Today we’re going to quickly cover some core concepts brought to you by Capital Returns. I’m going to apply it to the cannabis space. A space that is in dire need of basic understanding.

A simple review of the first 20 pages of this book would have helped prevent so much pain in the cannabis sector.

PREAMBLE

It’s worth knowing that the phrase “supply and demand” is known as a binomial phrase. It has two nouns (supply, demand) that are connected by a conjunction (and). There’s a reason that there’s two nouns and not just one. That might be your first clue that they both matter. Yet for some reason, supply doesn’t get much public discourse. It’s as though the word supply gets included only out of habit and not conscious consideration. Supply is treated as though it has no relevance and at most it’s a second thought. Well, that’s the sort of mistake that a person who wants to be permanently removed of their capital makes.

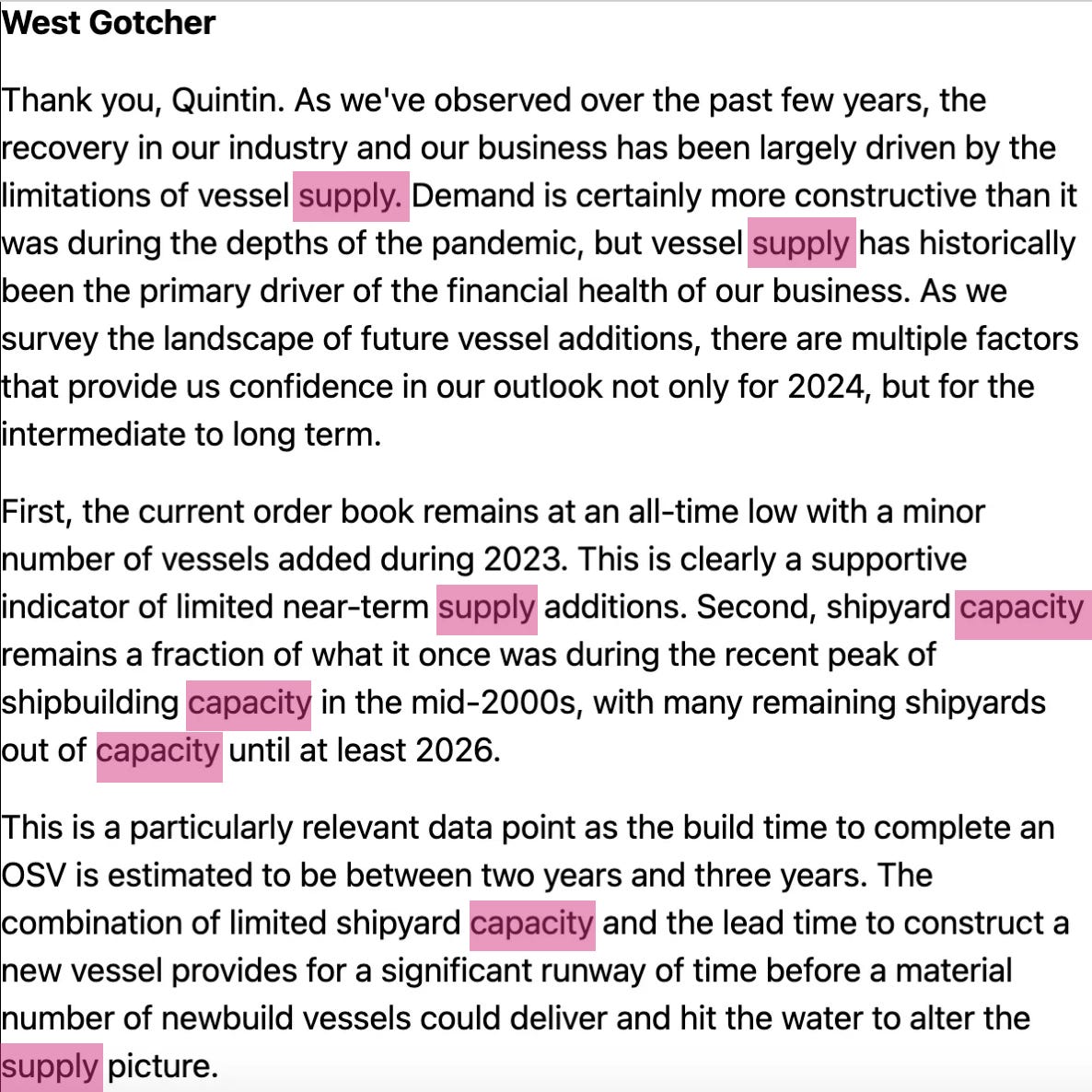

Some sectors and industries understand the importance of supply better than others. For instance, the offshore oil & gas supply vessel market. An example of the seriousness that they have towards it can be demonstrated from following screenshot from Tidewaters $TDW Q4 2023 Conference Call:

Notice the attention on supply & capacity? There’s a reason for that.

