding a lottery ticket of being a trailblazer in an industry and building a legacy while getting paid to burn other people's capital, why wouldn’t you throw your hat in the ring. And that’s what many management teams did. If people are begging you to take their money to buy unprofitable investments, what are you supposed to do? If you think the answer is to be a reasonable custodian of their capital then they’ll just give their money to someone else willing to entertain their delusion. There are all sorts of principal-agent problems in the investing realm.

The issue with the “GAAP” investors is that their argument is logically sound. Company A needs to pour money into the space to outcompete Company B. if this comes at a loss, so be it. It will ensure their stronghold in the sector and give them first mover advantage.

I’ll repeat it again.

The logical validity of an argument is a function of its internal consistency, not the truth value of its premises.

Like I’ve already said, these bullish people had internally consistent valid and logical arguments. The problem is that it lacked in its truth value because their premise never went past the thesis stage.

The problem with their constrained and forced narrative is it might be true if the companies had to only battle it out for only one state. However there are 50 states.

What starts happening is that the companies start stacking up debt and burning through more and more cash. Meaning, that it’s not sustainable. But yet again, that’s the antithesis to these peoples' thesis. And we’ve already talked about how people don’t engage in the discovery process of alternative perceptions via antithesis and synthesis.

Most people are right at the exclusion of information not the inclusion of information. This is why people spend more effort shouting down others than they spend on finding the flaws in their logic. People are more interested in FEELING right than being right. That’s a crucial distinction to make. They want to subjectively feel validated, not objectively be confirmed in their thoughts. This is a generic and patternable trait of most people. Do you not see how this could go horribly wrong? And I’m not trying to pick on these people per se. Practically everything within these pages could explain many other sectors that saw bubbles or practically any commodity or cyclical sector.

I was recently listening to a podcast of a guy who shut down his hedge fund after two years. He made an astute observation though. He said that often the best time to raise capital for a fund is the worst time to invest that capital. It’s when people are the most excited that they’re willing to invest their money and that often correlates to crazy valuations and horrible future returns. Funny how that factor of the folly of investors never gets mentioned when people are condemning hedge fund performance. A clue that this is going on is when a bunch of ETFs get listed.

When things are priced for perfection it’s hard to get any more perfect and all the risk is to the downside. Cannabis has been a wonderful example of this.

