MAG 7

MAG 7 is the newest version of what started out as FANG (back in 2013). FANG became FAANG which became FANGMAN and now we’re speaking of the MAG 7. And ever since the genesis of FANG people have been hating on them. And each and every year people call for their demise. If I was an inadequate and inept individual looking to obfuscate and detract from my underperformance I’d hate them too. Just look at their 10 year performance. Wow!

If you’re new to markets or are forgetful you might say: “Yeah, well, looking at the chart they’ve only outperformed since the Covid era of easy money and transaction free trading.” Ok, let's look at a chart from January 2013 - January 2020.

What’s your next excuse for dismissing and disqualifying them in a thought terminating cliche fashion?

While playing around with the chart I surprisingly found that the SPY has outperformed 3 of the 7 names on a 3Y timeframe.

What irritates me is that no one in my camp wants to give the devil his due. This has been a phenomenal place to be investing for the last decade with secular tailwinds in their favor.

Most money managers woefully underperform the SPY let alone the MAG 7. By blaming the MAG 7 in an intellectually dishonest way through a chain of narrative spins in order to justify their underperformance they are able to coerce their investors or themselves into staying invested. You sure as hell can’t just return the money back to your LPs and tell them you suck.

The narrative is something along the lines of, “I’m underperforming the benchmark because the benchmark has been hijacked by a handful of names. And that handful of names are trading at “crazy” valuations. Therefore, it’s not my fault that I’m being a reasonable custodian of your capital and as such underperforming.”

The implicit supposition of this is that if people weren’t crazily buying unreasonably priced equities then there would be more money to go around and buy their undervalued names. It also presupposes that there aren’t companies outside of the Mag 7 which are doing quite well and are reasonably priced. FYI there is. Also notice the qualifier being used “crazy” or “illogical” in an attempt to relatively contrast and compare themselves too by implying that they’re sane and logical. People are more tricky than most give credit too.

So let me ask this, why are they underperforming the equal weighted index???

Of course such a question goes against the grain of such a heavily eschewed convenient narrative and would force culpability. You can only come to these sorts of realizations when you keep constant your comparisons and control for variables.

Why didn’t these money managers own URNM, XHB, short China etc. What you come to realize is that they always have a reason for their underperformance. It’s misdirection at its finest. Why are they running at 200% gross yet are only 50% net long? All year they’ve been talking about how the equal weighted index is flat on the year. They use that as evidence by proxy to excuse their underperformance.

But so what? What does that have to do with anything? When did the equal weighted index become their benchmark? Or are they implicitly using that as a proxy to justify their underperformance? There’s always some reason, it’s not a one off.

It’s always interesting to hear people bemoan late stage capitalism and then act surprised that increasing concentration is occurring in the S&P 500. They talk about Corporatocracy, socialism, crony capitalism and banana republics but then don’t buy the very names that are in bed with the government and would benefit from such forms of government. They don’t buy the names who benefit from regulatory capture. Isn’t that the sort of moat that their demigod Buffett is always talking about?

It doesn’t make sense to me. Here they are laying out the playbook for late stage capitalism and how they’re always talking about how emotional and groupthink obsessed people are and then when that’s expressed to its logical conclusion, they are taken aback in a ghastly fashion. Huh, how did they miss the trend…for the last decade!?

Along those same lines people talk about how the markets rigged. In which I almost always respond the same: then that means there’s a fixed set of rules, so find out what they are and then play by them. But that’s when you find out that their conspiratorial mind is all about generating fantasies to provide cope and fallacy. Because when the big names go down like they did in 2022 there’s a new conspiracy about how the fatcats are dumping on the innocent peasants. Then when the market goes back up in 2023 the newest rendition of the conspiracy is that 2022 was to make the peasants sell so the fatcats could buy them for cheap. They put forth unfalsifiable claims which always seem to validate their ineptness and victimhood. They also seem to pay no mind towards the inconsistency and contradictions of the narratives they put forth.

As often is the case in life, people want to give you one side of the story. They’ll show you a chart like the one below.