Now you might be asking, “What does this have to do with the cannabis industry?” It’s so that this doesn’t happen:

But this is what happens when people want to solely focus on stuff like this:

While writing this, this came across my feed. It’s yet another example of people not understanding supply & demand.

This is a great example of what I mean when I speak of the uni-dimensional focus on demand with minimal if any concern towards supply. Demand solutions for supply problems only exacerbates the initial problems and makes it inevitably worse. But I digress.

Onto lessons from the book.

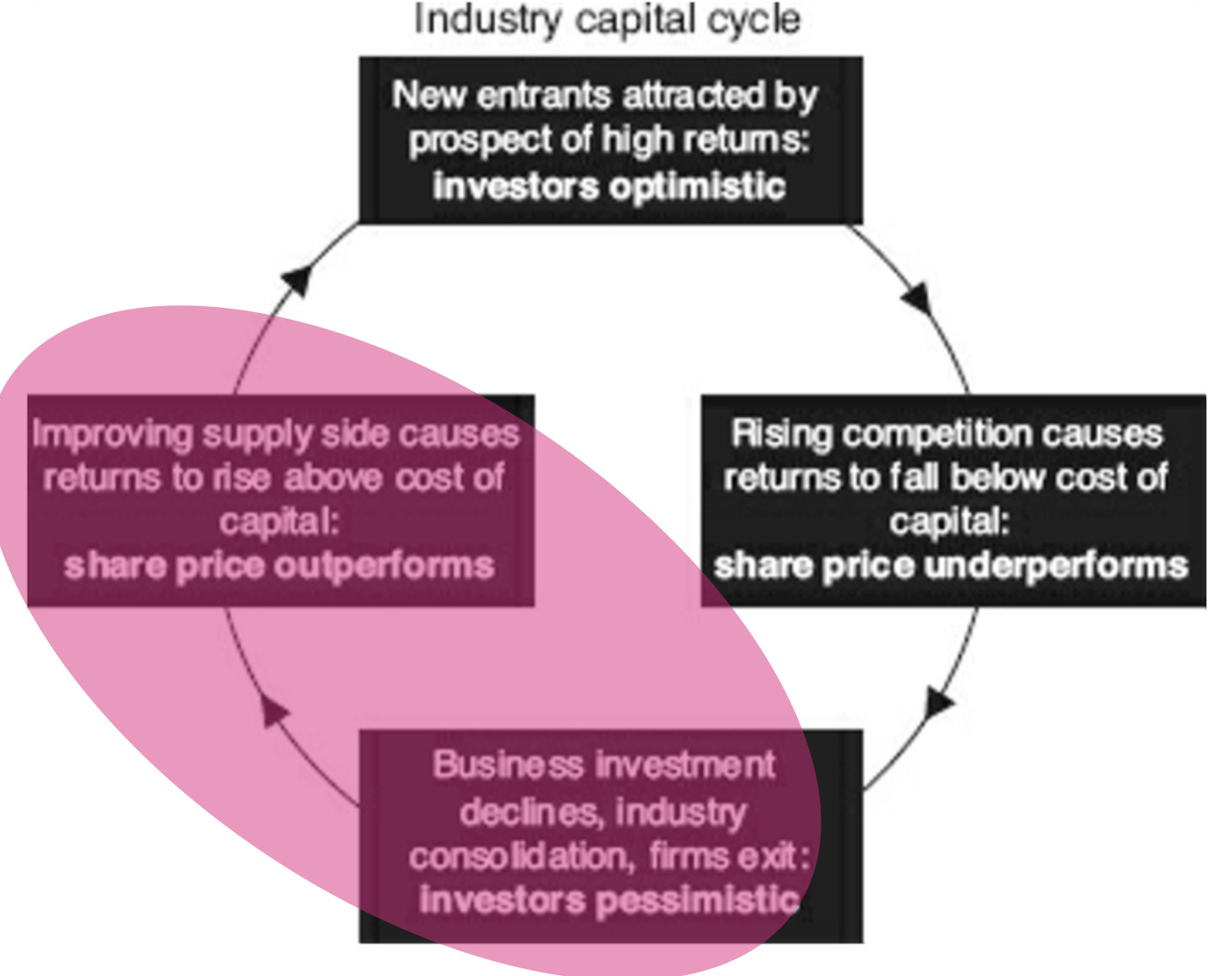

INDUSTRIAL CAPITAL CYCLE

“Rising competition causes returns to fall below cost of capital: share price underperforms.”

What does this look like contextualized to the cannabis industry?

Now let me ask you this. Do you think that their interest payments are more or less than the low to mid-single digits that they’re getting on their investments? And if it's less what do you think will happen given enough time? The answer is what’s currently playing out within many companies.

