Cannabis: Why I'm involved

After all these years, things have gotten bad enough that they're starting to look good.

I’ve been watching this industry for years.

And for years stock investors have been calling for change in this industry.

And things have changed: multiple players have been zeroed out, shares outstanding have exploded, companies have become ladened with debt and flower prices have dropped precipitously.

And the investors have mostly done well. Of course I should clarify that. By investors I mean the C-suite executives, preferred equity and debt issuers.

WHY AM I JUST NOW GETTING INVOLVED?

Sentiment had largely washed out.

For instance, podcast hosts for the longest time suggested blindly buying pot stocks but in the last year or so they have been saying that you should wait for the upcoming recession and to do so in small quantities at a slow pace. That’s a much different tune than the years before.

Valuation metrics, after all this time have finally come down to “reasonable” levels. Which is really to say that they’re not asininely expensive.

The Growth at Any Cost (G.A.A.C.) has largely stopped, capex spend fell off a cliff and companies are now focused more on repairing their balance sheets rather than growing their unprofitability.

The marginal cost of production is below the selling price. More so because of company bloat and inefficiencies in operations but hey, it’s still the case.

It’s when the mines get shuttered and commodity prices are in the toilet that you want to look at investing in a sector.

Also, capital is harder to come by in this space.

To sum it up: washed out sentiment in a bombed out sector, not sky high valuations, management teams are more focused on the balance sheet & cash flow than the income statement (although top line isn’t doing well, the internals are improving or deteriorating less rapidly) and capital has largely left the sector.

These are the sorts of things I look for as someone who loosely considers themselves a cyclical commodity speculator/investor.

I should also mention that I’m only getting involved in a very few select names.

PLAYING IT SAFE

If you’re betting on federal litigation then you’re probably taking more risk. After all, why wouldn’t you? If that’s where your focus is then your concern with business health is at best a secondary thought. The most desperate and leveraged players are the ones who’ll benefit the most. The highest cost producers are the ones who are geared the most towards the upside in a commodity bull market. Except in this case, it’s more along the lines of a legislative and legal bull market which is being anticipated.

And that’s definitely a game to play.

However, that’s not the game I’m interested in. participating in a bombed out sector itself affords enough potential upside. For me, there’s no need to layer on risks. It’s risky enough as is. I’m trying to find competent management teams who are the lowest quartile cost producers.

This sector as a whole is risky enough. Most of these companies have enough operating leverage as it is. I needn’t go further out on the risk curve by betting on quasi-competent management teams who’s game plan has been to bum rush into states in an attempt to establish pseudo oligopolies via regulatory capture, yet still manage to incinerate millions of dollars in the process.

This preoccupation with maximum upside is predicated on things changing. But guess what? These companies have to manage not going into receivership first before they’re able to capitalize on any potential future catalysts. A recent example of a company that failed to bide their time until regulations benefited them is Medmen. Rarely is their discussion on downside risk among sector participants. Instead the conversations are saturated with how well varying companies will do with regulatory change.

I want to know that if this sector doesn’t see any legislative catalysts in the near future that the names I’m invested in will make it through. And not just make it through but be able to use their competitors' weakened state to their advantage by taking market share or consolidating the industry.

I’m not focused on the half-decade plus pipe dream of tomorrow, I’m focused on the guarantee of the past. Which is to say management teams track record which in large part has been abysmal and unblemished by success.

That’s the narrative I care about. Not all this hoopla that’s among the mainstream outlets.

Why not other MSOs?

“There’s Curaleaf International, don’t you want to be a part of that?”

I don’t care about these so-called catalysts. Catalyst has become a placeholder word for the promise of tomorrow. I’m purposefully keeping my expectations low. I’m extrapolating present and recent occurrences in this industry and projecting that forward. I’m well aware that that’s a dangerous game. But it also provides a margin of safety.

You can’t justify buying an expensive company once you remove the promise of tomorrow. Most peoples investing thesis is light on arithmetic and heavy on the promises of tomorrow. The strategy I’m taking will ensure that I don’t maximize gains in the near future. No solution is without its own set backs. My bet is on things normalizing and not deteriorating any further.

The fact that I’m even involved in this sector is one of implicit optimism. My focus is on downside risk. I’m trying to discount the narrative as much as possible without being completely blind to it. Most people need the narrative to justify these stock prices. I’d rather just gravitate towards the companies which don’t need enthusiasm, yet elicit enthusiasm based upon their business practices and developments. Arithmetic is what gets me excited.

I’m adopting such expressions as:

The past is prologue

The past is the best predictor of the future

History doesn’t rhyme but it often does repeats

You could say that most people in this space are putting forth these expressions:

“There are decades where nothing happens and there are weeks when decades happen”

“Gradually and then suddenly”

May I remind you of the irony of the second quote, being that it pertains to bankruptcies.

I want the cleanest balance sheets, cash flows, low interest bearing debt etc.