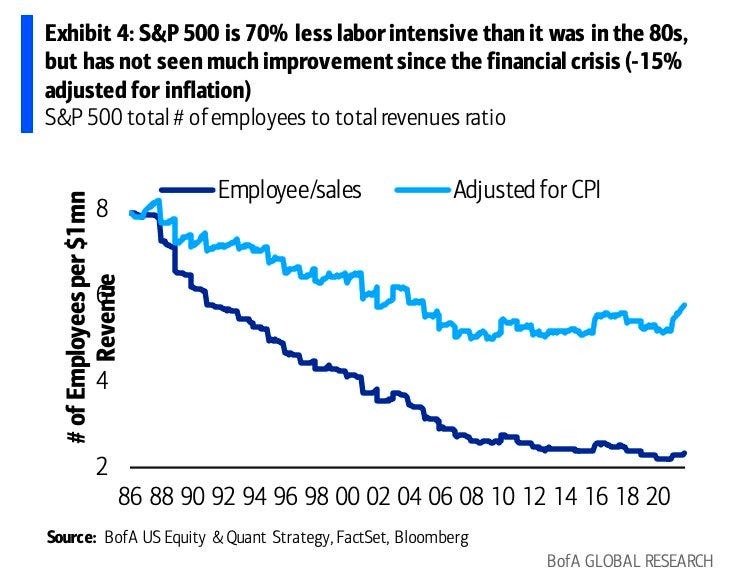

But fail to mention charts like this:

As a side note: Of course the chart above gets depicted as increased efficiencies through technology and how we’re becoming a service based economy. What I rarely see mentioned accompanying these sort of charts is how inflation impacts those numbers. If it takes 8 people to generate $1M and inflation goes up 100% over the subsequent years then those same number of employees, all else being equal, would be generating $2M. Is it because they’re more efficient? Is it because the company has pricing power? Maybe, or it could simply be inflation. Well, the same works in the opposite direction. It will only take 4 employees to generate $1M after a 100% inflation. Guess what? We’ve had nearly 200% inflation since the beginning of the chart. And just like that, voila, you have a scary chart that’s fallen by 75%. Yet another reason to keep constant your comparisons and control for the variables.

Here’s a more intellectually honest chart that depicts it adjusted for inflation.

Back to my point. There’s real reasons why the MAG 7 has experienced the rip roaring bull market they’ve been in for over the past decade. They’re practically monopolies in their respective domains and they absorb any competition that steps into their territory. They’ve had numerous years of solid growth, solid margins, they have strong balance sheets, strong brands and economic scale. But no, that all gets looked over.

I’m not saying that any of this is sustainable. Lord knows I wouldn’t call this a new permanent plateau. But people don’t even try to explain what has led to it. Nope, just shit on it like any good hater does. Like any good subjective emotionalist they point and sputter and manufacturer indignation.