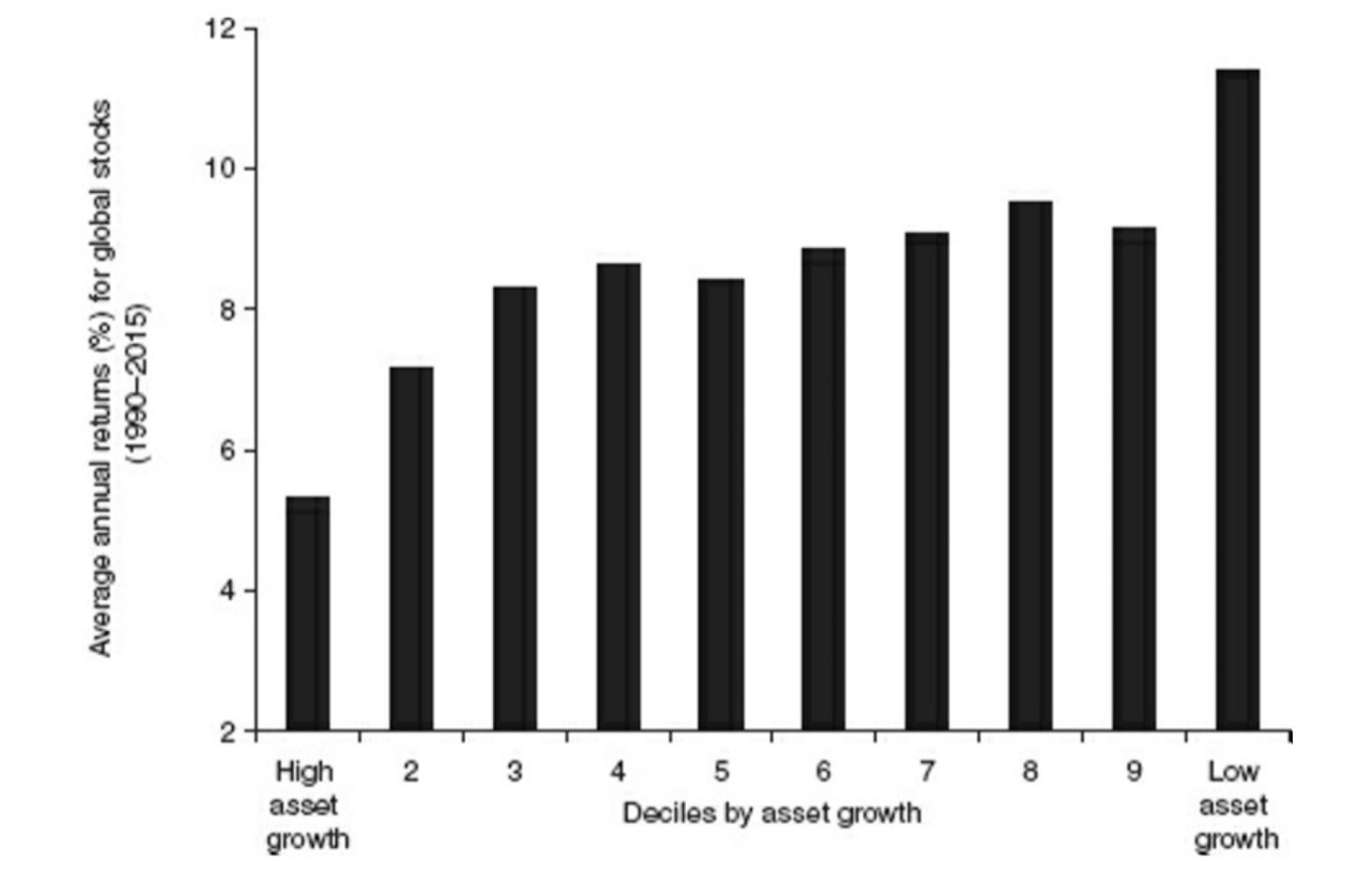

THE CAPITAL CYCLE ANOMALY

Asset growth (capex) doesn’t necessarily equal a good thing. The reason being is that if an industry is experiencing decent growth, more likely than not that’s going to bring about competition. And that competition will compete away the profits and then some.

What does this look like?

Look at all that capex spend (supply coming online). And that supply overwhelmed demand. That’s what happens in new growth industries with initial high returns on capital deployed. The interesting thing is that people were and still are talking about capex spend as a positive but remember, it’s the same as saying, “I’m excited for collapsing margins and negative or de minimis returns on capital.”

INVESTOR OVERREACTION

Who could have predicted that these companies weren’t going to indefinitely grow their revenue to the tune of 100’s of percent in perpetuity? Or even double digits? I suppose that the answer to that question is anyone with a rudimentary understanding of base rates, base effects and capital cycles.

MEAN REVERSION

TAM BROS

What does this look like?

This is from 2018:

They undershot 2023 by nearly 50% or to the tune of $10B.

And here we go again. I guess we’ll find out its accuracy in a few more years.

Simply put, the scope of possible outcomes is vast. In 2018 people undershot the size of the future market yet overshot the growth of the companies. Which means they underestimated the supply & demand which disproportionately affected the companies (stocks). The revenue that these companies have grown has been more the consequence of volume than price.

BASE RATES

Remember earlier when I said,

“Who could have predicted that these companies weren’t going to indefinitely grow their revenue to the tune of 100’s of percent in perpetuity? Or even double digits? I suppose that the answer to that question is anyone with a rudimentary understanding of base rates and base effects.”

Well, Capital Returns also talked about base rates. However, it’s being referred to as the “outside view.”

GAME THEORY

I’ve presented this below image to you numerous times.

THE TENETS

Pot stock shareholders underestimated the shift on the supply side, as well as the subsequent price declines a.k.a. price normalization.