Oh Canada

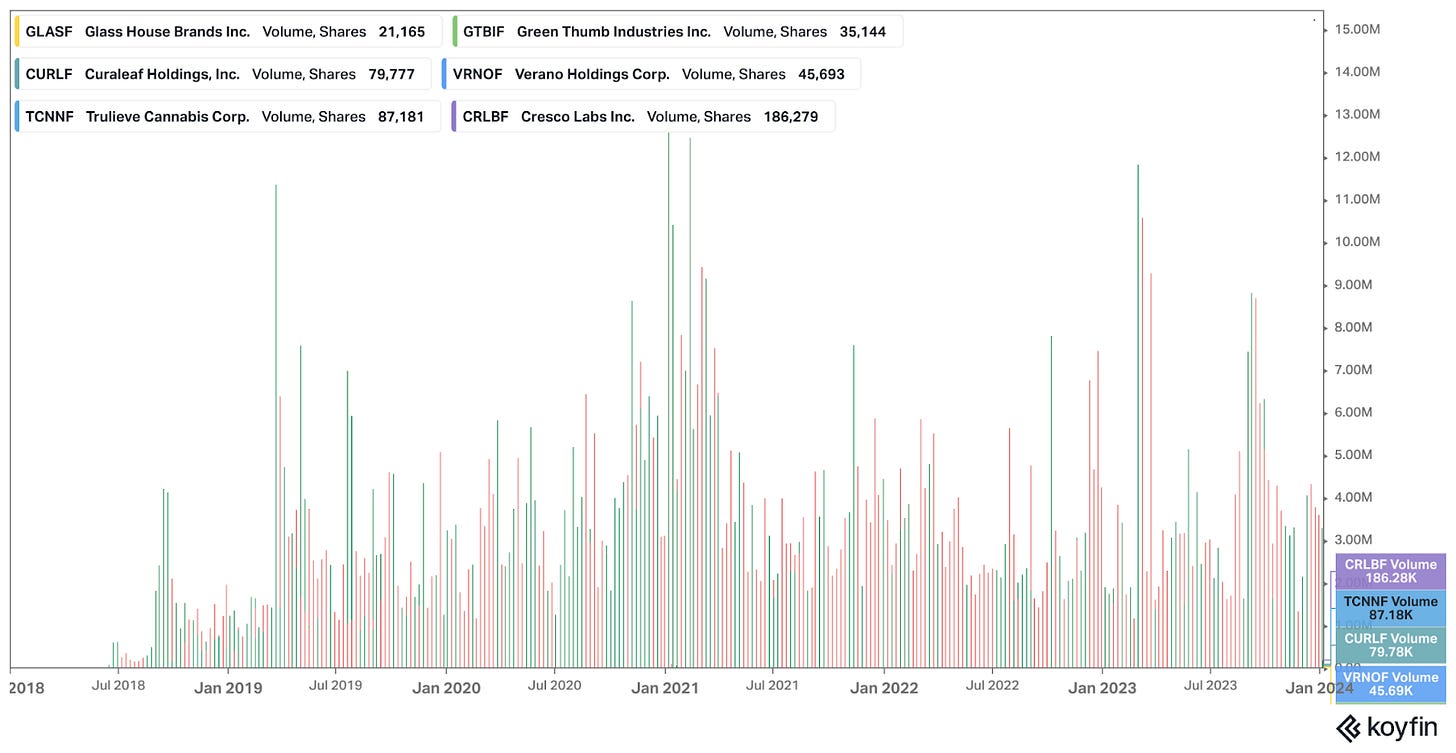

This entire publication is predominantly focused on the 2018-2021 period with a focus on the Canadian names. I’m also focusing predominantly on the Canadian names because those are the ones that got the most attention. The true believers will tell me about how the American names got a lot of attention too. I know, no one said they didn’t. I think trading volume is a pretty good gauge and way to quantify attention. Yet again, the true believers will say that’s only because the American names aren’t up-listed. I know, the fact of the matter is that that has in part led to the Canadian names getting more attention.

Of course these “counter arguments” are the consequence of ideological pathology. They’re alluding to the fact that American names shouldn’t be on the OTC because the exchanges should up-list them and the government should legalize it. You see all those should’s? I’m focused on the praxeological description of what is not what should be from some ideological moral prescriptivist standpoint. You think they’d rid themselves of that after it cost them a bunch of money. After all, many of their so-called investing strategies were predicated on the belief that the government should and thus would pass federal laws. Which is kind of ironic because many of those same people would call the government slow to act and the politicians out for themselves. But true believers won’t let a little cognitive dissonance stop them from believing.

So, back to what I was saying. Volume is a good indicator of what’s getting attention.

Here are the Canadian names. Trading volume is in the 100,000’s to millions currently. And when the sector was full of excitement it was trading in the 10’s of millions to 100’s of millions.

Now look at the American OTC listed names. They often trade in the 10,000’s to 100,000’s presently. Sure, you’ll have spikes of 100x volume but it’s still an order of magnitude less than the Canadian names have.

Ideologues

Fundamentally this article is trying to answer how not to act like these people..

The quick answer is not to be an ideologue and fall for propaganda. But that’s easier said than done. That’s essentially saying don’t be the average human. Which as you might imagine the average human might struggle with. And since this article is for the average human you can see how this is all a problem. I’m hoping that by bringing these behaviors to conscious awareness people can reflect on it and behave better next time. As the saying goes, forewarned is forearmed.

The point of a story is to describe reality via abstract representation. That can be art, speech or in today's case written language. The point is to help others conceptualize ideas to help them act on those ideas in the world. However, unconscious motivations and influences often twist stories to not make them match reality.

A simple but illustrative example is, “I find these sticks, I do this with these sticks, I make fire.” You have told me a story that I can interpret due to shared language and then I can make fire.

But quickly enough people learned how to use speech to distort reality and mislead others and themselves. Just pull up a list of maladaptive coping mechanisms. You can think of maladaptive coping mechanisms as a form of unconscious self-deception or trickery. But what better way for a highly social creature like humans to continue with a behavior than to con someone else into accepting it by condoning, encouraging, participating in, facilitating it and enabling it.

I welcome you to Google maladaptive coping mechanisms. There’s a whole long list of them and each particular mechanism can be expressed in multiple ways. You can mix and match to create 100’s if not 1,000’s of problematic behaviors. And this is all before peoples bias corrupts their speech, such as the fundamental attribution error.