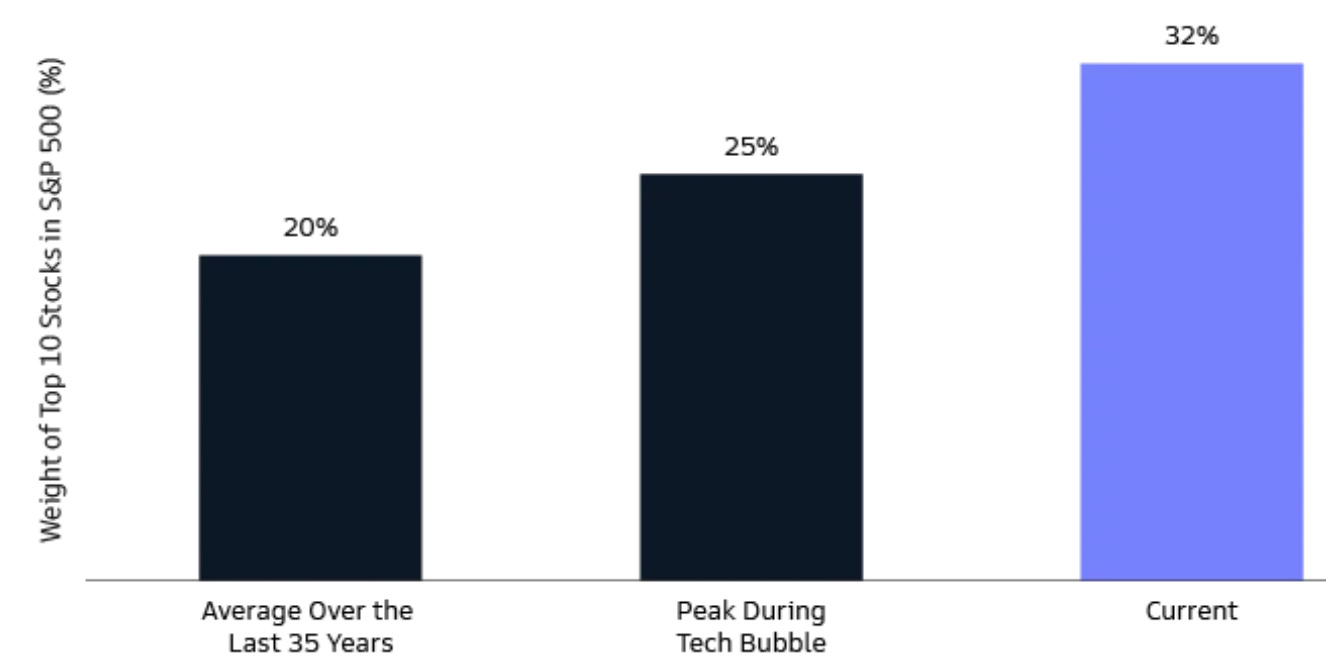

As the above chart demonstrates the disparity between normal times and now is an additional 15% of concentration. Normally the top 10 names make up 20% of S&P and we’re currently sitting at 35% concentration in the top 10 names. So they’re actually complaining about 15% not 35%. But 35% is a bigger number and validates their narrative. Matter of fact, I’ve seen this sort of misleading representation of numbers before…

Depending on how you want to spin a story you could also say: 70% of the market is controlled by 25 companies with an average market share of 2.8% per company. But they don’t represent it that way, I wonder why?

While writing this article I came across the following tweet.

What excuse do the hedge funds have in not owning those LatAm stocks? See, the problem with ideology is that it causes you to arbitrarily lump things into one of two categories: in-group and out-group. It also forces the possessor of the ideology to be woefully ignorant and personally incredulous. This is what leads to calling Columbia, Panama, Brazil etc socialist/communist countries. The consequence of that is you miss out on opportunities by committing voluntary unforced errors.

Now compare these Latin American O&G producers to the performance of the MAG 7 within the same time frame.

What prevented money managers from outperforming their benchmark or even the MAG 7, since people want to treat them the same even though MAG 7 is only a third of their benchmark. Why didn’t these money managers own EC, YPF, PBR etc? Ideology. ESG ideology, blatant mislabelling of Latin American countries as communist ideology, recession preoccupation dogmatism. They missed it and by it I mean their benchmark and by a wide margin.

DOOM!

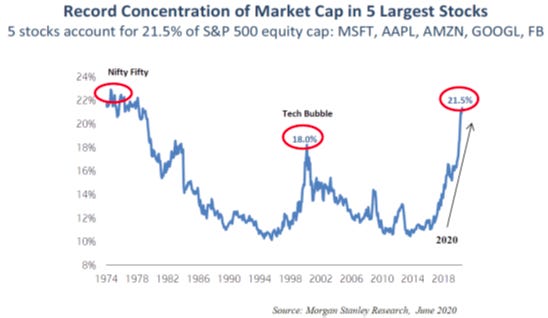

We’ve all seen charts like these.

Or

But so what? What actionable insight are you deriving from these charts? And there’s really no need for people to be nasty about it.

And just as I pointed out with the Biden Tweet you can frame the above graphs differently too. Positive/negative labeling of an attribute is expected to evoke positive/negative aspects of what’s being labeled. In the medical field Attribute Framing posits that patients are more likely to choose a treatment when it is framed positively. Just imagine if I said you had a 20% chance of dying. Alternatively I could say that you have an 80% chance of survival. Which treatment would you choose? It’s a trick question, they're the same treatment. Add a picture to the narrative and your work is done.

This is from a 2018 article.