M&A (IT’S NOT WHAT YOU THINK)

And to think that all you had to do was read the first 20 pages of this book to not get wrecked in the cannabis industry over the last half decade.

I’ll throw in one more because it’s a nice parallel.

“Poor and overpriced acquisitions”, wonder where we’ve heard that before? Here are but a few examples.

It’s no surprise that consolidation can provide better pricing power.

But let me ask you this, if consolidation means pricing power what does not being consolidated mean?

Consolidation = pricing power

Non-consolidated = non-pricing power

For the last half decade people have been saying, “What makes this new industry so exciting is that there are a lot of new participants rapidly growing.”

But as I have outlined to you above, that’s the same as saying, “This is a heavily fragmented market with little pricing power and even less profits.”

If you replaced the word cannabis with practically any other word or phrase people wouldn’t have been interested in investing in this sector. But they turned a blind eye to the natural unraveling and development of the industry due to their affinity for the product and its associated ideas. And that has been a costly belief to many.

IN CONCLUSION

So there you have it, spending $50 and a couple hours of time reading would have saved the industry participants a collective fortune.

But to each their own I suppose. I still get ample push back on these basic market dynamic concepts.

Demand side led growth stories without consideration to the supply side is the evergreen false idol of fools.

But I guess with comments like the one below, maybe I’m wrong for even recommending this book?

Oh, and in case you’re wondering where I think we are with things, I’d currently say somewhere in here.

But be forewarned. With federal legalization, up-listing and interstate commerce, we could see a redux of the period where everyone lost their minds, capital poured in and returns on capital vanished.

And if the American politicians don’t enforce some sort of countervailing measure in the form of anti-dumping laws, Canadian companies are going to put the hurt on American companies. But that’s a whole different conversation…