Take for example escapism. It can take the form of reading fiction books, playing video games, jumping from hobby to hobby, wine, beer, hard alcohol and a whole slew of drugs. These things aren’t bad in and of themselves per se but it’s when they’re overdone and distract from the reality you’re trying to escape which leads to compounding problems through denial and procrastination that they become problems. I’d refer you to the song, “because I got high.”

It’s only a small leap of logic to go from what I just explained to a person telling you why pot stocks are on the rise of late. They attribute reasons which aren’t the real reasons and don’t cite the reasons which are the reasons. And they ignore or marginalize any reasons as to why they shouldn’t. I’ve never heard anyone obsessed with video games citing maladaptive coping mechanisms as to the reason for their fixation. Which means when they do justify it they’re ignoring contributing reasons and cite reasons that are less the reason. They provide you with the symptoms of “because it’s fun” and not “because I’m living a nihilistic hedonic life of quiet desperation.”

The narrative arc in its simplest form looks something like this:

“I want money, I like cannabis, I bought these cannabis stocks.”

You want money and you like cannabis so perhaps you too will buy cannabis stocks. And then it escalates from there. Certain details get included, excluded, emphasized and deemphasized. People become emboldened, the conversation broadens out further and so on and so on.

Yet they overlook position sizing, stock metrics, business performance metrics and so on. They can’t be bothered with such details when all they supposedly need to do is buy cannabis stocks and make money.

To sum this section up it’s crucial that you know what the contributing factors are to your behavior and not falsely ascribe lesser reasons as though they were the entire reason. Such as saying that the reason the stocks are falling is because of a short attack, when it could as well just be due to atrocious earnings in relation to stock valuations. Which transitions us nicely to the next segment.

Blaming WallStreet (yes, the vague, ambiguous WallStreet placeholder phrase)

Many people want to blame Wall Street for all the hype created and all the destruction that followed. But not so fast. The best I can tell is that it's an easy excuse for people to let themselves off the hook. The classic conspiratorial mind that lacks the will or capacity to actually understand what’s going on. Most people want you to think like this:

But being that you’ve read to this point you’re not going to fall for that, right? Remember, people present information in a selective and partial way. If you are nodding your head to the above image then this article applies to you more than you’d like to admit.

How is it propaganda? Because it’s a partial representation with spin using a visual medium to prompt emotion to drive you to a conclusion without thinking through all the facts. As though the set of individual investors and their collective response to certain stimuli with certain varying preferences and fluctuating appetites for risk doesn’t start the daisy chain that then gets Wall Street to act on. So shouldn’t it be the set of collective investors at the top? Why does the set of collective finance and investment industries get placed at the top?

Why did Valaris or Tidewater practically go without mention when they re-listed yet DoorDash got all sorts of fanfare? Was that because WallStreet wanted that or because WallStreet knew that investors didn’t care about some post bankruptcy re-listing? As though it’s a simple linear directional chain? In all reality the investing community isn’t a complex dynamic system in which the interplay between the subcomponents create an emergent property? Get real.

And think of the knock on effects that could imply. Under such circumstances anyone is for all practical purposes absolved from committing any atrocity in some sort of pleading insanity circumstance from the brain washing. Because after all, you think what WallStreet wants you to think. And let me ask you this. If you believe that to be true and you have kids I guess you’re below the individual journalist and your kid is below you. Which makes you a puppet master. Which makes you guilty by association due to you being in the puppet hierarchy pushing the agenda of WallStreet. Why not? Oh, because 5 degrees of separation is where innocence lies but 4 degrees of separation such as an independent journalist is one of guilt. Get real. Maybe your kid is the puppet master to their younger sibling. Now what?

So now what? We’re all brainwashed while simultaneously brainwashing others. I actually believe that is true to some extent. However, it’s an incomplete picture and is a snide, cynical sarcastic take that comes from an unserious and unsophisticated mind that has a chip on its shoulder. And now you’re tainting and corrupting your speech by mischaracterizing reality by fragmenting it in a partial and incomplete representation. Part of a picture should never be confused with the whole picture, even though it is a whole picture in the sense that it is technically a singular image.

Innocent Beginnings set the Groundwork: How things develop and how they take a turn for the worse

What’s a good faith argument behind the coalescence of cannabis investors?