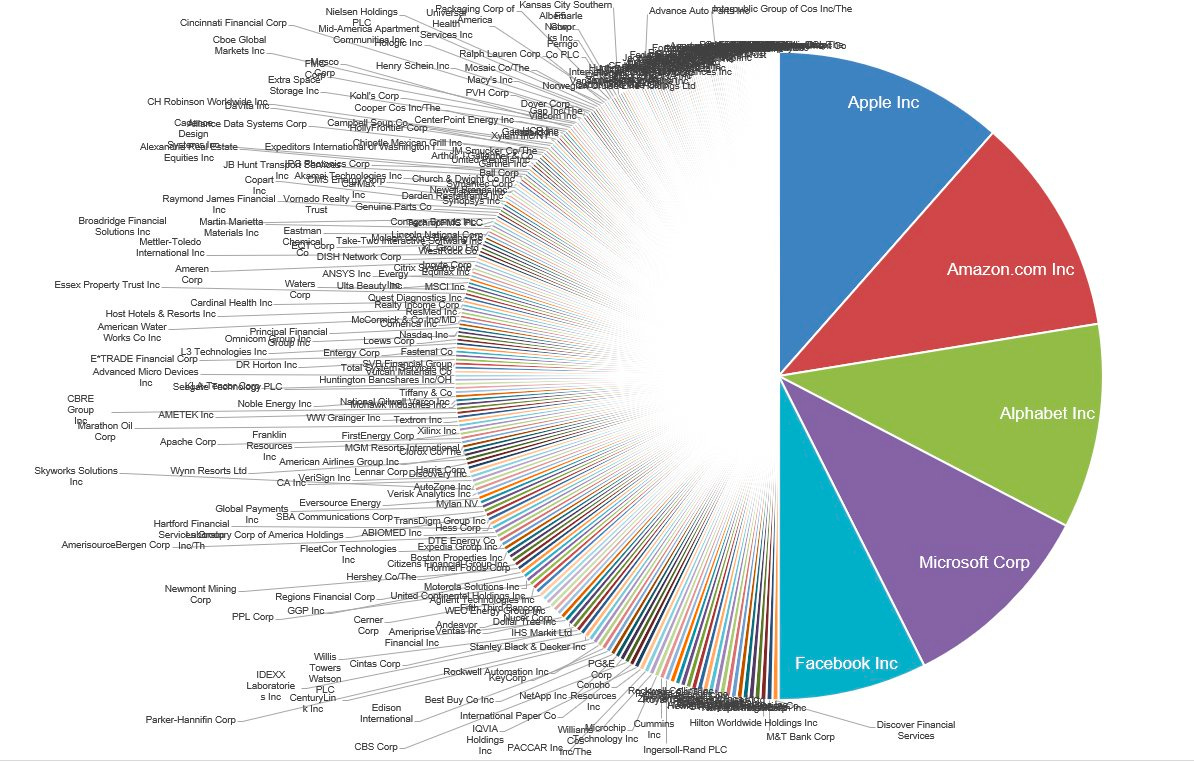

The article goes on to explain how the majority of the money made in the markets comes from a handful of stocks. Well no shit. It’s nothing new. It’s called the Pareto Distribution and it is a very real phenomenon that governs our universe in numerous domains. As much as I’d like to talk about that, it's beyond the scope of this article. To sum it up, look at this chart.

The Pareto Distribution is a law that governs any creative productive system where the fundamental underlying measure is human productivity. And the law goes like this: a tiny minority of people will make the large majority. The difference between an individual artist, athlete, author etc and a business is that an individual has until they die yet businesses can keep going and going. People seem upset that the Mag 7 has been in the good graces of the Pareto Distribution. But I digress.

Then you have disparities in the charts which adds to the confusion. Look at 1990 in the below charts and tell me which is correct.

Versus

So which is it? Did 1990 have 40% or 21% concentration in the top 10 names? Hell if I know and I don’t really care. My time and attention is a valuable resource and I’m not quite sure how I’m supposed to generate returns with this sort of information. Am I supposed to short it? No thanks. Am I supposed to get all hot and bothered by it? No thanks?

Then layer on a chart like the one below and you have yourself a solid alibi for DOOM!

Don’t player hate…congratulate. That’s what I say.

If you like to have your emotions riled up and manufacture indignation while pointing and sputtering I’d recommend curling up on the couch and watching the Bachelor. The financial markets aren't the place for that sort of nonsense.