I’m trying to make a safe bet. Or more accurately, a less dangerous bet. I’m not interested in this infinite horizon and evergreen story that people have been pushing for over half a decade.

It will come but I’m not counting on it. And how would I count it? As in what probability would I assign it in any given time period? And what numbers do I assign to the companies who benefit from reform? How much is it worth to them?

We all know of Nassim Taleb's Thanksgiving Turkey and the error in assuming that things stay the same. I’m trying not to be a turkey both in the sense of being a dud or loser, as well as not being someone else's dinner.

My baseline behavior is to be skeptical of others and presume they’re out for their own self interest and for nefarious reasons. You need not look any further then an investor presentation to see how biased and partial management teams are. Oftentimes, it isn’t that they’re lying, it's that they’re selectively framing facts while conveniently obscuring, obfuscating and ignoring unflattering facts. FYI, that’s called propaganda.

The more novel and new an industry, the more true this is. The asinine and ludicrous projections that some of these companies made a few years back is frightening.

But hey, this isn’t a management only problem, this is a human problem.

I’ve never gone on a date and had a woman tell me why I shouldn’t be with her, only why I should be with her. It’s more along the lines of me needing to do my own due diligence. Seemingly, people don’t feel obligated to tell you anything that’s unflattering. And yes, these are the same people who will look you in the eye and tell you that they believe that people should tell the truth, the whole truth and nothing but the truth. And that honesty is the best policy. Quite an interesting divergence and contradiction between their speech and behavior, don’t you think?

But I digress.

The point is that you need to come to the investing game with these realizations of human condition and to recognize that these are professional, top notch spin artists. Most people are rather transparent in their unsophisticated, low-level coercive tactics. Management teams are consummate professionals at it.

Remember that turkey from earlier? It thanked the people for protecting him and taking care of him. And the whole time ulterior motives were at play. Do you not think that management teams have ulterior motives? Take for example the phenomenon of Adjusted EBITDA that your handlers use (management teams). A proper gaslighting of investors to not only tolerate it but to standardize it due to its repetitive use as you and the generations after you become increasingly desensitized, habituated, normalized and accepting of it as a baseline reporting practice. And then before you know it, management compensation packages are based upon it. Well played management teams, well played.