The assembly of groups often has an innocent enough beginning. A couple of people get together because they’re interested in the same topic. Then other people interested in the topic join too. Network effects occur and draw in more and more people. Eventually and seemingly inevitably that group takes on a life of its own. Groups often form in a natural enough serendipitous and spontaneous way. This is all to say that it’s innocent enough.

They’re often not orchestrated initially by some top down control. Yes, inevitably a structure finds a leader but not at first. It’s a weird amalgamation, swirling and conjoining of people with similar beliefs that forms which creates this microcosm and ecosystem. This is important to understanding a new wave of investors to a particular niche sector and new industry. Not all people chase all bubbles. In 2020 - 2021 some people took the EV route and other people took the Chinese tech route. It really just depends on whatever theme that is uniquely aligned with a person's particular predilections.

The point is that these groups start off as the consequence of innocent enough and intellectually curious people pursuing a topic that interests them. However, it often doesn’t stay in this form.

The WallStreet narrative has underlying notes of a conspiratorially minded individual detecting a false positive psy-op. And fair enough, foul play has occurred. However, might another explanation be that there aren’t people in cloaks tacitly colluding in a coordinated attack in a centrally planned top-down controlled fashion? Couldn’t instead a bunch of individuals with self interests who share similar situations and who have similar goals come together. And then from there they do what comes so naturally, which is to energetically engage in an activity that excites them that they’re passionate about.

The thing is that I could be talking about an elderly birdwatching group or psychopathic tyrants at the World Economic Forum. And that’s my point, people with similar interests find each other with no other intention than to indulge themselves in regards to what it is that brought them together in the first place. Oftentimes there isn’t any particular hidden guiding hand that subtly nudged them, they came to those situations on their own.

And what do people do when they’re in a group? In part, they engage in group biases.

And that brings us to the dark-side, innocent participants turning into a mob or cult. Lets not forget that this article started off with #MSOGang. It’s in the name…gang. In more severe circumstances a psychopath through self selection co-opts an otherwise well meaning group to utilize it for their own self gain. Through creeping normality and shifting baselines things change. I need not belabor this point, there’s entire libraries worth of information on sociology. An interesting book on the topic is: Corruptible: Who Gets Power and How it Changes Us by Brian Klass.

A democratic community has a tendency to deteriorate to extremism and tyranny. This is nothing new. And it’s a scalable phenomenon. From online chat rooms to homeowners associations to corporate boards and all the way to government entities. And let's not forget family units, how many parents have said, “My way or the highway.”, “My house, My rules.” Or, “Like it or leave it.” Just know it’s a real phenomenon that happens in practically all domains of existence. And if not, practically every domain of existence is susceptible to this sort of entropy.

Think of someone who says you shouldn’t judge people. Or, if you have nothing nice to say, don't say anything. They justify this by appealing to a higher morality that allegedly sets the tone for how you’re supposed to interact with others. However, it’s a rhetorical smokescreen and an ostensibly specious argument. In reality, it’s a false appeal to morality meant to coerce your behavior.

How do I know this to be the case? Because they don’t mind when you judge them in a flattering beneficial light. And these people chronically contradict the alleged higher morality by condemning and criticizing other people. But they justify it because it’s the “outside” tribe. They just think they’re being clever when they do it in a cloying, backbiting and heel-nipping fashion. It’s ok to condemn others but it’s not ok to condemn those within your own tribe. This leads people to police their own when they say unflattering things and allow flattering things to be said. This means that they’re not particularly interested in the truth value of things but the sentiment. This then leads to untruthful positive sentiment statements being made. And since you’re not allowed to correct it, higher and higher magnitude false but positive statements are made. If you don’t see how this can lead to a group of individuals developing unrealistic expectations and making subsequent poor investing decisions then you’ve probably not read this far anyway.

And what results do you get from not judging? You fail to make discernments of value and you fail to assess potential risks in regards to the thing which isn’t to be judged. Because after all, “Who do you think you are?” Perhaps you’ve heard this phrase too, “You shouldn’t be a back seat driver.” Or, “You don’t know what it’s like to blah blah blah (run a business with a lot of red tape and governmental headwinds).” As though an appeal to experience is a sound argument. I guess you’ll need to jump off a building to see what will happen, because after all, how do you have any insight on the matter, you have no experience in the matter. Please don’t, that too was a thought experiment to elucidate a point.