And no, I’m well aware of all the problems and misdirection occurring in these names. One of my favorite tweets and charts on the topic is the following:

Haters Gonna Hate

I’m sick and tired of hearing this subtextual, bitter, resentful, jealous, strawmanning mockery of the MAG 7. It’s such an unhealthy obsessive fixation and preoccupation for certain people. Many of my peers have this sort of absolutist rigidity towards wishing for the downfall of the tech stocks and I find it repulsive. I would say it’s comical if it wasn’t so tragic. It doesn’t resonate with me at all. The only time I think about the Mag 7 is when someone else brings it up. When it comes to the MAG 7 Chamath says it best for me:

I take vengeful fantasies very seriously. The warnings were provided to us by Cain & Abel. That’s an entire article unto itself. But I’ll sum it up. Cain's sacrifices were rejected. This made him bitter towards Abel who’s sacrifices were accepted. He developed a pathological fixation towards Abel in a jealous rage. Cain felt unappreciated, marginalized and alienated. He then acted on his vengeful fantasies to destroy the symbolic representation of the ideal (Abel). It’s classic displacement and lessons going unlearnt.

How does this apply to the financial markets?

An investor doesn’t make the right sacrifices. Sacrifices could include doing due diligence on the company or sector, not position sizing correctly or expressing the theme in the right way. Just imagine being bullish uranium for a multi year period and then buying monthly call options with all your capital. They didn’t sacrifice the time to learn why that’s a bad idea. Sacrifices can include not following along via the 10-Q or conference calls. They don’t sacrifice the parts of themselves which are inadequate to the task of making money in the markets, such as: impulsivity, short sightedness, being result oriented, not establishing a proper decision making process and adopting mental models that would aid them.

Over time they observe other stocks going up (for no good reason they’ll tell themselves) while their own portfolio underperforms. Instead of wishing for themselves to do better they wish for the downfall of the stocks that are doing well. Instead of finding out the why behind the what they cling to cope and fallacy to adjudicate themselves as being righteous and thus by necessity the others as sinful.

Unlike Cain, they can’t destroy these other stocks though. So they might try to express their grievance by shorting them to feel good about themselves, capitalizing on the downfall of those stocks. But they fail at that too. Inevitably these people rage quit or burn through their capital. They’ll go on to talk about how the stock market is rigged and they’ll generate all sorts of conspiratorial narratives.

These people fail to realize what Shakespear noted some time ago, “The fault is not in our stars, but in ourselves.”

A poetic way of expressing this is the following: People rather stand downwind of a fire cursing God for the smoke and soot they’re breathing in rather than moving upwind of the fire.

Meaning that people don’t mobilize and orientate themselves in the world to better position themselves. Instead they stay static and stagnant blaming some external, existential malevolent predator for their victim status. The willful blindness required for this is quite the burden to bear.

There’s nothing more dangerous than a bear case. The reason is simple. It sounds too good to our ears. I’ve seen marvelous and brilliant sounding bear cases for why the markets were to fall but it rarely ever happened. The argument was so convincing and sweet to my ears. There’s all kinds of reasons why the market shouldn’t have gone up after ‘08 yet it did. The reason is simple: there’s all kinds of reasons that the market should have gone up. After all, it did go up. There’s something about a bear case and how it attaches to our egos and our desire to feel validated that I find extremely dangerous, at least to my portfolio.

Haters in the face of context

In a simplified way of viewing the world you can say that there are value investors and growth investors. The camp that I squarely fall into is the value investors. But neither side is without its faults. I notice a lot of anger towards the growth investors in my camp of people. I don’t see much of that sort of hate towards us from the growth investors.

People who indiscriminately hate tech stocks are bigots. I always recommend being weary of anyone who prays for the downfall of someone else. A Cainish heart is not one that you want to make friends with. A bigot is someone who holds an unreasonable prejudice against an individual based upon their affiliation and membership to a group. You might recognize this by the phrase, “guilty by association.” In the context of today's piece it follows the following logic: any and all tech stocks are bad for the simple fact that they fall within a broader category of “tech stock”.

And what does this mean for me? I own Townsquare Media and I would consider them a tech company. What I want to know is why are these people calling for the downfall of Townsquare Media?