I’m investing with the following attitude

The absence of bad is good

The slowing deterioration of things is good

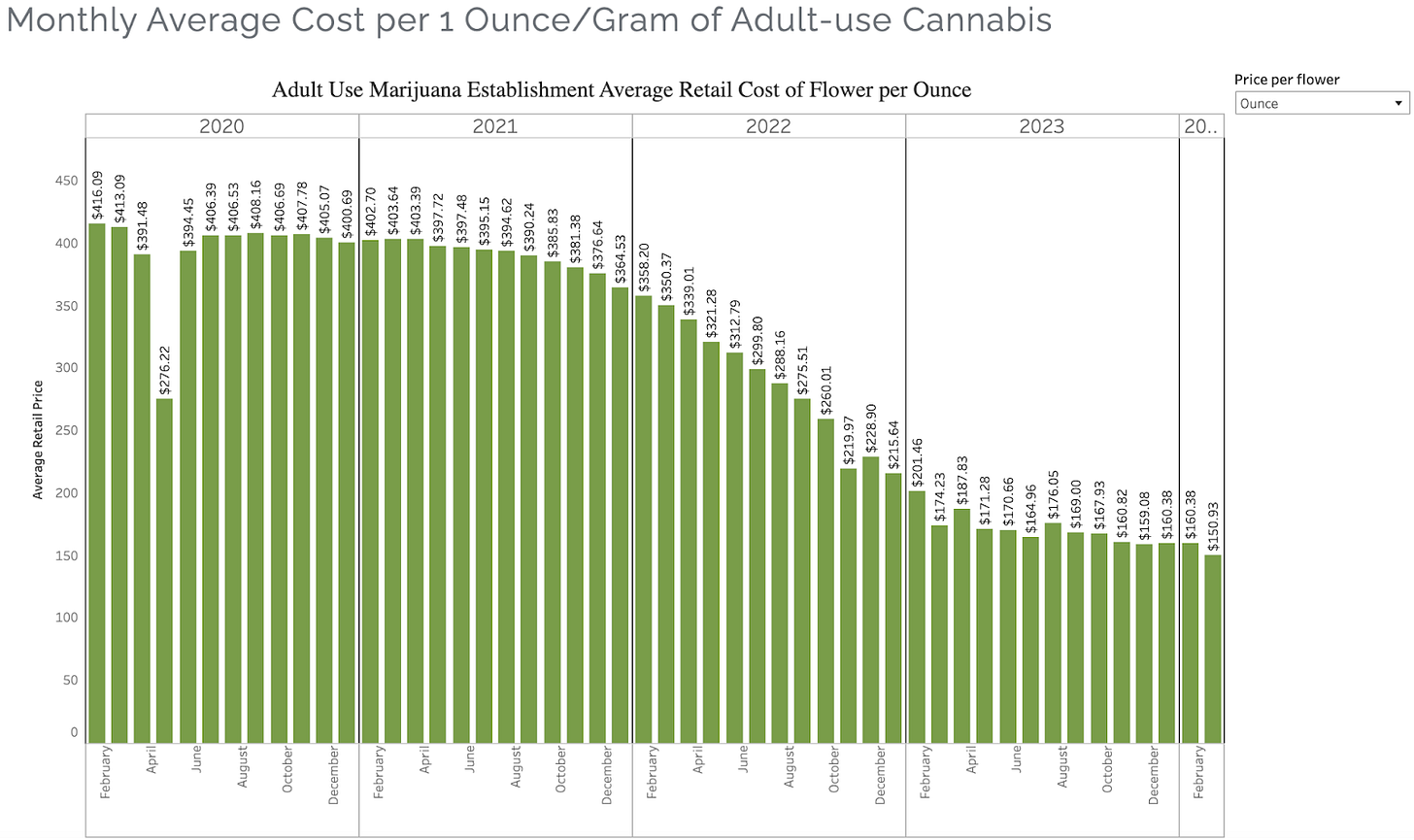

The leveling off of precipitous declines is good. (whether that be flower prices or the basing formations that many of these stocks have created since their late 2022 end of year dump).

Washed out sentiment in a bombed out sector is normally where I do my stock shopping at.

Charts like this peak my interest.

Might we be at a new normal, a lower plateau? Is it sustainable? Is the cure for lower prices lower prices?

IN CONCLUSION

I’m a big ship that doesn’t turn on a dime. That’s my personality, like it or not. Therefore, I can’t invest in something that requires me to stay up to date on every new industry detail. The funny thing is, that’s why so many people like this sector, it gets their feelings engaged.

I stay in my lane for the most part with hard assets and old economy type businesses. Things are established and everyone knows what to expect, for the most part. This is all to say that I’m already out of my comfort zone participating in this sector.

Things are anything but settled in the cannabis industry. It doesn’t seem obvious to me that the current Tier 1 MSOs will still be the Tier 1 MSOs in a decade's time. A lot of crazy things can happen in a decade.

I imagine one will run itself into the ground. Perhaps another one will get gobbled up in an M&A. Another one will get bought out by a big alcohol/pharmaceutical/tobacco player. And the list of pure plays will slowly dwindle. I suspect some will forgo being vertically integrated and instead become more of a branding retail play that merely buys their product wholesale. How many hops producers are you aware of in the alcohol industry? How many grape growers are you aware of in the wine industry?

For those counting that’s 5 Tier 1 MSO’s turning into 2. I’m sure that federal litigation developing will shake things up and some smaller more regional players will zoom ahead in this game.

New solutions will create new problems. For instance, what are the implications of interstate commerce?

What about the moats that have been created from regulation that bans interstate commerce? We might come to find out that the banning of interstate commerce was their primary tactical advantage.

There’s a tactical benefit to the 280E staying in place too. It allows the players who are benefiting from it to get bigger and stronger while the weaker players get absorbed and strangled. Intrastate commerce + limited license states + 280E has allowed for financially backed players to establish a pseudo oligopoly due to regulatory capture.

There’s a reason why Apple, Microsoft, Meta and Google like regulation; it creates an artificial barrier to entry. And guess what? The Big MSO players might be getting hurt by regulation but they’re also, in a very real way, benefiting from the regulation. Limited licenses help minimize competition, for instance. And we’ve seen how brutal things are even with the limited licenses.

To even ask a question like what’s the downside for rescheduling people will look at you dumbfounded. And it gives me PTSD to 2018 when I asked a similar group of people in spirit and intellect what the downside for cannabis was. And I got that same look. It gives me the chills.

Lets not forget that this is a game of brands. The longer these artificial barriers can stay in place the more loyalty, dedication and rapport the customers have with the product. You might see a real bifurcation last for years after the lifting of interstate commerce among consumers and their preferences. And it will be a slow and incremental shift of consumers to different brands. Only to find out that your particular company of choice had such loyal customers as a consequence of lack of optionality. This is a problem with consumer packaged goods. Do you buy generic, some west coast buds or if you’re a Floridian do you stick with Trulieve?

Do you not think that when regulations loosen up that we won’t see billions upon billions of dollars flood into this market…again. We saw the drama and trauma that that created last time. I suspect this might be on a grander scale. Do we get a 2.0 rendition and rinse and repeat of last time when capital poured in? And will that lead to another lost half decade for stock investors? Why not, executives get paid on Adjusted EBITDA and revenue figures, meaning that they don’t need to run a profitable business. Matter of fact they’re perversely incentivized to make horrible M&A deals.

These are but a few questions I have and my positioning in the names that I own are my answers to these questions. As time goes on, I expect these questions to be answered.

P.S. This piece should have come out a couple of months ago but I thought it to be a better use of my time to dive deeper into this industry and its actors than solidifying my thoughts on why I was looking at the industry to begin with.