I’ve heard all of those above expressions outside the context of cannabis, as well as within the context of cannabis. The fallacies and folly of people was well established in them before they entered the investing sector. So why wouldn’t they take their bias, cope and fallacy along with them, it’s part of who they are. Hopefully by now you’re really putting the pieces together as to how innocent enough people who group together can cause one hellacious of an experience for practically everyone involved in that group.

In regards to making an appeal to experience, later on we’ll look at what a market pundit had to say about why you shouldn’t listen to short reports. The reasoning in the article was that short reporters don’t have the internal knowledge that the business leaders have so therefore a short report is based upon circumstantial evidence. A common misnomer of the public is that circumstantial evidence isn’t enough to prosecute someone within the legal system. Wrong!

By this author's logic, if they came across someone standing above a dead body with a bloody knife in their hand and the person holding the knife said they didn’t do anything, he would believe them. After all, that individual has knowledge that the author doesn’t, after all the author wasn’t there to see what happened. And to make any judgments would be circumstantial. Do you see how stupid that logic is? I hope so.

One of the reasons I brought up the phrases such as “don’t judge” is because it sets the groundwork for what will become the catechisms and precepts that you’re allowed to operate in. There's a particular script that you’re not allowed to deviate from. Honesty is secondary to remaining a member of the group. This is how ideas take on a life form of their own. This is in part what people are talking about in the saying, “People don’t have ideas, ideas have people.”

What people often enough try to do is censor their speech and try to censor your speech in order to emphasize some parts of reality and diminish other parts of reality depending on what’s beneficial and flattering for them. They want their ideas and beliefs reinforced and validated. And what better way to do that than having other people commiserate with them and validate them. This is what’s often referred to as an echo chamber. We all have them, let's not fool ourselves.

But echo chambers have varying degrees of severity. Oftentimes in the investing community they can become quite severe. Anything that isn’t complete and utter support is labeled dissenting speech and is condemnable via ostracism. And don’t you dare even bring up a point in the form of a question which risks threatening or undermining the prevailing narrative. To ask such a question is to demonstrate your impurity and lack of allegiance to the common cause.

This is why podcasts don’t invite guests who disagree. And if they do disagree it’s only on the finer details and not the overarching narrative. This is why chat rooms kick out those who aren't going along to get along. This is why people so heavily use the block button on Twitter. Group harmony is sanctimonious to individual sovereignty. You might say this sounds like tribalism and you’d be right. Remember all of this the next time someone says that they believe in a balanced perspective. I believe that they believe that. I also believe that they’re unlikely to behave that way. Especially, when others are around to reinforce the prevailing narrative and especially in a public setting.

To give you a simple enough example, let me use myself.

Many would say that I would fall in the value investor camp. And in that camp a lot of people talk down on the tech bros. If I decided to start correcting these people's speech as to what they’re saying wrong and what they’re not considering, what do you think would happen? Over time, they would distance themselves from me. And that would cost me their valuable insights and knowhow, as well as human connection, which we all desire. Therefore, I’m incentivized to let them continually spread inaccurate, misleading statements about the tech bros. In part because in reality the probability of me finding a group of people who aren’t biased in some form or the other is highly unlikely. So therefore I find a group in which I align the most with which is the least inflammatory to my senses.

True Believers

There are many self identified “believers" of cannabis.” And then there’s a lot of low key, under the radar covert believers.

These people strongly and unwaveringly believe in the virtues and benefits of cannabis. A portion of them just so happen to be stock investors. These people are deeply committed to the ideology surrounding cannabis, which includes advocating for its legalization, promoting its medicinal properties, or supporting its recreational use.

They’re champions of the cause working to de-stigmatize it. Quick to emphasize the positive impacts on various aspects of society, such as health, economy, criminal justice reform and how it’s a symbolic representation of personal freedom. Passion and conviction is how they live their life.

Now your initial take of that is that there’s nothing wrong with that. Perhaps willing to go so far as to say that all of those things are true. For sake of argument let's say they are all true. The problem is that that information in and of itself isn’t sufficient for making an investment decision. Also, becoming a true believer in something oftentimes clouds your judgment in regards to evaluating the metrics that would make it a sound investment decision. This is often subsequently followed with justifying outlandish valuations or data dredging in a cherry picking fashion to search out for metrics that does justify it.