This is when these haters will start to add context. They’ll say, “It isn’t all tech stocks, just the ones at stupid valuations.” But not so fast. That’s not what they said. Then they back peddle and engage in adding context to clarify. This is what you might call in-group fighting. But just imagine how the ball's deep tech investors feel about this. They were never afforded any clarity and context. They just had someone wish them immense suffering as a consequence of stocks they own. Too late for clarity bub. It’s this unnecessary division and so-called politics in the investing community that I find unpleasant. The irony is that these same value oriented investors are acting in a hyperbolic emotionalist fashion and then have the audacity to complain about how people in the media and political realm are doing the same thing.

It’s an interesting juxtaposition. Normally the value investor camp has a bunch of anti-liberal/Democratic party people in it. Yet, here they are in real time, acting like one of the people they despise. They’re engaging in identity politics to cause a rift through hyperbolic misrepresentation. The irony.

MAG 7 is the popular kid: charming, smart, attractive and gets the pretty lady that the hater can’t. So what do people do, they mumble under their breath and talk shit. The beta males rejoice when they hear bad news about their enemy (tech company coming under scrutiny of European antitrust litigation).

Everybody needs a whipping boy and scapegoat.

It's never resonated with me to have celebrity fixations. It’s never resonated with me to pay such close attention to a handful of stocks that I have no interest in. The haters are not objective dispassionate observers. Their motives are sinister and born from their copulation and entertainment with the devil. In other words, they’re pissy and sour.

After Hours segment

This article has been an idea for a while. Yet two things prompted it into being created. The amount of shitposting I’ve seen on Twitter in the last two days and how it’s juxtaposed to the Nasdaq falling and a couple of podcasts I’ve listened to lately.

To sum up the tweets I’ve seen lately, observe the following.

The second reason was me being triggered by a couple of comments made while listening to podcasts.

Let's look at a loaded question formatted in a false dichotomy with a lack of understanding of what logic is.

It’s important to note that this is coming from a person who claims to help “guide you through the analysis of market trends in search of opportunities unfolding within major sectors. Then once ___ has narrowed down the sector or industry, he analyzes the price action across dozens of charts and indicators to find the opportunities with the biggest profit potential.”

All I know is he chronically talks with a negative connotation towards the Mag 7. Is his trading course trading these names in an attempt to “hit financial home runs or take paper cut losses”. I sure as hell would hope so. It’s been one of the biggest themes and most profitable sectors of the year and for that matter the decade.

I also find it odd that he doesn’t provide evidence of his trade and portfolio performance. I mean if I was “prolific and innovative” I would want to show you my “asymmetric approach” via my performance history to convince you to buy my course. Hell, I show you and I’ve claimed none of these things. The secrecy around peoples portfolio performance has always been an alarming red flag to me. It’s simple, show your 1,3,5,10 years or however long you’ve been at it percentage returns. I’m not asking for names or some proprietary investment strategy, just the percentage returns. Why is that too much to ask?

Back to the podcast remark.

“The markets really have almost been fragmented because there’s the magnificent 7 that are bullet proof and keep rising and defying all logic in terms of some of the valuations that they’re reaching, yet it is the trade that is working. And any prudent investor that is looking at things from a value or growth and trying to diversify is simply getting chewed up as the performance in the market has not been broad. What do you make of the Mag 7 and where we are in general in equities? Do you view it as a true bear market risk or do you view it as the markets will trade in a sideways range until valuations normalize?”

First off, others and myself haven’t been getting chewed up. We’re up double digit percentage points for the year. Sure, our performance has been lacking in the 2H but I wouldn’t call double digit percentage gains on the year “chewed up.”

Why are the outcomes constrained to down or sideways? Why can’t Mag 7 stay flat and 65% of the market go up? Or why can’t Mag 7 fall while the rest of the market disproportionately catches a bid and thus pushes the market higher? I’ll tell you why, and it’s not because of some backtested historical example, it’s because the common denominator for such a biased and loaded question is just that…bias.

It kind of looks like valuations are normalizing, does it not? The high flyers are coming down or are within their historical range. This chart is the P/E for LTM.

This chart is the P/E for NTM:

Yes, I’m aware that AAPL has had a multiple rerating from 20x to 30x and all the while they’re comping negative QoQ or YoY. But they’re also buying back stock to offset that. Let me guess, that doesn’t count. If you believe that then the degree of pathological delusion and detachment from the structure of the stock market which you possess is beyond my talents of helping you. ALL a company needs, assuming all else being equal, is to buy back stock.