This makes them an ideological investor.

And ideologies need propaganda to support themselves. Because oftentimes propaganda is narrow and partial in its accounting of the world. This is to say that propaganda lacks merit in a lot of categories and thus requires narrative and spinning of the truth. This is why censoring dissenting speech is crucial. You can’t have people start questioning your faith and poking holes in your logic.

An ideological investor is someone who incorporates their personal beliefs, values, or ideologies into their investment decisions. This isn’t bad in and of itself per se. The problem comes as a consequence of prioritizing the beliefs over the financial returns. This results in them staying in a stock for belief reasons instead of financial reasons. Because, in a sense, to sell the stock is to turn their back on their beliefs.

Just imagine someone who’s a big fan of Jesus. And then they get the bright idea to open a church. It would be foolish to not factor in the tax consequences, cash flows, working capital, rent or buying of the property, budgeting etc. I’ve seen many people try to provide a service but they don’t know the first thing about business. As such, their business often fails. The same could be said about cannabis ideologues. They know about how terpenes can work synergistically with cannabinoids to create the entourage effect. They understand the medical benefits and varying strain selections. Yet they don’t understand basic supply and demand and economics 101.

But their thinking is simple. It’s something along the lines of: Cannabis is great so cannabis stocks must be great too. And it’s in this thought process or lack of it that they become bag holders.

Ideological investors prioritize investing in companies or sectors that align with their values or support causes they believe in. EVs and “renewable energy” have been good places for true believers to get wrecked in the markets. Not because the cause is necessarily bad but because the investment doesn’t make good financial sense. That’s why coal stocks are multiples off their lows and renewable energy stocks are drastically off their highs.

These investors actively seek out investments that reflect their personal beliefs, whether it's related to social justice, environmental conservation, human rights, gender equality, or other issues. They may also avoid investing in sectors or companies that contradict their values, such as coal. So they removed the money making sector and went all in on the money losing sector. Ouch!

I don’t know how many podcasts I’ve listened to where the guest seemingly has to give some long disclaimer around the social equity injustices. As though being opposed to cannabis means you’re for so-called social equity injustices. I’m not a fan of ad hominem, straw-manning false dichotomies. You often hear these sorts of disclaimer from people who are seemingly trying to seek the audience's favor but are also indifferent to cannabis and are looking at it from an investment opportunity in and of itself. Which should ring some alarm bells. Because what that means is there’s a toxic tension in the atmosphere. It also means that a lot of people are only partially looking at cannabis stocks from an investing standpoint. What other standpoint is there for investing in a company?

If you believe in the “cause” then donate to a charity. And perhaps you find buying these cannabis stocks as a form of subsidizing and donation. But if that’s true you should probably share that disclaimer with your audience.

Sky High Valuations

There’s certain heuristics that are reasonable to invest in. I know that most people don’t do a DCF model in order to find the NPV of a company. Fine, I’m not even bothered by that. But that’s why these heuristics are so important. They’re there to protect you from sensational headline figures. That’s why buying anything at 25+ times sales is a no go. And even that figure is rich. That simple heuristic would have saved them. But they were an ideological investor playing a greater fools theory game not realizing that they too were a fool. Your true believer status will get checked when your emotions can’t bear any more of a loss.

People fail at differentiating good companies, good products and good investments. They also fail at getting a theme correct and having that translate to profits in their trading account. Investors seem to fail at realizing that oftentimes they’re the ones subsidizing the end consumer. Wework, Peloton, Uber and Doordash are just a few examples. Many people have accurately predicted inflection points in society. The building of canals, railroads, cars, all the varying commodities that go into them. Yet most people lost money on what was inevitably the right macro call. Tomorrow's Gold is a book I’d recommend that highlights this point. How you express your view and manage your position is just as crucial as identifying a theme.

The sentiment seems so washed out in this sector that it seems that what once were federal legislative upside is now not being priced in. This means people are offsides. I’m hearing frequently enough that pot stocks aren’t a buy unless we have a recession, in which case you can slowly build a position. I’m hearing how the valuations are at fair value. No more of this subjective relative valuation garbage.

How could they have been so stupid? That’s a serious question worth asking yourself.

The problem with the initial bunch of people is they do what you never do…

If you believe that both the tragedy and opportunity in life lies in the fact that most people are retarded then a question one could derive from that is: how can I take advantage of the opportunity in this sector that has been saturated with retards, from management teams to individual investors?

Now I know that’s not a nice thing to say. But also calling them naive, innocent and optimistic doesn’t quite capture the whole picture. As I said earlier, everyone I talked to early on adamantly refused to take what I said to them seriously. They had this moral puritan and sterilized take. The problem with honesty is it snaps you out of your fantasy. People have this peculiar Disney-esque take. The problem is that it’s just not so. To be confronted with information that you can’t account for nor refute based upon its merits and then to also casually dismiss it is to demonstrate a learning disability. And that’s what a personally incredulous ideological individual requires. They have to be able to ignore reality and not let the facts steer them away from their faith.

Who in their right mind would have bought at these valuations? I’ve answered that question in a serious fashion up to this point. But now I’m asking it rhetorically to emphasize how poor of an idea it was. That question implies that one must be in their wrong mind. Which is really to say that they let their executive functions lapse and their investing was predicated on narrative and emotions. They justified their actions with post hoc rationalization by creating a constrained narrative that excluded or discounted any factual information that disconfirmed it. This is what ideologues do.

Who thinks that it’s even remotely appropriate to buy an unproven company, with an unproven management team in this sector, let alone any company, for between 30x and 100x sales?

If you think that is bad, look at these names. 400x sales!!! WTF.

Go woke, go broke. These would be the useful idiots and true believers who wanted to make it about something that it wasn’t. A more recent example of that would be the Gamestop crowd.

So what was it then? It was the simple reality of the Arc of Development of New Industry. The rubber boom taught us that, right? You know about the rubber boom, don’t you? You’ve read your history haven’t you? Here’s an excellent piece on the matter.

The idea that something can be a burgeoning industry that will change the lives of millions of people for the better does not mean that it’s a good investment. It just doesn’t.

This is an industry where revisions matter. When people aren’t willing to check others on the things they say that only further emboldens and incentivizes people to say crazier and crazier things. Matter of fact, they want you to outright lie to them or at least not tell the whole truth. Ever wonder why cannabis media outlets practically never invite someone who has something negative to say?

I’ve seen all sorts of projections as to the CAGR of the cannabis industry. From 12% to 25%.

At first expectations are high and unrealistic and overtime they get revised lower and lower. Which is the result of delusional people becoming more realistic. At first numerous headlines talked about how this was a $100 billion dollar industry by 2030. Such sensationalism dies off with the enthusiasm that the individuals lose as they get beaten up in their stock names.

My favorite part of the below chart is how they don’t give you the % for the other industries. Do you see what else they did there? They fragmented the alcohol industry into its sub-segments and then compared it to the entire industry of cannabis, not its sub-segments such as vaping, edibles, beverages and flower. You got to love that degree of intellectual dishonesty by not keeping constant their comparisons and controlling for the variables in order to deceive you.

A more updated model:

You’ll note that the alcohol industry is seemingly growing at a faster rate than the cannabis industry. I also question whether the alcohol industry is growing that quickly. The numbers I’ve seen are anywhere between 3%-10%, not 17%.

Another common theme of the Arc of Development of New Industry is that the malfeasance of capital catches up with the industry participants. The absurd valuations in which they buy other companies will inevitably get written down and impaired. These acquisitions often occur via equity share issuance or debt.

Look at the growth of shares outstanding.

But look at the revenue growth you say.

But you don’t pay your debtors with revenue, you pay them with interest and eventually principle.

The below image would be the compressed margins I talked about in the Arc of Development of New Industry.

Conventional measurements like the leverage ratio won’t even work for some of these companies. Debt to EBITDA requires that you have EBITDA. And many of these companies don’t have that. So naturally they don’t report EBITDA they report Adjusted EBITDA. Screw it, why not. At some point people give up on reality so why not just go deeper into the realm of fantasy. If people are willing to participate based upon fantasy why wouldn’t management teams indulge them. This is also why it’s hazardous to short a fraudulent company. They will go to any lengths to keep the show going.

Another part of the Arc of Development is that after a while sentiment fades. And with fading sentiment comes the unwillingness to keep dumping money in. Or, if they do, they want to be compensated with higher rates. This scarce capital forces management to issue shares to raise cash. The reason they have to raise cash is to fund their lifestyle but also because the companies are profitless and burning through cash.