Point in case, a coal producer:

Although its EBITDA has been declining over the last 12 months their share repurchases have more than offset that. Yet I see the value investors promoting this and condemning Apple. But they’re doing the same thing. But AMR gets a pass because it’s trading at a 6.3x P/E and it falls into the “in-group” of stocks.

I just don’t get why people are so obsessed with Apple. And I don’t get why they’re so hateful towards a stock that offers such a great trading opportunity (if you’re into those sorts of things).

“Defying all logic”

The real kicker here is he provided a logical explanation to why they’re valued the way they are in a podcast that he did a week earlier. Sure, he provided a partial and heavily biased answer that provided an incomplete picture that refused to address the merits of the question he was asked but nonetheless he outlined the inferences that formulate peoples ideas which create the logic they use in their argument, as well as, a general overlay of the sociological patterns that people conduct themselves in. People pretend for some reason that informal logic isn’t logic. As I’ve insisted multiple times in my writings:

The logical validity of an argument is a function of its internal consistency, not the truth value of its premises.

Onto the quote:

“When a major trend is underway, those people who are in the trend will always find a reason why it’s happening. So when Teslas ripping to the upside, everyones going to be driving an EV car and that’s the future. When the agricultural stocks are running, everyone will say: everyones got to eat. There’s always some reason they come up with to justify what the trend is. But the market always does what the market always does. It’s all about flows. And when everyone gets too crowded into one trade, inevitably there will be a turning point and the trends mean revert. I’m not saying that has to be devastating or anything but I’m saying that this idea that the Mag 7 keeps running relentlessly and because of this they’ll never go down is nonsense. The markets will always correct. That’s the way it is and that’s the way it will always be.”

This is what you call an emotional response to a question. He’s answering a question that wasn’t asked but was tangentially associated. We’ve all done it. Matter of fact, it’s quite a good clue to enlighten yourself about how sensitive you are to a topic. Let me explain with an example.

You’re tired of your boss taking advantage of you. You come home and your spouse innocently asks you to do something. And you rip into her. After it’s all said and done you ask yourself, “where in the hell did that come from?” You come to realize that you’ve become extra sensitive to requests as they often come from your inconsiderate boss and that you’re feeling unappreciated and abused at work. It’s only when you unload on your undeserving and unsuspecting spouse that it forces you into conscious awareness. In the case of the podcast, it’s merely revealing to me that he has a strong bias in a certain way. It’s not a moral judgment but an observation. You must know the bias of the people you seek counsel from.

I’m sure he’s irritated and bothered with all of the stock promoters grandstanding in the media. I’m sure he’s concerned with the naive investors who pile into these names with some utopian expectation. He might be irritated that his trading portfolio is being shadowed by the Mag 7 performance. Ultimately IDK.

My point is that in the initial quote he said that they were “defying all logic”. That’s a false statement. It’s a common enough practice of humans to substitute words or phrases which carry a certain connotation, although it’s factually untrue, in favor of using correct words based upon their denotation. But hey, humans are human. The problem is that that’s a trigger for me.

An interesting juxtaposition to this is: when a major trend is underway and it rubs your senses the wrong way, you’ll always find a reason why it shouldn’t go up and yet it will. And you’ll be suspended in disbelief as you get your face ripped off trying to repeatedly short it based on valuation. As though valuation is the only variable to consider. Just ask anyone who was short Nvidia going into 2023.

Now I’m not accusing him of that, I have no idea whether he’s made money on these names on either the long or short side.

I purposefully left out who this individual is. He’s a cool enough guy and I’m not trying to start any beef. I also think he’s a net positive for the investing community and therefore am under no moral obligation to say his name. Ultimately, I think I can get away with quoting him because not enough people read or listen to my work. If I had a larger audience I’d probably leave this out. Along those lines, I actually have another article I want to write about what a “famous” person said on a podcast but I’ll save that for another time.

With that I’m done, I’ve said enough and hopefully I’ve made my points. This is something I’ve been wanting to get off of my chest for some time. Hope you enjoyed it. And if not, it was a cathartic experience for me.